Overtime is the amount of time someone works beyond normal working hours. The term is also used for the pay received for this time. Normal hours may be determined in several ways:

Goodwill Industries International Inc., simply known as Goodwill, is an American nonprofit 501(c)(3) organization that provides job training, employment placement services, and other community-based programs for people who face barriers in their employment.

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts. Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company.

A salary is a form of periodic payment from an employer to an employee, which may be specified in an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid separately, rather than on a periodic basis. Salary can also be considered as the cost of hiring and keeping human resources for corporate operations, and is hence referred to as personnel expense or salary expense. In accounting, salaries are recorded in payroll accounts.

A golden parachute is an agreement between a company and an employee specifying that the employee will receive certain significant benefits if employment is terminated. These may include severance pay, cash bonuses, stock options, or other benefits. Most definitions specify the employment termination is as a result of a merger or takeover, also known as "change-in-control benefits", but more recently the term has been used to describe perceived excessive CEO severance packages unrelated to change in ownership.

The Mondragon Corporation is a corporation and federation of worker cooperatives based in the Basque region of Spain.

A worker cooperative is a cooperative owned and self-managed by its workers. This control may mean a firm where every worker-owner participates in decision-making in a democratic fashion, or it may refer to one in which management is elected by every worker-owner who each have one vote.

Piece work or piecework is any type of employment in which a worker is paid a fixed piece rate for each unit produced or action performed, regardless of time.

For the Old Age, Survivors and Disability Insurance (OASDI) tax or Social Security tax in the United States, the Social Security Wage Base (SSWB) is the maximum earned gross income or upper threshold on which a wage earner's Social Security tax may be imposed. The Social Security tax is one component of the Federal Insurance Contributions Act tax (FICA) and Self-employment tax, the other component being the Medicare tax. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a worker's Social Security benefit.

In United States government contracting, a prevailing wage is defined as the hourly wage, usual benefits and overtime, paid to the majority of workers, laborers, and mechanics within a particular area. This is usually the union wage.

Say on pay is a term used for a role in corporate law whereby a firm's shareholders have the right to vote on the remuneration of executives. In the United States this provision was ushered in when the Dodd Frank Act Wall Street Reform and Consumer Protection Act was passed in 2010. While Say on pay is a non-binding, advisory vote, failure reflects shareholder dissatisfaction with executive pay or company performance.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage. The Act was enacted by the 75th Congress and signed into law by President Franklin D. Roosevelt in 1938.

Executive compensation is composed of both the financial compensation and other non-financial benefits received by an executive from their employing firm in return for their service. It is typically a mixture of fixed salary, variable performance-based bonuses and benefits and other perquisites all ideally configured to take into account government regulations, tax law, the desires of the organization and the executive.

A maximum wage, also often called a wage ceiling, is a legal limit on how much income an individual can earn. It is a prescribed limitation which can be used to effect change in an economic structure, but its effects are unrelated to those of minimum wage laws used currently by some states to enforce minimum earnings.

The Dodd–Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd–Frank, is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the Great Recession, and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry.

Amalgamated Bank is an American financial institution. It is the largest union-owned bank and one of the only unionized banks in the United States. Amalgamated Bank is currently majority-owned by Workers United, an SEIU Affiliate.

Wage theft is the failing to pay wages or provide employee benefits owed to an employee by contract or law. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors; illegal deductions in pay; forcing employees to work "off the clock", not paying annual leave or holiday entitlements, or simply not paying an employee at all.

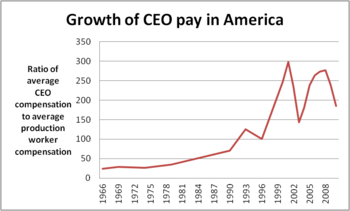

In the United States, the compensation of company executives is distinguished by the forms it takes and its dramatic rise over the past three decades. Within the last 30 years, executive compensation or pay has risen dramatically beyond what can be explained by changes in firm size, performance, and industry classification. This has received a wide range of criticism leveled against it.

Employer compensation in the United States refers to the cash compensation and benefits that an employee receives in exchange for the service they perform for their employer. Approximately 93% of the working population in the United States are employees earning a salary or wage.

The CEO Pay Ratio is a wage ratio. Pursuant to Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, publicly traded companies are required to disclose (1) the median total annual compensation of all employees other than the CEO and (2) the ratio of the CEO's annual total compensation to that of the median employee, (3) the wage ratio of the CEO to the median employee.