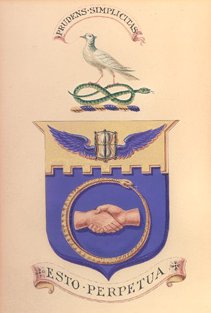

Amicable Society coat of arms

Fire insurance contract of 1796

Amicable Society for a Perpetual Assurance Office (a.k.a.Amicable Society) is considered the first life insurance company in the world. [1] [2] [3] It was acquired by Norwich Union Life Insurance Society in 1866, this required an act of Parliament. [4] [5]