Related Research Articles

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

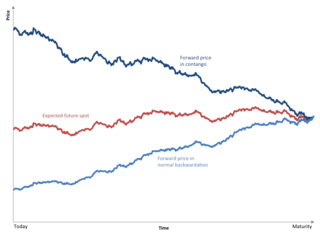

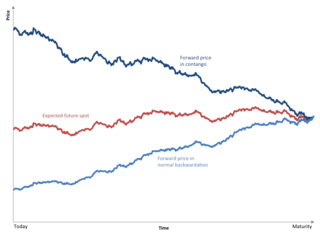

Normal backwardation, also sometimes called backwardation, is the market condition where the price of a commodity's forward or futures contract is trading below the expected spot price at contract maturity. The resulting futures or forward curve would typically be downward sloping, since contracts for further dates would typically trade at even lower prices. In practice, the expected future spot price is unknown, and the term "backwardation" may refer to "positive basis", which occurs when the current spot price exceeds the price of the future.

Contango is a situation where the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options.

The London Gold Fixing is the setting of the price of gold that takes place via a dedicated conference line. It was formerly held on the London premises of Nathan Mayer Rothschild & Sons by the members of The London Gold Market Fixing Ltd.

In finance, cornering the market consists of obtaining sufficient control of a particular stock, commodity, or other asset in an attempt to manipulate the market price. One definition of cornering a market is "having the greatest market share in a particular industry without having a monopoly".

Amaranth Advisors LLC was an American multi-strategy hedge fund founded by Nicholas M. Maounis and headquartered in Greenwich, Connecticut. At its peak, the firm had up to $9.2 billion in assets under management before collapsing in September 2006, after losing in excess of $6 billion on natural gas futures. Amaranth Advisors collapse is one of the biggest hedge fund collapses in history and at the time (2006) largest known trading losses.

In economics and finance, market manipulation is a type of market abuse where there is a deliberate attempt to interfere with the free and fair operation of the market; the most blatant of cases involve creating false or misleading appearances with respect to the price of, or market for, a product, security or commodity.

The Sumitomo copper affair refers to a metal trading scandal in 1996 involving Yasuo Hamanaka, the chief copper trader of the Japanese trading house Sumitomo Corporation (Sumitomo). The scandal involves unauthorized trading over a 10-year period by Hamanaka, which led Sumitomo to announce US$1.8 billion in related losses in 1996 when Hamanaka's trading was discovered, and more related losses subsequently. The scandal also involved Hamanaka's attempts to corner the entire world's copper market through LME Copper futures contracts on the London Metal Exchange (LME).

High-frequency trading (HFT) is a type of algorithmic trading in finance characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. While there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, co-location, and very short-term investment horizons in trading securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second.

The May 6, 2010, flash crash, also known as the crash of 2:45 or simply the flash crash, was a United States trillion-dollar flash crash which started at 2:32 p.m. EDT and lasted for approximately 36 minutes.

Bartholomew Hamilton Chilton was an American civil servant.

The London bullion market is a wholesale over-the-counter market for the trading of gold, silver, platinum and palladium. Trading is conducted amongst members of the London Bullion Market Association (LBMA), tightly overseen by the Bank of England. Most of the members are major international banks or bullion dealers and refiners.

In April and May 2012, large trading losses occurred at JPMorgan's Chief Investment Office, based on transactions booked through its London branch. The unit was run by Chief Investment Officer Ina Drew, who later stepped down. A series of derivative transactions involving credit default swaps (CDS) were entered, reportedly as part of the bank's "hedging" strategy. Trader Bruno Iksil, nicknamed the London Whale, accumulated outsized CDS positions in the market. An estimated trading loss of $2 billion was announced. However, the loss amounted to more than $6 billion for JPMorgan Chase.

The aluminium price-fixing conspiracy was an effort by Goldman Sachs, JPMorgan Chase, Glencore and their warehouse companies to inflate the price of aluminium by creating artificial supply shortages at their warehouses between 2010 and 2013.

The forex scandal is a 2013 financial scandal that involves the revelation, and subsequent investigation, that banks colluded for at least a decade to manipulate exchange rates on the forex market for their own financial gain. Market regulators in Asia, Switzerland, the United Kingdom, and the United States began to investigate the $4.7 trillion per day foreign exchange market (forex) after Bloomberg News reported in June 2013 that currency dealers said they had been front-running client orders and rigging the foreign exchange benchmark WM/Reuters rates by colluding with counterparts and pushing through trades before and during the 60-second windows when the benchmark rates are set. The behavior occurred daily in the spot foreign-exchange market and went on for at least a decade according to currency traders.

Daniel Shak is an American semi-professional poker player and hedge fund manager known for his accomplishments in high buy-in poker events.

Spoofing is a disruptive algorithmic trading activity employed by traders to outpace other market participants and to manipulate markets. Spoofers feign interest in trading futures, stocks, and other products in financial markets creating an illusion of the demand and supply of the traded asset. In an order driven market, spoofers post a relatively large number of limit orders on one side of the limit order book to make other market participants believe that there is pressure to sell or to buy the asset.

Fideres Partners LLP (Fideres) is an international economic consulting firm that specializes in investigating corporate and financial wrongdoing. It provides economic analysis to competition regulators, law firms and their clients, from preliminary investigation to expert testimony. Fideres was founded following the 2008 financial crisis.

References

- ↑ "Manipulating Gold and Silver: A Criminal Naked Short Position that Could Wreck the Economy" DeepCapture.com (April 2, 2010). Retrieved May 4, 2011

- ↑ Eric Nalven class action lawsuit against JPMorgan Chase and HSBC (PDF) The New York Times (November 2, 2010). Retrieved May 7, 2011

- ↑ Andrew Maguire, "A Formal Response from Andrew Maguire" Archived 2013-10-31 at the Wayback Machine Silver Doctors (October 29, 2013). Retrieved October 29, 2013

- ↑ McKenna, Brian; MacDonald, Ann-Marie (21 April 2013). "The Secret World Of Gold". CBC.

- 1 2 3 4 Eric King, Interview with Andrew Maguire and GATA board member Adrian Douglas Archived 2011-06-15 at the Wayback Machine King World News (March 30, 2010). Retrieved May 6, 2011

- ↑ Lawrence Williams, "GATA's evidence of silver and gold manipulation at CFTC hearing" Mineweb (March 26, 2010). Retrieved May 11, 2011

- ↑ Silver prices are easy to manipulate: NIA International Business Times (April 5, 2010). Retrieved May 5, 2011

- ↑ E-mail exchange between Maguire and the CFTC Archived 2011-04-30 at the Wayback Machine King World News (January 26, 2010 - February 9, 2010). Retrieved May 4, 2011

- ↑ Silver Price Manipulation Investigation Focused On JPMorgan Chase TheStreet.com (May 11, 2010). Retrieved May 5, 2011

- 1 2 3 4 William D. Cohan, "A Conspiracy With a Silver Lining" The New York Times (March 2, 2011). Retrieved May 7, 2011

- ↑ Charlie Rose, Interview with filmmaker Charles Ferguson YouTube video (February 25, 2011). Retrieved March 14, 2011