Related Research Articles

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many of the new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Electronic funds transfer at point of sale is an electronic payment system involving electronic funds transfers based on the use of payment cards, such as debit or credit cards, at payment terminals located at points of sale. EFTPOS technology was developed during the 1980s.

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff.

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer, and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but can also be dispensed with or sent electronically.

A personal identification number (PIN), or sometimes redundantly a PIN number or PIN code, is a numeric passcode used in the process of authenticating a user accessing a system.

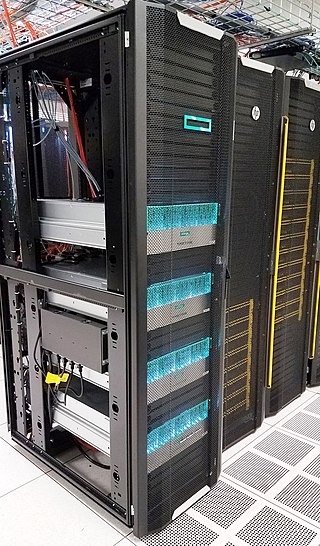

NonStop is a series of server computers introduced to market in 1976 by Tandem Computers Inc., beginning with the NonStop product line. It was followed by the Tandem Integrity NonStop line of lock-step fault tolerant computers, now defunct. The original NonStop product line is currently offered by Hewlett Packard Enterprise since Hewlett-Packard Company's split in 2015. Because NonStop systems are based on an integrated hardware/software stack, Tandem and later HPE also developed the NonStop OS operating system for them.

Verifone is an American multinational corporation headquartered in Coral Springs, Florida. Verifone provides technology for electronic payment transactions and value-added services at the point-of-sale. Verifone sells merchant-operated, consumer-facing and self-service payment systems to the financial, retail, hospitality, petroleum, government and healthcare industries. The company's products consist of POS electronic payment devices that run its own operating systems, security and encryption software, and certified payment software, and that are designed for both consumer-facing and unattended environments.

A hardware security module (HSM) is a physical computing device that safeguards and manages secrets, performs encryption and decryption functions for digital signatures, strong authentication and other cryptographic functions. These modules traditionally come in the form of a plug-in card or an external device that attaches directly to a computer or network server. A hardware security module contains one or more secure cryptoprocessor chips.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards.

Network for Electronic Transfers, colloquially known as NETS, is a Singaporean electronic payment service provider. Founded in 1986, by a consortium of local banks, it aims to establish the debit network and drive the adoption of electronic payments in Singapore. It is owned by DBS Bank, OCBC Bank and United Overseas Bank (UOB).

The Electronic Fund Transfer Act was passed by the U.S. Congress in 1978 and signed by President Jimmy Carter, to establish the rights and liabilities of consumers as well as the responsibilities of all participants in electronic funds transfer activities.

Enscribe is the native hierarchical database in the commercial HP NonStop (Tandem) servers. It is designed for fault tolerance and scalability and is currently offered by Hewlett Packard Enterprise.

The payment card industry (PCI) denotes the debit, credit, prepaid, e-purse, ATM, and POS cards and associated businesses.

Euronet Worldwide is an American provider of global electronic payment services with headquarters in Leawood, Kansas. It offers automated teller machines (ATM), point of sale (POS) services, credit/debit card services, currency exchange and other electronic financial services and payments software. Among others, it provides the prepaid subsidiaries Transact, PaySpot, e-pay, Movilcarga, TeleRecarga and ATX.

The BancNet (BN) Point-Of-Sale System is a local PIN-based electronic funds transfer (EFTPOS) payments solution operated by BancNet on behalf of the member banks and China UnionPay (CUP). The BN point of sale (POS) System allows merchants to accept the automated teller machine (ATM) cards of any active BancNet member bank as payment for goods or services and obliges BN to settle the transaction as early as the following banking day through a direct deposit to a settlement account with any member bank. Acceptance of CUP cards is limited to SM Prime Holdings, Inc.'s Department Store, Supermarket, Hypermarket, Super Sale, Watson's, Sports Central, SM Appliance, Toy Kingdom, and select Surplus Stores.

4690 Operating System is a specially designed point of sale (POS) operating system, originally sold by IBM. In 2012, IBM sold its retail business, including this product, to Toshiba, which assumed support. 4690 is widely used by IBM and Toshiba retail customers to run retail systems which run their own applications and others.

ACI Worldwide Inc. is a payment systems company headquartered in Miami, Florida. ACI develops a broad line of software focused on facilitating real-time electronic payments. These products and services are used globally by banks, financial intermediaries such as third-party electronic payment processors, payment associations, switch interchanges, merchants, corporations, and a wide range of transaction-generating endpoints, including automated teller machines ("ATM"), merchant point of sale ("POS") terminals, bank branches, mobile phones, tablet computers, corporations, and internet commerce sites.

Worldpay, Inc. was an American payment processing company and technology provider. In June 2019 it was acquired and merged into Fidelity National Information Services (FIS). Before its acquisition, it was headquartered in the greater Cincinnati, Ohio area. Worldpay, Inc., was the largest U.S. merchant acquirer ranked by general-purpose transaction volume.

Multicaixa (MCX) is currently the only brand name for debit cards issued in Angola, and also the only interbank network of automated teller machines and point of sales terminals for electronic payments. While the ATMs and the POS terminals are owned by the supporting bank, the network is operated by EMIS, and the Multicaixa cards of any bank are accepted at the same terms at any Multicaixa ATM or POS terminal. This is regulated by the national law on Angolan payment systems, the BNA directive No. 9/2011 of 13 October on the regulation of bank payment cards, and various other laws and directives regulating the Angolan financial system.

The Four Corners model, often referred to as the Four Party Scheme is the most used card scheme in card payment systems worldwide. This model was introduced in the 1990s. It is a user-friendly card payment system based on an interbank clearing system and economic model established on multilateral interchange fees (MIF) paid between banks or other payment institutions.

References

- ↑ "BASE24-atm". ACI Worldwide, Inc. Archived from the original on 4 October 2009. Retrieved 1 Sep 2009.

- ↑ "BASE24-eps". ACI Worldwide, Inc. Archived from the original on 2009-06-20. Retrieved 1 Sep 2009.

- ↑ "A Guide to the ACI Worldwide BASE24-eps on z/OS". IBM Redbooks. Retrieved 1 Sep 2009.

- ↑ "BASE24-infobase". ACI Worldwide, Inc. Archived from the original on 12 March 2012. Retrieved 16 Jun 2011.

- ↑ "BASE24-pos". ACI Worldwide, Inc. Archived from the original on 2009-05-29. Retrieved 1 Sep 2009.