Related Research Articles

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded by the merger of NationsBank and Bank of America in 1998. It is the second-largest banking institution in the United States and the second-largest bank in the world by market capitalization, both after JPMorgan Chase. Bank of America is one of the Big Four banking institutions of the United States. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking.

Kellen Boswell Winslow Sr. is an American former professional football tight end who played in the National Football League (NFL). A member of the Pro Football Hall of Fame (1995), he is widely recognized as one of the greatest tight ends in the league's history. Winslow played his entire NFL career (1979–1987) with the San Diego Chargers after being selected in the first round of the 1979 NFL draft. He played college football for the Missouri Tigers, earning consensus All-American honors in 1978. He was inducted into the College Football Hall of Fame in 2002.

Bank of America Home Loans is the mortgage unit of Bank of America. It previously existed as an independent company called Countrywide Financial from 1969 to 2008. In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion. In 2006, Countrywide financed 20% of all mortgages in the United States, at a value of about 3.5% of the United States GDP, a proportion greater than any other single mortgage lender.

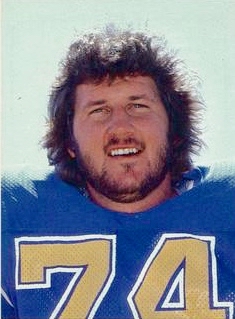

Louis James Kelcher is an American former professional football player who was a defensive tackle in the National Football League (NFL), spending most of his career with the San Diego Chargers. He was a four-time All-Pro and a three-time Pro Bowl selection. Kelcher was inducted into the Chargers Hall of Fame and is a member of their 40th and 50th anniversary teams.

Roman Brian Fortin is a former National Football League (NFL) player from 1991 to 2000. He played center, guard, offensive tackle, tackle, and tight end through the course of his career. He was the quarterback for his high school team at Ventura High School. He played the first part of his college football career at Oregon State University, and later transferred to San Diego State. He was selected in the 1990 NFL draft by the Detroit Lions. He played with them in the 1991 season, but would end up being picked up by the Atlanta Falcons in 1992. He stayed there through the 1997 season, where he would then play for the San Diego Chargers for his last three seasons.

James Michael Lachey is an American former professional football player who was an offensive tackle for 10 seasons in the National Football League (NFL) with the San Diego Chargers, Los Angeles Raiders, and Washington Redskins. He was selected by the Chargers in the first round of the 1985 NFL draft with the 12th overall pick.

James Joseph FitzPatrick, III is an American former professional football player who was an offensive tackle for six seasons in the National Football League (NFL).

Jared Dwight Gaither is a former American football offensive tackle who played in the National Football League (NFL). He was selected by the Baltimore Ravens in the fifth round of the 2007 Supplemental Draft. He played college football at Maryland.

Jeff Davidson is an American football coach who most recently served as the offensive line coach for the Detroit Lions of the National Football League (NFL) and is also a former player. He has also spent time as offensive line coach of the New England Patriots and Denver Broncos and as offensive coordinator of the Carolina Panthers and Cleveland Browns.

Carlos Joseph was an American professional football player who was an offensive tackle. He played college football for the Miami Hurricanes. He was drafted by the San Diego Chargers of the National Football League (NFL) in the seventh round of the 2004 NFL draft.

Kevin Patrick Gogan is an American former professional football player who was a guard in the National Football League (NFL) for the Dallas Cowboys, Los Angeles/Oakland Raiders, San Francisco 49ers, Miami Dolphins, and San Diego Chargers. He played college football for the Washington Huskies and was selected in the eighth round by the Dallas Cowboys in the 1987 NFL draft. With the Cowboys, Gogan won Super Bowl XXVII and Super Bowl XXVIII, both over the Buffalo Bills.

Eric Scott Sievers was an American professional football player who was a tight end for 10 seasons in the National Football League (NFL), primarily with the San Diego Chargers. He played college football for the Maryland Terrapins before being selected by the Chargers in the fourth round of the 1981 NFL draft. Sievers was named to the NFL All-Rookie team in 1981. He played in the NFL from 1981 to 1990 for the Chargers, the Los Angeles Rams and the New England Patriots.

American Freedom Mortgage, Inc. (AFM) was a private S Corporation incorporated on February 2, 2001, according to the Georgia Secretary of State, and headquartered in Marietta, Georgia. AFM conducted business as a multi-state direct-to-consumer correspondent lender and mortgage broker specializing in the origination of subprime and Alt-A mortgage loans. AFM also operated a wholesale mortgage lending division that originated loans via approved mortgage brokers and which used the fictitious name AFMI Funding. As a correspondent lender, AFM sold the mortgage loans on the open market to larger investors.

William Dean Shields is an American former professional football player who was an offensive tackle in the National Football League (NFL), primarily for the San Diego Chargers. He played college football for the Georgia Tech Yellow Jackets and was selected by the Chargers in the sixth round of the 1975 NFL draft. Shields also played in the NFL for the San Francisco 49ers, New York Jets and Kansas City Chiefs.

Angelo Robert Mozilo was an Italian American mortgage industry banker who was co-founder, chairman of the board, and chief executive officer of mortgage giant Countrywide Financial until July 1, 2008. Mozilo retired shortly after the sale to Bank of America for a total of $4.1 billion in stock The company's status as a major lender of subprime mortgages made it a central player in a subsequent mortgage crisis which collapsed the industry, bursting a housing bubble which had accumulated throughout the 2000s, and contributing heavily to the Great Recession. Mozilo later paid over $67 million in fines to settle a series of federal charges related to his conduct at the company. While Mozilo is often mentioned in connection with the 2008 housing crisis, he remains highly regarded among many mortgage and housing industry leaders and insiders.

Taylor, Bean & Whitaker was a top-10 wholesale mortgage lending firm in the United States, the fifth-largest issuer of Government National Mortgage Association securities. Their slogan was "Perfecting the Art of Mortgage Lending".

Kenneth D. Lewis is the former CEO, president, and chairman of Bank of America, currently the second largest bank in the United States and twelfth largest by total assets in the world. While CEO of Bank of America, Lewis was noted for purchasing the failing companies Countrywide Financial and Merrill Lynch, resulting in large losses for the bank and necessitating financial assistance from the federal government. On September 30, 2009, Bank of America confirmed that Lewis would be retiring by the end of the year. Lewis was replaced by Brian Moynihan as president and CEO and Walter Massey as chairman of the board.

Craig Marlon Bingham is a former American football linebacker who played five seasons in the National Football League (NFL) with the Pittsburgh Steelers and the San Diego Chargers. He is distinguished as being the first Jamaican to play in the NFL.

Andre Benoise Young is a former professional American football player who played defensive back for two seasons for the San Diego Chargers

Axos Financial, Inc. is a bank holding company based in Las Vegas, Nevada. The company operates Axos Clearing LLC, a financial custodian; Axos Bank, a direct bank; registered investment adviser services via Axos Advisor Services; and operates an electronic trading platform via Axos Invest, Inc.

References

- 1 2 3 4 5 6 "Andrew Gissinger". Players. National Football League . Retrieved March 27, 2013.

- ↑ Maffei, John (November 12, 1984). "Receptions record within Joiner's grasp". Times-Advocate. p. C3. Retrieved April 18, 2024– via Newspapers.com.

The injuries forced Drew Gissinger — normally a tackle — to play tight end for the second week in a row, and this week had a catch for three yards.

- ↑ Gates, Marshall M. (September 27, 2005). SEC FORM 8-K. Calabasas, California: Countrywide Financial Corporation.

- ↑ Hagerty, James R.; Karp, Jonathan (October 3, 2007). "Countrywide Tells Workers, 'Protect Our House'". The Wall Street Journal . Retrieved August 8, 2009.

- ↑ Hagerty, James R.; Fitzpatrick, Dan (September 24, 2008). "BofA Cuts Countrywide's No. 3: Gissinger Is Out as Bank Turns In for Integration Work". The Wall Street Journal . pp. C6. Retrieved August 8, 2009.

- 1 2 Hagerty, James R. (June 11, 2008). "BofA Selects Countrywide Officials for Mortgage Unit". The Wall Street Journal . Retrieved August 8, 2009.