990 may refer to:

- Year 990

- EgyptAir Flight 990

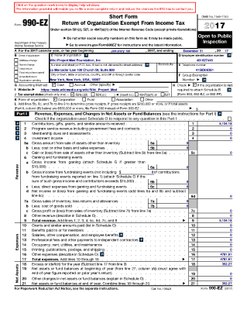

- Form 990, "Return of Organization Exempt From Income Tax," a form from the Internal Revenue Service of the United States

- List of highways numbered 990

- 990 AM - the frequency of some radio stations

990 may refer to:

The James Randi Educational Foundation (JREF) is an American grant-making foundation. It was started as an American non-profit organization founded in 1996 by magician and skeptic James Randi. The JREF's mission includes educating the public and the media on the dangers of accepting unproven claims, and to support research into paranormal claims in controlled scientific experimental conditions. In September 2015, the organization said it would change to a grant-making foundation.

The American Association of State Highway and Transportation Officials (AASHTO) is a standards setting body which publishes specifications, test protocols, and guidelines that are used in highway design and construction throughout the United States. Despite its name, the association represents not only highways but air, rail, water, and public transportation as well.

Ironside or Ironsides may refer to:

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification. When the number is used for identification rather than employment tax reporting, it is usually referred to as a Taxpayer Identification Number (TIN), and when used for the purposes of reporting employment taxes, it is usually referred to as an EIN. These numbers are used for tax administration and must not be used for any other purpose. For example, the EIN should not be used in tax lien auction or sales, lotteries, etc.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code Section 501(c) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

1990 is a year.

Charity Navigator is a charity assessment organization that evaluates hundreds of thousands of charitable organizations based in the United States, operating as a free 501(c)(3) organization. It provides insights into a nonprofit’s financial stability, and adherence to best practices for both accountability and transparency. It is the largest and most-utilized evaluator of charities in the United States. It does not accept any advertising or donations from the organizations it evaluates.

A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

Ekkehard is a German given name. It is composed of the elements ekke "edge, blade; sword" and hart "brave; hardy". Variant forms include Eckard, Eckhard, Eckhart, Eckart. The Anglo-Saxon form of the name was Ecgheard, possibly attested in the toponym Eggerton.

Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. They are used to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

E-file is a system for submitting tax documents to the US Internal Revenue Service through the Internet or direct connection, usually without the need to submit any paper documents. Tax preparation software with e-filing capabilities includes stand-alone programs or websites. Tax professionals use tax preparation software from major software vendors for commercial use.

Form 990 is a United States Internal Revenue Service form that provides the public with financial information about a nonprofit organization. It is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations.

A laboratory rat is a rat of the species Rattus norvegicus which is bred and kept for scientific research.

University of the People (UoPeople) is a private non-profit, distance education university with its offices in Pasadena, California and in Israel.

There were several Counts of Poitiers named William:

The National Center for Charitable Statistics (NCCS) is a clearing house of data on the U.S. nonprofit sector. The National Center for Charitable Statistics builds national, state, and regional databases and develops standards for reporting on the activities of all tax-exempt organizations.

DX10 is an operating system for the Texas Instruments TI-990 CPU.

The Punjabi Bagh West Metro Station is located on the Pink Line of the Delhi Metro. It was opened on 14 March 2018.

Americans for Prosperity Foundation v. Bonta is a pending United States Supreme Court case dealing with the disclosure of donors to non-profit organizations. The case challenges California's requirement that requires non-profit organizations to disclose the identity of their donors in the state tax returns. The case is consolidated with Thomas More Law Center v. Bonta.