Related Research Articles

Amiga is a family of personal computers introduced by Commodore in 1985. The original model is one of a number of mid-1980s computers with 16- or 16/32-bit processors, 256 KB or more of RAM, mouse-based GUIs, and significantly improved graphics and audio compared to previous 8-bit systems. These systems include the Atari ST—released earlier the same year—as well as the Macintosh and Acorn Archimedes. Based on the Motorola 68000 microprocessor, the Amiga differs from its contemporaries through the inclusion of custom hardware to accelerate graphics and sound, including sprites and a blitter, and a pre-emptive multitasking operating system called AmigaOS.

Commodore International was an American home computer and electronics manufacturer founded by Jack Tramiel. Commodore International (CI), along with its subsidiary Commodore Business Machines (CBM), was a significant participant in the development of the home computer industry in the 1970s to early 1990s. In 1982, the company developed and marketed the world's second-best selling computer, the Commodore 64, and released its Amiga computer line in July 1985. Commodore was one of the world's largest personal computer manufacturers, with sales peaking in the last quarter of 1983 at $49 million.

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. This is done at the risk of magnified cash flow losses should the acquisition perform poorly after the buyout.

The R. J. Reynolds Tobacco Company (RJR) is an American tobacco manufacturing company based in Winston-Salem, North Carolina, and headquartered at the RJR Plaza Building. Founded by R. J. Reynolds in 1875, it is the second-largest tobacco company in the United States. The company is a wholly owned subsidiary of Reynolds American, after merging with the U.S. operations of British American Tobacco in 2004.

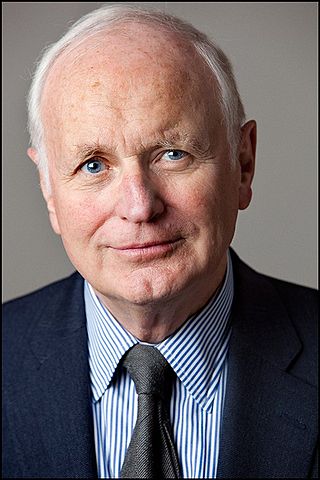

John Sculley III is an American businessman, entrepreneur and investor in high-tech startups. Sculley was vice-president (1970–1977) and president of PepsiCo (1977–1983), until he became chief executive officer (CEO) of Apple Inc. on April 8, 1983, a position he held until leaving in 1993. In May 1987, Sculley was named Silicon Valley's top-paid executive, with an annual salary of US$10.2 million.

Carl Celian Icahn is an American businessman, investor, and philanthropist. He is the founder and controlling shareholder of Icahn Enterprises, a public company and diversified conglomerate holding company based in Sunny Isles Beach, Florida. Icahn's business model is to take large stakes in companies that he believes will appreciate from changes to corporate policy. Subsequently, Icahn then pressures management to make the changes that he believes will benefit shareholders. Widely regarded as one of the most successful hedge fund managers of all time and one of the greatest investors on Wall Street, he was one of the first activist shareholders and is credited with making that investment strategy mainstream for hedge funds.

Nabisco is an American manufacturer of cookies and snacks headquartered in East Hanover, New Jersey. The company is a subsidiary of Illinois-based Mondelēz International.

R. J. Reynolds Nabisco, Inc., doing business as RJR Nabisco, was an American conglomerate, selling tobacco and food products, headquartered in the Calyon Building in Midtown Manhattan, New York City. R. J. Reynolds Nabisco stopped operating as a single entity in 1999. Both RJR and Nabisco still exist.

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. As of December 31, 2022, the firm had completed more than 690 private equity investments in portfolio companies with approximately $700 billion of total enterprise value. As of December 31, 2022, assets under management (AUM) and fee paying assets under management (FPAUM) were $504 billion and $412 billion, respectively.

Louis Vincent Gerstner Jr. is an American businessman, best known for his tenure as chairman of the board and chief executive officer of IBM from April 1993 until 2002, when he retired as CEO in March and chairman in December. He is largely credited with turning IBM's fortunes around.

Frederick Ross Johnson, OC was a Canadian businessman, best known as the chief executive officer of RJR Nabisco in the 1980s.

Bennett S. LeBow is an American businessman and philanthropist. He is the founder and chairman of the board of Vector Group. After LeBow acquired the cigarette manufacturer Liggett Group in 1986, the company became involved in anti-tobacco lawsuits culminating in the 1998 Tobacco Master Settlement Agreement.

Indra Nooyi is an Indian-American business executive who was the chairperson and chief executive officer (CEO) of PepsiCo.

Karl von der Heyden is a German-American businessman best known for his former roles as the Co-Chairman and CEO of RJR Nabisco, and CFO of PepsiCo, as well as multiple other positions and roles in the world of finance and business.

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

Peter A. Cohen is the chairman and CEO of Andover National Corporation, a public holding company. He was formerly the chairman and CEO of Cowen Inc., also known as Cowen & Company now TD Cowen. Prior to his current role, Cohen founded Ramius Capital Management in 1994, a $13 billion investment firm, which he merged with Cowen Inc. in 2009. Prior to this, Cohen was the chairman and chief executive officer of Shearson Lehman American Express from 1983 through 1991.

Blair W. Effron is an American financier. Effron co-founded Centerview Partners, a leading global investment banking firm based in New York City. Centerview has offices in London, Paris, Chicago, Los Angeles, Palo Alto and San Francisco. The firm provides advice on mergers and acquisitions, financial restructurings, valuation, and capital structure to companies, institutions and governments.

Pankaj Kumar Agarwal is an Indian computer scientist and mathematician researching algorithms in computational geometry and related areas. He is the RJR Nabisco Professor of Computer Science and Mathematics at Duke University, where he has been chair of the computer science department since 2004. He obtained his Doctor of Philosophy (Ph.D.) in computer science in 1989 from the Courant Institute of Mathematical Sciences, New York University, under the supervision of Micha Sharir.

Barbarians at the Gate: The Fall of RJR Nabisco is a 1989 book about the leveraged buyout (LBO) of RJR Nabisco, written by investigative journalists Bryan Burrough and John Helyar. The book is based upon a series of articles written by the authors for The Wall Street Journal. The book was made into a 1993 made-for-TV movie by HBO, also called Barbarians at the Gate. The book centers on F. Ross Johnson, the CEO of RJR Nabisco, who planned to buy out the rest of the Nabisco shareholders.

John Helyar is an American journalist and author. He is a graduate of Boston University. He is married to The Wall Street Journal’s Betsy Morris. Helyar has worked for The Wall Street Journal, Fortune magazine, ESPN.com, ESPN The Magazine and Bloomberg News. He is the author of the 1994 book, Lords of the Realm: The Real History of Baseball.

References

- ↑ Jeremy Reimer (2008-02-11). "A history of the Amiga, part 6: stopping the bleeding". Ars Technica. Retrieved 2016-02-16.

- ↑ Christine Winter (1987-04-24). "SURPRISE COMMODORE SHAKEUP". Chicago Tribune. Retrieved 2020-06-14.

- ↑ "Jury Verdict". Info Magazine. May 1991. Retrieved 2022-10-22.

- ↑ Susan Pulliam (1996-11-19). "Some Analysts Question Icahn's Choice for RJR" . The Wall Street Journal. Retrieved 2016-02-16.

- ↑ Glen Collins (1997-02-28). "Icahn Ends RJR Nabisco Proxy Fight". The New York Times. Retrieved 2016-02-16.