The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker and debt manager, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank.

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

His Majesty's Treasury, occasionally referred to as the Exchequer, or more informally the Treasury, is a ministerial department of the Government of the United Kingdom. It is responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting, the replacement for the Combined Online Information System, which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts annual financial statements are produced.

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

The pound sterling is the official currency of the United Kingdom, Jersey, Guernsey, the Isle of Man, British Antarctic Territory, South Georgia and the South Sandwich Islands, and Tristan da Cunha.

The Bank of Scotland plc is a commercial and clearing bank based in Edinburgh, Scotland, and is part of the Lloyds Banking Group. The bank was established by the Parliament of Scotland in 1695 to develop Scotland's trade with other countries, and aimed to create a stable banking system in the Kingdom of Scotland. The bank is the ninth oldest bank in continuous operation.

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage, it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodities, particularly cloth merchants. Historically, merchant banks' purpose was to facilitate or finance the production and trade of commodities, hence the name "merchant". Few banks today restrict their activities to such a narrow scope.

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. Fractional-reserve banking differs from the hypothetical alternative model, full-reserve banking, in which banks would keep all depositor funds on hand as reserves.

Henry Thornton was an English economist, banker, philanthropist and parliamentarian.

The Trustee Savings Bank (TSB) was a British financial institution that operated between 1810 and 1995 when it was merged with Lloyds Bank. Trustee savings banks originated to accept savings deposits from those with moderate means. Their shares were not traded on the stock market but, unlike mutually held building societies, depositors had no voting rights; nor did they have the power to direct the financial and managerial goals of the organisation. Directors were appointed as trustees on a voluntary basis. The first trustee savings bank was established by Rev. Henry Duncan of Ruthwell in Dumfriesshire for his poorest parishioners in 1810, with its sole purpose being to serve the local people in the community. Between 1970 and 1985, the various trustee savings banks in the United Kingdom were amalgamated into a single institution named TSB Group plc, which was floated on the London Stock Exchange. In 1995, the TSB merged with Lloyds Bank to form Lloyds TSB, at that point the largest bank in the UK by market share and the second-largest by market capitalisation.

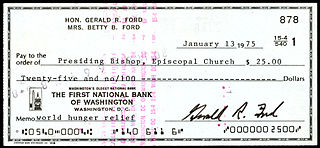

A cheque or check ; is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

This history of central banking in the United States encompasses various bank regulations, from early wildcat banking practices through the present Federal Reserve System.

In the United Kingdom, public holidays are days on which most businesses and non-essential services are closed. Many retail businesses do open on some of the public holidays. There are restrictions on trading on Sundays, Easter and Christmas Day in England and Wales and on New Year's Day and Christmas Day in Scotland. Public holidays defined by statute are called "bank holidays", but this term can also be used to include common law holidays, which are held by convention. The term "public holidays" can refer exclusively to common law holidays.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The Royal Bank of Scotland is a major retail and commercial bank in Scotland. It is one of the retail banking subsidiaries of NatWest Group, together with NatWest and Ulster Bank. The Royal Bank of Scotland has around 700 branches, mainly in Scotland, though there are branches in many larger towns and cities throughout England and Wales. The bank is completely separate from the fellow Edinburgh-based bank, the Bank of Scotland, which pre-dates the Royal Bank by 32 years. The Royal Bank of Scotland was established to provide a bank with strong Hanoverian and Whig ties.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

United Kingdom banking law refers to banking law in the United Kingdom, to control the activities of banks.

The Prudential Regulation Authority (PRA) is a United Kingdom financial services regulatory body, formed as one of the successors to the Financial Services Authority (FSA). The authority is responsible for the prudential regulation and supervision of banks, building societies, credit unions, insurers and major investment firms. It sets standards and supervises financial institutions at the level of the individual firm. Although it was initially structured as a limited company wholly owned by the Bank of England, the PRA's functions have now been taken over by the Bank and are exercised through the Prudential Regulation Committee. The company has since been liquidated.

The British credit crisis of 1772–1773, also known as the crisis of 1772, or the panic of 1772, was a peacetime financial crisis which originated in London and then spread to Scotland and the Dutch Republic. It has been described as the first modern banking crisis faced by the Bank of England. New colonies, as Adam Smith observed, had an insatiable demand for capital. Accompanying the more tangible evidence of wealth creation was a rapid expansion of credit and banking, leading to a rash of speculation and dubious financial innovation. In today's language, they bought shares on margin.

Keyser Ullman was a British merchant bank, based in London and founded in 1868.