A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual managers, and some government-sponsored enterprises.

A money order is a payment order for a pre-specified amount of money. As it is required that the funds be prepaid for the amount shown on it, it is a more trusted method of payment than a cheque.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

Online shopping is a form of electronic commerce which allows consumers to directly buy goods or services from a seller over the Internet using a web browser or a mobile app. Consumers find a product of interest by visiting the website of the retailer directly or by searching among alternative vendors using a shopping search engine, which displays the same product's availability and pricing at different e-retailers. As of 2020, customers can shop online using a range of different computers and devices, including desktop computers, laptops, tablet computers and smartphones.

The Australian financial system consists of the arrangements covering the borrowing and lending of funds and the transfer of ownership of financial claims in Australia, comprising:

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks.

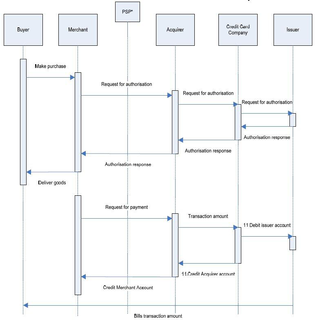

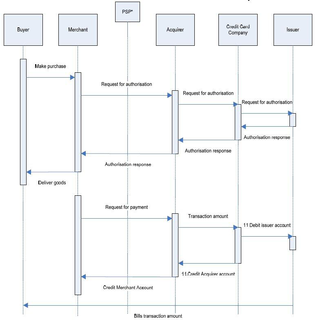

An e-commerce payment system facilitates the acceptance of electronic payment for online transactions. Also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

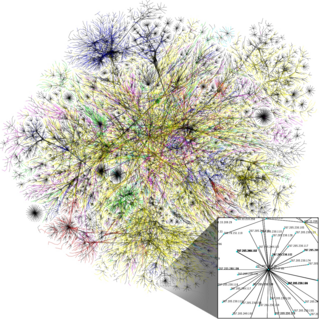

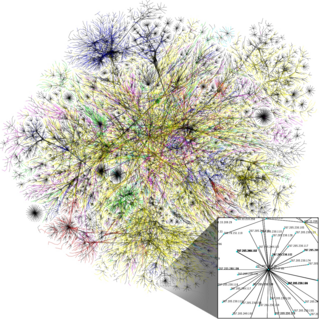

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make its exchange possible. A common type of payment system, called an operational network, links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

Fedwire is a real-time gross settlement funds transfer system operated by the United States Federal Reserve Banks that allows financial institutions to electronically transfer funds between its more than 9,289 participants. Transfers can only be initiated by the sending bank once they receive the proper wiring instructions for the receiving bank. These instructions include: the receiving bank's routing number, account number, name and dollar amount being transferred. This information is submitted to the Federal Reserve via the Fedwire system. Once the instructions are received and processed, the Fed will debit the funds from the sending bank's reserve account and credit the receiving bank's account. Wire transfers sent via Fedwire are completed the same business day, with many being completed instantly.

Cash management refers to a broad area of finance involving the collection, handling, and usage of cash. It involves assessing market liquidity, cash flow, and investments.

Payment and settlement systems in India are used for financial transactions. They are covered by the Payment and Settlement Systems Act, 2007, legislated in December 2007 and regulated by the Reserve Bank of India and the Board for Regulation and Supervision of Payment and Settlement Systems.

Alternative payments are payment methods other than cash or major credit cards. Alternative payments include prepaid cards, mobile payments, e-wallets, bank transfers, and "buy now, pay later"-type instant financing. Most alternative payment methods address a domestic economy or have been specifically developed for electronic commerce and the payment systems are generally supported and operated by local banks. Each alternative payment method has its own unique application and settlement process, language and currency support, and is subject to domestic rules and regulations.

Electronic commerce, commonly known as e-commerce or eCommerce, or e-business consists of the buying and selling of products or services over electronic systems such as the Internet and other computer networks. The amount of trade conducted electronically has grown extraordinarily with widespread Internet usage. The use of commerce is conducted in this way, spurring and drawing on innovations in electronic funds transfer, supply chain management, Internet marketing, online transaction processing, electronic data interchange (EDI), inventory management systems, and automated data collection systems. Modern electronic commerce typically uses the World Wide Web at least at some point in the transaction's lifecycle, although it can encompass a wider range of technologies such as e-mail as well.

In the legal code of the United States, a money transmitter or money transfer service is a business entity that provides money transfer services or payment instruments. Money transmitters in the US are part of a larger group of entities called money service businesses or MSBs. Under federal law, 18 USC § 1960, businesses are required to register for a money transmitter license where their activity falls within the state definition of a money transmitter.

ZainCash is a mobile wallet, money transfer, electronic bill payment, funds disbursement service, licensed by the Central Bank of Iraq.

An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits. The ACH system is designed to process batches of payments containing numerous transactions and charges fees low enough to encourage its use for low value payments.