The euro is the official currency of 20 of the 27 member states of the European Union. This group of states is officially known as the euro area or, more commonly, the eurozone. The euro is divided into 100 euro cents.

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. When measured in stable foreign currencies, prices typically remain stable. Effective capital controls and currency substitution (“dollarization”) are the orthodox solutions to ending short-term hyperinflation; however there are significant social and economic costs to these policies. Ineffective implementations of these solutions often exacerbate the situation. Many governments choose to attempt to solve structural issues without resorting to those solutions, with the goal of bringing inflation down slowly while minimizing social costs of further economic shocks.

The economy of Zimbabwe is a tertiary sector based economy, making up to 56.64% of total GDP as of 2021. Zimbabwe has a $44 billion dollar informal economy in PPP terms which translates to 64.1% of the total economy. Agriculture and mining largely contribute to exports. The economy is set to reach $66 billion by end of 2023, 88% increase in forecast from $35 billion.

Seigniorage, also spelled seignorage or seigneurage, is the difference between the value of money and the cost to produce and distribute it. The term can be applied in two ways:

The Australian dollar is the official currency and legal tender of Australia, including all of its external territories, and three independent sovereign Pacific Island states: Kiribati, Nauru, and Tuvalu. As of 2022, it is the sixth most-traded currency in the foreign exchange market and also the seventh most-held reserve currency in global reserves.

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency.

The rupiah is the official currency of Indonesia, issued and controlled by Bank Indonesia. Its name is derived from the Sanskrit word for silver, rupyakam (रूप्यकम्). Sometimes, Indonesians also informally use the word perak in referring to rupiah in coins. The rupiah is divided into 100 cents, although high inflation has rendered all coins and banknotes denominated in cents obsolete.

The peso is the currency of Argentina since 1992, identified within Argentina by the symbol $ preceding the amount in the same way as many countries using peso or dollar currencies. It is subdivided into 100 centavos, but due to rapid inflation, coins with a face value below one peso are now rarely used. Its ISO 4217 code is ARS. It replaced the austral at a rate of 10,000 australes to one peso.

The Saudi riyal is the currency of Saudi Arabia. It is abbreviated as ر.سSAR, or SR (Saudi Arabian Riyal/Saudi Riyal). It is subdivided into 100 halalas. The currency is pegged to the US dollar at a constant rate of exchange.

The lira is the official currency of Turkey and Northern Cyprus, as well as one of the two currencies used in northern Syria under the country's interim government. One lira is divided into one hundred kuruş.

The Reserve Bank of Zimbabwe is the central bank of Zimbabwe and is headquartered in the capital city Harare.

Hyperinflation in Zimbabwe is an ongoing period of currency instability in Zimbabwe which, using Cagan's definition of hyperinflation, began in February 2007. During the height of inflation from 2008 to 2009, it was difficult to measure Zimbabwe's hyperinflation because the government of Zimbabwe stopped filing official inflation statistics. However, Zimbabwe's peak month of inflation is estimated at 79.6 billion percent month-on-month, 89.7 sextillion percent year-on-year in mid-November 2008.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

The banknotes of Zimbabwe were physical forms of Zimbabwe's first four incarnations of the dollar, from 1980 to 2009. The banknotes of the first dollar replaced those of the Rhodesian dollar at par in 1981, one year after the proclamation of independence. The Reserve Bank of Zimbabwe issued most of the banknotes and other types of currency notes in its history, including the bearer cheques and special agro-cheques that circulated between 15 September 2003 and 31 December 2008: the Standard Chartered Bank also issued their own emergency cheques from 2003 to 2004.

The Zimbabwean dollar was the name of four official currencies of Zimbabwe from 1980 to 12 April 2009. During this time, it was subject to periods of extreme inflation, followed by a period of hyperinflation.

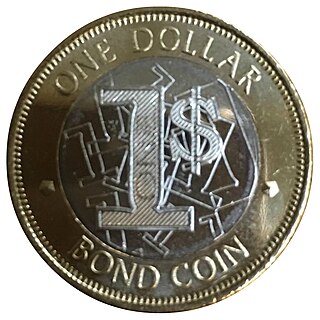

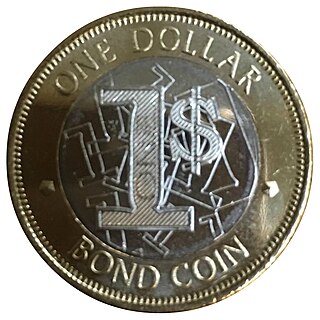

The Reserve Bank of Zimbabwe began to release Zimbabwean bond coins on 18 December 2014. The coins are supported by a US$50 million facility extended to the Reserve Bank of Zimbabwe by Afreximbank. To date coins worth US$15 million have been struck out of the total $50 million available. The coins were first issued in denominations of 1, 5, 10, and 25 cents and are pegged to the corresponding values in U.S. dollars. A 50 cents bond coin was released in March 2015.

Fidelity Printers and Refiners (FPR) is Zimbabwean security printing and gold refinery company wholly owned by the Reserve Bank of Zimbabwe. The company was established in 1966. FPR operates from a printing and gold refinery plant located in Msasa Industrial area in Harare and a coin minting facility in Bulawayo.

John Panonetsa Mangudya is a former governor of the Reserve Bank of Zimbabwe. He was appointed in March 2014 by the then Zimbabwean president, Robert Mugabe, and began his tenure as governor on 1 May that year. His second 5 year term ended on 28 March 2024. He succeeded Gideon Gono as the governor of Zimbabwe's central bank and became the nation's 6th substantial exchequer.

Zimbabwean bond notes are a form of banknote in circulation in Zimbabwe. Released by the Reserve Bank of Zimbabwe, the notes were stated to not be a currency in itself but rather legal tender near money pegged equally against the U.S. dollar. In 2014, prior to the release of bond notes, a series of bond coins entered circulation.

The Mosi-oa-Tunya is a gold coin introduced in Zimbabwe in 2022 in the context of rising inflation.