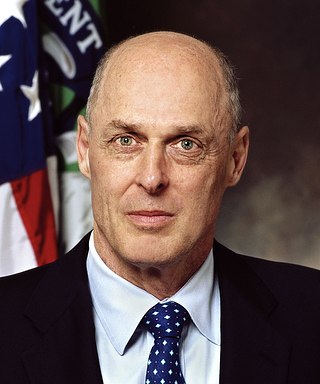

Henry "Hank" Merritt Paulson Jr. is an American banker and financier who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the chairman and chief executive officer (CEO) of major investment bank Goldman Sachs.

"Too big to fail" (TBTF) is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and therefore should be supported by government when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions of people losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst and the subprime mortgage crisis which developed during 2007 and 2008. It includes United States enactment of government laws and regulations, as well as public and private actions which affected the housing industry and related banking and investment activity. It also notes details of important incidents in the United States, such as bankruptcies and takeovers, and information and statistics about relevant trends. For more information on reverberations of this crisis throughout the global financial system see 2007–2008 financial crisis.

James Christopher Flowers is an American private equity investor and investment manager focused on the financial services industry. He is a Managing Director and CEO of J.C. Flowers & Co., and a member of the firm's Management Committee.

James B. Lockhart III is an American U.S. Navy officer, business executive, and, since September 2009, Vice Chairman of WL Ross & Co, which manages $9 billion of private equity investments, a hedge fund and a Mortgage Recovery Fund. It is a subsidiary of Invesco, a Fortune 500 investment management firm. He coordinates WL Ross's investments in financial services firms and mortgages. Lockhart serves co-chairs the Bipartisan Policy Center's Commission on Retirement Security and Personal Savings.

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing financial institutions and banks. The bill was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and was signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008. It created the $700 billion Troubled Asset Relief Program (TARP), which utilized congressionally appropriated taxpayer funds to purchase toxic assets from failing banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.

The government interventions during the subprime mortgage crisis were a response to the 2007–2009 subprime mortgage crisis and resulted in a variety of government bailouts that were implemented to stabilize the financial system during late 2007 and early 2008.

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George W. Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis.

Neel Tushar Kashkari is an American banker, economist and politician who is the president of the Federal Reserve Bank of Minneapolis. As interim Assistant Secretary of the Treasury for Financial Stability from October 2008 to May 2009, he oversaw the Troubled Asset Relief Program (TARP) that was a major component of the U.S. government's response to the Financial crisis of 2007–2008. A Republican, he unsuccessfully ran for Governor of California in the 2014 election.

The Term Asset-Backed Securities Loan Facility (TALF) is a program created by the U.S. Federal Reserve to spur consumer credit lending. The program was announced on November 25, 2008, and was to support the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA). Under TALF, the Federal Reserve Bank of New York authorized up to $200 billion of loans on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. As TALF money did not originate from the U.S. Treasury, the program did not require congressional approval to disburse funds, but an act of Congress forced the Fed to reveal how it lent the money. The TALF began operation in March 2009 and was closed on June 30, 2010. TALF 2 was initiated in 2020 during the COVID-19 pandemic.

The Emergency Economic Stabilization Act created the Troubled Asset Relief Program to administer up to $700 billion. Several oversight mechanisms are established by the bill, including the Congressional Oversight Panel, the Special Inspector General for TARP (SIGTARP), the Financial Stability Oversight Board, and additional requirements for the Government Accountability Office (GAO) and the Congressional Budget Office (CBO).

Timothy Franz Geithner is an American former central banker who served as the 75th United States Secretary of the Treasury under President Barack Obama from 2009 to 2013. He was the President of the Federal Reserve Bank of New York from 2003 to 2009, following service in the Clinton administration. Since March 2014, he has served as president and managing director of Warburg Pincus, a private equity firm headquartered in New York City.

The Subprime mortgage crisis solutions debate discusses various actions and proposals by economists, government officials, journalists, and business leaders to address the subprime mortgage crisis and broader 2007–2008 financial crisis.

The subprime mortgage crisis reached a critical stage during the first week of September 2008, characterized by severely contracted liquidity in the global credit markets and insolvency threats to investment banks and other institutions.

The Last Days of Lehman Brothers is a British television film, first broadcast on BBC Two and BBC HD on Wednesday 9 September 2009. Filmed in London, it was written by Craig Warner and directed by Michael Samuels. It was shown as part of the BBC's "Aftershock" season, a selection of programmes marking the first anniversary of the collapse of the American investment bank Lehman Brothers. It featured James Cromwell, Ben Daniels, Corey Johnson, Michael Landes and James Bolam.

James Mark Pittman was a financial journalist covering corporate finance and derivative markets. He was awarded several prestigious journalism awards, the Gerald Loeb Award, the George Polk Award, a New York Press Club award, the Hillman Prize and several New York Associated Press awards.

Inside Job is a 2010 American documentary film, directed by Charles Ferguson, about the late-2000s financial crisis. Ferguson, who began researching in 2008, said the film is about "the systemic corruption of the United States by the financial services industry and the consequences of that systemic corruption", amongst them conflicts of interest of academic research, which led to improved disclosure standards by the American Economic Association. In five parts, the film explores how changes in the policy environment and banking practices helped create the financial crisis.

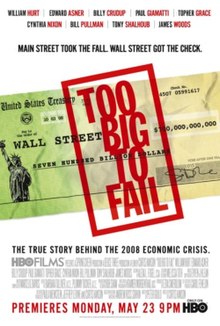

Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System—and Themselves, also known as Too Big to Fail: Inside the Battle to Save Wall Street, is a non-fiction book by Andrew Ross Sorkin chronicling the events of the 2008 financial crisis and the collapse of Lehman Brothers from the point of view of Wall Street CEOs and US government regulators. The book was released on October 20, 2009, by Viking Press.

The 2007–2008 financial crisis, or Global Economic Crisis (GEC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.