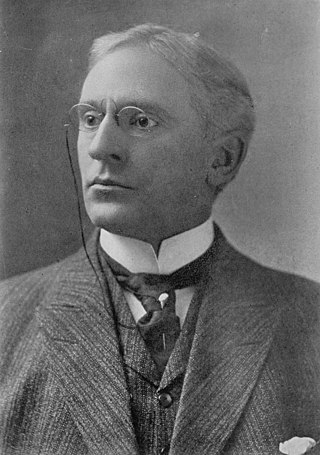

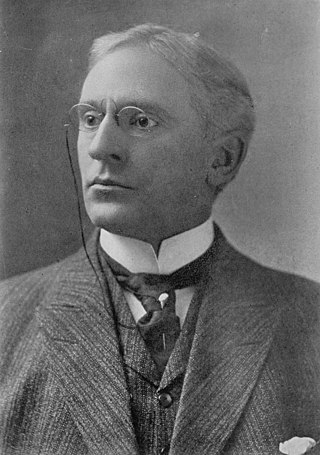

Charles Arnette Towne was an American politician.

City of Boerne v. Flores, 521 U.S. 507 (1997), was a landmark decision of the Supreme Court of the United States concerning the scope of Congress's power of enforcement under Section 5 of the Fourteenth Amendment. The case also had a significant impact on historic preservation.

Gertz v. Robert Welch, Inc., 418 U.S. 323 (1974), was a landmark decision of the US Supreme Court establishing the standard of First Amendment protection against defamation claims brought by private individuals. The Court held that, so long as they do not impose liability without fault, states are free to establish their own standards of liability for defamatory statements made about private individuals. However, the Court also ruled that if the state standard is lower than actual malice, the standard applying to public figures, then only actual damages may be awarded.

Eisner v. Macomber, 252 U.S. 189 (1920), was a tax case before the United States Supreme Court that is notable for the following holdings:

Balzac v. Porto Rico, 258 U.S. 298 (1922), was a case in which the Supreme Court of the United States held that certain provisions of the U.S. Constitution did not apply to territories not incorporated into the union. It originated when Jesús M. Balzac was prosecuted for criminal libel in a district court of Puerto Rico. Balzac declared that his rights had been violated under the Sixth Amendment to the U.S. Constitution as he was denied a trial by jury since the code of criminal procedure of Puerto Rico did not grant a jury trial in misdemeanor cases. In the appeal, the U.S. Supreme Court affirmed the judgments of the lower courts on the island in deciding that the provisions of the Constitution did not apply to a territory that belonged to the United States but was not incorporated into the Union. It has become known as one of the "Insular Cases".

The federal judiciary of the United States is one of the three branches of the federal government of the United States organized under the United States Constitution and laws of the federal government. The U.S. federal judiciary consists primarily of the U.S. Supreme Court, the U.S. Courts of Appeals, and the U.S. District Courts. It also includes a variety of other lesser federal tribunals.

Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955), was an important income tax case before the United States Supreme Court. The Court held as follows:

Gonzales v. O Centro Espírita Beneficente União do Vegetal, 546 U.S. 418 (2006), was a United States Supreme Court case in which the Court held that, under the Religious Freedom Restoration Act of 1993, the government had failed to show a compelling interest in prosecuting religious adherents for drinking a sacramental tea containing a Schedule I controlled substance. After the federal government seized its sacramental tea, the União do Vegetal (UDV), the New Mexican branch of a Brazilian church that imbibes ayahuasca in its services, sued, claiming the seizure was illegal, and sought to ensure future importation of the tea for religious use. The church won a preliminary injunction from the United States District Court for the District of New Mexico, which was affirmed on appeal.

Irwin v. Gavit, 268 U.S. 161 (1925), was a case before the U.S. Supreme Court regarding the taxability, under United States tax law, of a divided interest in a bequest. It is notable for the following holding:

Time, Inc. v. Firestone, 424 U.S. 448 (1976), was a U.S. Supreme Court case concerning defamation suits against public figures.

Richardson v. Ramirez, 418 U.S. 24 (1974), was a landmark decision by the Supreme Court of the United States in which the Court held, 6–3, that convicted felons could be barred from voting without violating the Fourteenth Amendment to the Constitution. Such felony disenfranchisement is practiced in a number of states.

Jenkins v. Georgia, 418 U.S. 153 (1974), was a United States Supreme Court case overturning a Georgia Supreme Court ruling regarding the depiction of sexual conduct in the film Carnal Knowledge.

Taxation of income in the United States has been practised since colonial times. Some southern states imposed their own taxes on income from property, both before and after Independence. The Constitution empowered the federal government to raise taxes at a uniform rate throughout the nation, and required that "direct taxes" be imposed only in proportion to the Census population of each state. Federal income tax was first introduced under the Revenue Act of 1861 to help pay for the Civil War. It was renewed in later years and reformed in 1894 in the form of the Wilson-Gorman tariff.

United States v. Richardson, 418 U.S. 166 (1974), was a United States Supreme Court case concerning standing in which the Court held a taxpayer's interest in government spending was generalized, and too "undifferentiated" to confer Article III standing to challenge a law which exempted Central Intelligence Agency funding from Article I, Section 9 requirements that such expenditures be audited and reported to the public.

Lehman v. City of Shaker Heights, 418 U.S. 298 (1974), was a case in which the United States Supreme Court upheld a city's ban on political advertising within its public transportation system. The Court ruled that ad space on public transit is not a "public forum", meaning that speech within this space receives lower First Amendment protections.