Related Research Articles

Silicon Valley is a region in Northern California that serves as a global center for high technology and innovation. Located in the southern part of the San Francisco Bay Area, it corresponds roughly to the geographical areas San Mateo County and Santa Clara County. San Jose is Silicon Valley's largest city, the third-largest in California, and the tenth-largest in the United States; other major Silicon Valley cities include Sunnyvale, Santa Clara, Redwood City, Mountain View, Palo Alto, Menlo Park, and Cupertino. The San Jose Metropolitan Area has the third-highest GDP per capita in the world, according to the Brookings Institution, and, as of June 2021, has the highest percentage of homes valued at $1 million or more in the United States.

Vinod Khosla is an Indian-American businessman and venture capitalist. He is a co-founder of Sun Microsystems and the founder of Khosla Ventures. Khosla made his wealth from early venture capital investments in areas such as networking, software, and alternative energy technologies. He is considered one of the most successful and influential venture capitalists.

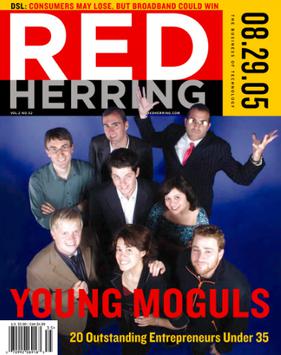

Red Herring is a media company that publishes an innovation magazine, an online daily technology news service, technology newsletters, and hosts events for technology leaders.

Sequoia Capital is an American venture capital firm. The firm is headquartered in Menlo Park, California, and specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, Sequoia's total assets under management were approximately US$85 billion.

Ronald Crawford Conway is an American venture capitalist and philanthropist. He has been described as one of Silicon Valley's "super angels".

Rich Karlgaard is an American journalist, bestselling author, award-winning entrepreneur, and speaker. He was named publisher of Forbes magazine in 1998 and has written three books, Life 2.0: How People Across America Are Transforming Their Lives by Finding the Where of Their Happiness (2004), which made The Wall Street Journal business bestseller list, The Soft Edge: Where Great Companies Find Lasting Success (2014), and Late Bloomers: The Power of Patience in a World Obsessed with Early Achievement (2019).

Donald Thomas Valentine was an American venture capitalist who concentrated mainly on technology companies in the United States. He had been referred to as the "grandfather of Silicon Valley venture capital". The Computer History Museum credited him as playing "a key role in the formation of a number of industries such as semiconductors, personal computers, personal computer software, digital entertainment and networking."

Jerry Colonna is an American venture capitalist and professional coach who played a prominent part in the early development of Silicon Valley. Colonna has been named to Upside magazine's list of the 100 Most Influential People of the New Economy, Forbes ASAP's list of the best VCs in the country, and Worth's list of the 25 most generous young Americans. He is a co-founder and CEO of the executive coaching and leadership development company, Reboot. He is the host of the Reboot Podcast. He also serves as chairman on the Board of Trustees at Naropa University.

Index Ventures is a European venture capital firm with dual headquarters in San Francisco and London, investing in technology-enabled companies with a focus on e-commerce, fintech, mobility, gaming, infrastructure/AI, and security. Since its founding in 1996, the firm has invested in a number of companies and raised approximately $5.6 billion. Index Venture partners appear frequently on Forbes’ Midas List of the top tech investors in Europe and Israel.

Battery Ventures is an American technology-focused investment firm. Founded in 1983, the firm makes venture-capital and private-equity investments in markets across the globe from offices in Boston, Silicon Valley, San Francisco, Israel and London. Since inception, the firm has raised over $13 billion and is now investing its fourteenth funds, Battery Venture XIV and Battery Ventures Select Fund II, with a combined capitalization of $3.8 billion.

James W. Breyer is an American venture capitalist, founder and chief executive officer of Breyer Capital, an investment and venture philanthropy firm, and a former managing partner at Accel Partners, a venture capital firm. Breyer has invested in over 40 companies that have gone public or completed a merger, with some of these investments, including Facebook, earning over 100 times cost and many others over 25 times cost. On the Forbes 2021 list of the 400 richest Americans, he was ranked #389, with a net worth of US$2.9 billion.

Danny Rimer OBE is a partner at Index Ventures, a global venture capital firm founded in Geneva in 1992. Rimer opened the firm's London office in 2002 and its San Francisco office in 2012. He has become a leading voice on venture capital in Silicon Valley and Europe, and has been actively involved in various philanthropic and cultural activities.

Aileen Lee is a U.S. venture capital angel investor and co-founder of Cowboy Ventures.

Women in venture capital or VC are investors who provide venture capital funding to startups. Women make up a small fraction of the venture capital private equity workforce. A widely used source for tracking the number of women in venture capital is the Midas List which has been published by Forbes since 2001. Research from Women in VC, a global community of women venture investors, shows that the percentage of female VC partners is just shy of 5 percent.

Buck's of Woodside is a restaurant in Woodside, California, that has gained fame as a meeting place for venture capitalists and tech entrepreneurs. Like nearby Sand Hill Road, Buck's has become a fixture of Silicon Valley.

Kirsten Green is an American venture capitalist, the founder and managing partner of Forerunner Ventures.

Jennifer Fonstad is an American venture capital investor and entrepreneur. She co-founded and leads the Owl Capital Group, a venture firm based in Silicon Valley. Fonstad has been a leading technology, healthcare, and energy investor for almost 25 years with 17 years as a Managing Director of Draper Fisher Jurvetson (DFJ). She is also co-founder of angel investing network Broadway Angels. Fonstad has been recognized as a top 100 tech investor on Forbes’ Midas List twice and was named 2016 Venture Capitalist of the Year by Deloitte. She is also a Founding Member of All Raise.

Mamoon Hamid is a Pakistani-American venture capitalist currently serving as a Managing Member and General Partner at the venture capital firm Kleiner Perkins.

Sonja Hoel Perkins is a venture capitalist, founder and managing director of the Perkins Fund and a co-founder of Broadway Angels. Before starting her own fund, Perkins worked as a venture capitalist at Menlo Ventures. In 2015, Worth magazine ranked her among the 100 Most Powerful People in Finance in the World.

David Martin Hornik is an American venture capitalist, lawyer, educator, art collector, and philanthropist. He is a founding partner at Lobby Capital, a Silicon Valley-based firm. Prior to founding Lobby Capital, Hornik was a General Partner at August Capital for 20 years.

References

- ↑ "Upside magazine closes". San Francisco Business Times. American City Business Journals. 2002-10-08. Retrieved 2008-10-29.

- ↑ Kopytoff, Verne (2002-10-08). "Upside magazine to cease publication". San Francisco Chronicle. Hearst Corp. Retrieved 2009-11-28.

- 1 2 3 "Fish Story". SF Weekly. Village Voice Media. 1996-04-10. Retrieved 2009-11-28.

- ↑ Fisher, Lawrence M. (1992-04-12). "Making a Difference; Another Side To Upside". New York Times . Retrieved 2009-11-28.

- 1 2 Fost, Dan (2002-04-01). "Upside's downside". San Francisco Chronicle. Hearst. Retrieved 2009-11-28.

- ↑ "Washington Post, Upside team to cover tech world". Silicon Valley Business Journal. American City Business Journals. 1997-10-31. Retrieved 2009-11-28.[ dead link ]

- ↑ "Dealing with dot-com's dark side". USA Today . Gannett Co. Inc. 2000-10-18. Retrieved 2009-11-28.

- ↑ "Can't Look Down at UpsideFN.com". Village Voice. Village Voice Media. 2001-01-30. Retrieved 2009-11-28.

- ↑ "Upside Pulls Plug on Live Webcasts". InternetNews.com. WebMediaBrands. 2001-05-16. Retrieved 2009-11-28.

- ↑ "Upside magazine meets its maker". Media Life. 2002-10-08. Archived from the original on 2009-06-20. Retrieved 2009-11-28.