Related Research Articles

Citigroup Inc. or Citi is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citigroup is incorporated in Delaware.

Citibank is the consumer division of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City Bank of New York. The bank has 2,649 branches in 19 countries, including 723 branches in the United States and 1,494 branches in Mexico operated by its subsidiary Banamex. The U.S. branches are concentrated in six metropolitan areas: New York, Chicago, Los Angeles, San Francisco, Washington, D.C., and Miami.

The American Express Company (Amex) is a multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards.

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered in Charlotte, North Carolina. The bank was founded in San Francisco, and took its present form when NationsBank of Charlotte acquired it in 1998. It is the second largest banking institution in the United States, after JPMorgan Chase, and the eighth largest bank in the world. Bank of America is one of the Big Four banking institutions of the United States. It serves approximately 10.73% of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking.

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual managers, and some government-sponsored enterprises.

President's Choice Financial, commonly shortened to PC Financial, is the financial service brand of the Canadian supermarket chain Loblaw Companies.

Citibank Limited is a licensed bank incorporated in Hong Kong.

An airport lounge is a facility operated at many airports. Airport lounges offer, for selected passengers, comforts beyond those afforded in the airport terminal itself, such as more comfortable seating, quieter environments, and often better access to customer service representatives. Other accommodations may include private meeting rooms, telephones, wireless internet access and other business services, along with provisions to enhance passenger comfort, such as free drinks, snacks, magazines, and showers.

Private banking is banking, investment and other financial services provided by banks and financial institutions primarily serving high-net-worth individuals (HNWIs)—defined as those with very high levels of income or sizable assets. Private banking is a more exclusive subset of wealth management, geared toward exceptionally affluent clients. The term "private" refers to customer service rendered on a more personal basis than in mass-market retail banking, usually provided via dedicated bank advisers. At least until recently, it largely consisted of banking services, discretionary asset management, brokerage, limited tax advisory services and some basic concierge-type services, offered by a single designated relationship manager.

Discover Financial Services is an American financial services company that owns and operates Discover Bank, which offers checking and savings accounts, personal loans, home equity loans, student loans and credit cards. It also owns and operates the Discover and Pulse networks, and owns Diners Club International. Discover Card is the third largest credit card brand in the United States, when measured by cards in force, with nearly 50 million cardholders. Discover is currently headquartered in the Chicago suburb of Riverwoods, Illinois.

First Republic Bank is an American bank and wealth management company offering personal banking, business banking, trust, and wealth management services, catering to low-risk, high net-worth clientele, and focusing on providing personalized customer experience. The bank specializes in delivering personalized relationship-based service through preferred banking or trust offices in the United States, including San Francisco, Palo Alto, Los Angeles, Santa Barbara, Newport Beach, San Diego, Portland, Palm Beach, Boston, Greenwich, New York City, Jackson, Wyoming, and Manhattan Beach.

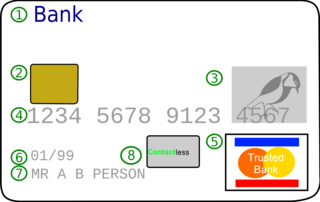

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

Citibank Berhad is a licensed commercial bank operating in Malaysia with its headquarters in Jalan Ampang, Kuala Lumpur. Citibank Berhad operates as a subsidiary of Citigroup Holding (Singapore) Private Limited. Commencing its banking operations in Malaysia in 1959, Citibank Berhad was locally incorporated in 1994.

Citigroup Pty Ltd is the Australian subsidiary of multinational financial services company, Citigroup. The bank operates consumer banking services, including credit cards, savings and transaction accounts, loans, insurance, and self-managed superannuation funds (SMSF), as well as private, corporate and investment banking, and wealth management.

Citibank Indonesia is a universal bank that offers a wide range of retail and commercial banking services. Citi has been present in Indonesia since 1968 and is one of the largest foreign banks in the country by asset size. Citibank Indonesia operates 11 branches and 70+ ATMs; it has a customer payment network with more than 50,000 payment points and a corporate distribution network with 4,800 locations across 34 provinces. Citibank Indonesia is a fully owned subsidiary of Citibank NA.

Citibank Philippines is the Philippines branch of Citibank. In July 1902 the International Banking Corporation, a predecessor to Citibank, opened its first branch in Manila. Currently, it is the largest commercial bank in the Philippines.

The American Express Centurion Card, known informally as the Amex Black Card, is an invitation-only charge card issued by American Express. An invitation is extended to Platinum Card holders after they meet certain criteria. The Centurion Card comes in personal and business variants.

The J.P. Morgan Reserve Card®, formerly known as the Palladium Card, is a Visa credit card issued by JPMorgan Chase. It was known as the J.P. Morgan Palladium Card until it was formally re-branded to its current name. The laser engraved card is minted out of brass and plated with palladium. This card is in a category of ultra exclusive, invitation-only credit and charge cards, such as the American Express Centurion Card. It is one of the most exclusive credit cards in the world, and reserved for the most important private clients of JPMorgan Chase.

Luxury Card is a privately held financial services company owned by Black Card LLC. It provides credit cards and card loyalties to clients through its Mastercard Titanium Card, Mastercard Black Card, and Mastercard Gold Card issued by Barclays. It also publishes Luxury Magazine, a members only digital and print publication. Cards are issued in the United States as well as Japan and China.

Citibank National Association, United Arab Emirates commonly known as Citibank U.A.E., is a franchise subsidiary of Citigroup, a multinational financial services corporation headquartered in New York City, United States. Citi U.A.E. is connected by a network spanning 98 markets across the world. The phone support call center for Citibank U.A.E. retail banking clients is based at Citibank Bahrain.

References

- 1 2 Payments News: Bank of America's Accolades American Express Card – June 11, 2007

- 1 2 3 4 Bank of America tries to burnish its image as it caters to the very rich – International Herald Tribune

- 1 2 "Bank of America Introduces Credit Card for Wealthy Clients". Fox News. 11 June 2007.

- 1 2 3 4 Moyer, Liz (3 July 2007). "The World's Most Exclusive Credit Cards". Forbes. Archived from the original on October 24, 2007.

- ↑ More Banks Go Black with American Express Cards for Wealthy, Wall Street Journal, June 11, 2007, p. C3

- ↑ https://www.rewards.ml.com

- ↑ "Q&A about the Accolades card with Bank of America Premier Client Manager Joseph Ligaya". Archived from the original on 2008-12-19. Retrieved 2008-12-31.

- ↑ "Bank of America Premier Client Manager Joseph Ligaya announces open application for Accolades Card". Archived from the original on 2009-03-01. Retrieved 2008-12-31.

- ↑ "BofA launches credit card for wealthy customers". 11 June 2007.

- ↑ Bank of America, Citigroup Offering American Express Cards for Wealthy – BankNet360.com Archived September 29, 2007, at the Wayback Machine

- ↑ "Preferred Offers". Archived from the original on 2005-01-22. Retrieved 2009-05-01.

- ↑ Lounge Club