Related Research Articles

At common law, damages are a remedy in the form of a monetary award to be paid to a claimant as compensation for loss or injury. To warrant the award, the claimant must show that a breach of duty has caused foreseeable loss. To be recognised at law, the loss must involve damage to property, or mental or physical injury; pure economic loss is rarely recognised for the award of damages.

In English civil litigation, costs are the lawyers' fees and disbursements of the parties.

Breach of contract is a legal cause of action and a type of civil wrong, in which a binding agreement or bargained-for exchange is not honored by one or more of the parties to the contract by non-performance or interference with the other party's performance. Breach occurs when a party to a contract fails to fulfill its obligation(s), whether partially or wholly, as described in the contract, or communicates an intent to fail the obligation or otherwise appears not to be able to perform its obligation under the contract. Where there is breach of contract, the resulting damages have to be paid to the aggrieved party by the party breaching the contract.

A hire purchase (HP), also known as an installment plan, is an arrangement whereby a customer agrees to a contract to acquire an asset by paying an initial installment and repaying the balance of the price of the asset plus interest over a period of time. Other analogous practices are described as closed-end leasing or rent to own.

Quantum meruit is a Latin phrase meaning "what one has earned". In the context of contract law, it means something along the lines of "reasonable value of services".

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:

The leaky bucket is an algorithm based on an analogy of how a bucket with a constant leak will overflow if either the average rate at which water is poured in exceeds the rate at which the bucket leaks or if more water than the capacity of the bucket is poured in all at once. It can be used to determine whether some sequence of discrete events conforms to defined limits on their average and peak rates or frequencies, e.g. to limit the actions associated with these events to these rates or delay them until they do conform to the rates. It may also be used to check conformance or limit to an average rate alone, i.e. remove any variation from the average.

In finance, a surety, surety bond or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party a certain amount if a second party fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. The person or company providing the promise is also known as a "surety" or as a "guarantor".

In law, liable means "responsible or answerable in law; legally obligated". Legal liability concerns both civil law and criminal law and can arise from various areas of law, such as contracts, torts, taxes, or fines given by government agencies. The claimant is the one who seeks to establish, or prove, liability.

In the United Kingdom, inheritance tax is a transfer tax. It was introduced with effect from 18 March 1986, replacing capital transfer tax.

Liquidated damages, also referred to as liquidated and ascertained damages (LADs), are damages whose amount the parties designate during the formation of a contract for the injured party to collect as compensation upon a specific breach. This is most applicable where the damages are intangible, such as a failure by the contractor on a public project to fulfill minority business subcontracting quotas.

A cost-plus contract, also termed a cost plus contract, is a contract such that a contractor is paid for all of its allowed expenses, plus additional payment to allow for a profit. Cost-reimbursement contracts contrast with fixed-price contract, in which the contractor is paid a negotiated amount regardless of incurred expenses.

A public adjuster is a professional claims handler/claims adjuster who represents the insured/policyholder in their insurance claim. Depending on the state, licensed public adjusters are required to prove competency in a variety of ways; written examination, experience time frames, and background checks. In many states, a public adjuster is a lawful fiduciary under either state or federal jurisdiction to legally and professionally represent the rights of an insured/policyholder during an insurance claim. The role of a public adjuster is to recover the best possible indemnification for their claims. Individuals may prefer to avoid the stress of claims handling themselves, and choose public adjuster representation to guide them through the process and minimize the time which must be spent to file their claim properly. Public adjusters negotiate with insurance companies/carriers for an adjustment or settlement. Primarily, public adjusters review the applicable insurance policy to determine coverage for the loss, assess the cause of loss to determine applicable coverage, assist the insured to prepare detailed scope and cost estimates to prove their loss. Public adjusters also provide insurance policy interpretation to determine if coverage exists, and to negotiate with the insurance company/carrier to a final and fair settlement. Most public adjusters charge a percentage of the settlement.

The Hudson Formula derives from Hudsons Building and Engineering Contracts and is used for the assessment of delay damages in construction claims.

The Law Reform Act 1943 is an act of the Parliament of the United Kingdom which establishes the rights and liabilities of parties involved in frustrated contracts. It amends previous common law rules on the complete or partial return of pre-payments, where a contract is deemed to be frustrated. It additionally introduces the concept that valuable benefits, other than financial benefits, may be returned upon frustration. It applies only to contracts governed by English law.

A changes clause, in government contracting, is a required clause in United States government construction contracts.

Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. A retention is money withheld by one party in a contract to act as security against incomplete or defective works. They have their origin in the British construction industry Railway Mania of the 1840s but are now common across the industry, featuring in the majority of construction contracts. A typical retention rate is 5% of which half is released at completion and half at the end of the defects liability period. There has been criticism of the practice for leading to uncertainty on payment dates, increasing tensions between parties and putting monies at risk in cases of insolvency. There have been several proposals to replace the practice with alternative systems.

Insolvency in South African law refers to a status of diminished legal capacity imposed by the courts on persons who are unable to pay their debts, or whose liabilities exceed their assets. The insolvent's diminished legal capacity entails deprivation of certain of his important legal capacities and rights, in the interests of protecting other persons, primarily the general body of existing creditors, but also prospective creditors. Insolvency is also of benefit to the insolvent, in that it grants him relief in certain respects.

A construction contract is a mutual or legally binding agreement between two parties based on policies and conditions recorded in document form. The two parties involved are one or more property owners and one or more contractors. The owner, often referred to as the 'employer' or the 'client', has full authority to decide what type of contract should be used for a specific development to be constructed and to set out the legally-binding terms and conditions in a contractual agreement. A construction contract is an important document as it outlines the scope of work, risks, duration, duties, deliverables and legal rights of both the contractor and the owner.

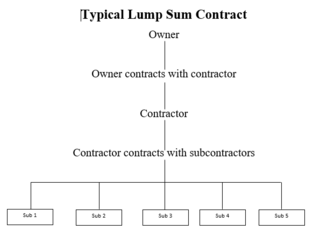

A lump sum contract in construction is one type of construction contract, sometimes referred to as stipulated-sum, where a single price is quoted for an entire project based on plans and specifications and covers the entire project and the owner knows exactly how much the work will cost in advance. This type of contract requires a full and complete set of plans and specifications and includes all the indirect costs plus the profit and the contractor will receive progress payments each month minus retention. The flexibility of this contract is very minimal and changes in design or deviation from the original plans would require a change order paid by the owner. In this contract the payment is made according to the percentage of work completed. The lump sum contract is different from guaranteed maximum price in a sense that the contractor is responsible for additional costs beyond the agreed price, however, if the final price is less than the agreed price then the contractor will gain and benefit from the savings.

References

- ↑ Rawlinsons Australian Construction Handbook 2013

- ↑ "Other contracts - Master Builders". masterbuilders.asn.au. Archived from the original on 2014-04-23. Retrieved 2014-04-21.

- ↑ "ABIC building industry contracts - Australian Institute of Architects". architecture.com.au. Retrieved 2014-04-21.

- ↑ http://www.dob.nt.gov.au/business/tenders-contracts/references/tendering-contract/Pages/npwc.aspx, [ dead link ]

- 1 2 3 "Australian Standards". contracts.com.au. Contracts & Purchasing Services Pty Ltd. Retrieved 2014-04-21.

- ↑ "Practical Law". construction.practicallaw.com. Retrieved 2014-04-21.