A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable commodity will gradually disappear from circulation.

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves as well as their value in buying goods. This is in contrast to representative money, which has no intrinsic value but represents something of value such as gold or silver, for which it can be exchanged, and fiat money, which derives its value from having been established as money by government regulation.

The Australian dollar is the official currency and legal tender of Australia, including all of its external territories, and three independent sovereign Pacific Island states: Kiribati, Nauru, and Tuvalu. In April 2022, it was the sixth most-traded currency in the foreign exchange market and as of Q4 2023 the seventh most-held reserve currency in global reserves.

The baht is the official currency of Thailand. It is divided into 100 satang. Prior to decimalisation, the baht was divided into eight feuang, each of eight att. The issuance of currency is the responsibility of the Bank of Thailand. SWIFT ranked the Thai baht as the 10th-most-frequently used world payment currency as of December 2023.

The Mexican peso is the currency of Mexico. Modern peso and dollar currencies have a common origin in the 16th–19th century Spanish dollar, most continuing to use its sign, "$".

The svenska riksdaler was the name of a Swedish coin first minted in 1604. Between 1777 and 1873, it was the currency of Sweden. The daler, like the dollar, was named after the German Thaler. The similarly named Reichsthaler, rijksdaalder, and rigsdaler were used in Germany and Austria-Hungary, the Netherlands, and Denmark-Norway, respectively. Riksdaler is still used as a colloquial term for krona, Sweden's modern-day currency.

In economics and law, fungibility is the property of a good or a commodity whose individual units are essentially interchangeable. In legal terms, this affects how legal rights apply to such items. Fungible things can be substituted for each other; for example, a $100 bill (note) is considered entirely equivalent to twenty $5 bills (notes), and therefore a person who borrows $100 in the form of a $100 bill can repay the money with twenty $5 bills. There is no requirement to return the same $100 bill. Non-fungible items are not substitutable in the same manner.

A banknote—also called a bill, paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to redeem the notes for legal tender when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authorities.

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency. Most forms of money are categorised as mediums of exchange, including commodity money, representative money, cryptocurrency, and most commonly fiat money. Representative and fiat money most widely exist in digital form as well as physical tokens, for example coins and notes.

The Indian rupee is the official currency in India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management based on the Reserve Bank of India Act, 1934.

The Egyptian pound is the official currency of Egypt. It is divided into 100 piastres, or qirsh, or 1,000 milliemes, but milliemes are no longer used.

The history of money is the development over time of systems for the exchange, storage, and measurement of wealth. Money is a means of fulfilling these functions indirectly and in general rather than directly, as with barter.

Japanese currency has a history covering the period from the 8th century AD to the present. After the traditional usage of rice as a currency medium, Japan adopted currency systems and designs from China before developing a separate system of its own.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

Metallism is the economic principle that the value of money derives from the purchasing power of the commodity upon which it is based. The currency in a metallist monetary system may be made from the commodity itself or it may use tokens redeemable in that commodity. Georg Friedrich Knapp (1842–1926) coined the term "metallism" to describe monetary systems using coin minted in silver, gold or other metals.

Between 1878 and 1885, the Cochinchina piastre was the currency of the French colony of Cochinchina. It was replaced by the French Indochinese piastre after the creation of a unified administration for Cochinchina and the other French protectorates and colonies in the Far East on 22 December 1885.

Fiat money is a type of currency that is not backed by a precious metal, such as gold or silver. It is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1971, the major currencies in the world are fiat money.

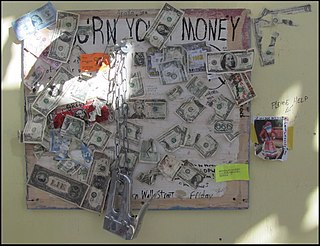

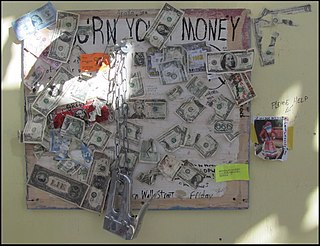

Money burning or burning money is the purposeful act of destroying money. In the prototypical example, banknotes are destroyed by setting them on fire. Burning money decreases the wealth of the owner without directly enriching any particular party. It also reduces the money supply and slows down the inflation rate.