Related Research Articles

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 190 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world."

The Washington Consensus is a set of ten economic policy prescriptions considered to constitute the "standard" reform package promoted for crisis-wracked developing countries by Washington, D.C.-based institutions such as the International Monetary Fund (IMF), World Bank and United States Department of the Treasury. The term was first used in 1989 by English economist John Williamson. The prescriptions encompassed free-market promoting policies such as trade liberalization, privatization and finance liberalization. They also entailed fiscal and monetary policies intended to minimize fiscal deficits and minimize inflation.

The debt of developing countries usually refers to the external debt incurred by governments of developing countries.

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

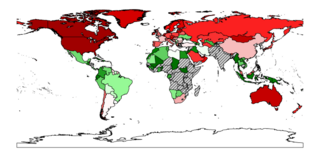

Dependency theory is the idea that resources flow from a "periphery" of poor and exploited states to a "core" of wealthy states, enriching the latter at the expense of the former. A central contention of dependency theory is that poor states are impoverished and rich ones enriched by the way poor states are integrated into the "world system". This theory was officially developed in the late 1960s following World War II, as scholars searched for the root issue in the lack of development in Latin America.

Brady bonds are dollar-denominated bonds, issued mostly by Latin American countries in the late 1980s. The bonds were named after U.S. Treasury Secretary Nicholas Brady, who proposed a novel debt-reduction agreement for developing countries.

Structural adjustment programs (SAPs) consist of loans provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experience economic crises. Their stated purpose is to adjust the country's economic structure, improve international competitiveness, and restore its balance of payments.

The Convertibility plan was a plan by the Argentine Currency Board that pegged the Argentine peso to the U.S. dollar between 1991 and 2002 in an attempt to eliminate hyperinflation and stimulate economic growth. While it initially met with considerable success, the board's actions ultimately failed. The peso was only pegged to the dollar until 2002.

A vulture fund is a hedge fund, private-equity fund or distressed debt fund, that invests in debt considered to be very weak or in default, known as distressed securities. Investors in the fund profit by buying debt at a discounted price on a secondary market and then using numerous methods to subsequently sell the debt for a larger amount than the purchasing price. Debtors include companies, countries, and individuals.

The Latin American debt crisis was a financial crisis that originated in the early 1980s, often known as La Década Perdida, when Latin American countries reached a point where their foreign debt exceeded their earning power, and they could not repay it.

In its economic relations, Japan is both a major trading nation and one of the largest international investors in the world. In many respects, international trade is the lifeblood of Japan's economy. Imports and exports totaling the equivalent of nearly US$1.309.2 Trillion in 2017, which meant that Japan was the world's fourth largest trading nation after China, the United States and Germany. Trade was once the primary form of Japan's international economic relationships, but in the 1980s its rapidly rising foreign investments added a new and increasingly important dimension, broadening the horizons of Japanese businesses and giving Japan new world prominence.

"La Década Perdida" of Latin America is a Spanish term used to describe the economic crisis suffered in Latin America during the 1980s, which continued for some countries into the 1990s. In general, the crisis was composed of unpayable external debts, taxes, and volatile inflation and exchange rates, which in the majority of the countries in the region were fixed.

Ecological debt refers to the accumulated debt seen by some campaigners as owed by the Global North to Global South countries, due to the net sum of historical environmental injustice, especially through resource exploitation, habitat degradation, and pollution by waste discharge. The concept was coined by Global Southerner non-governmental organizations in the 1990s and its definition has varied over the years, in several attempts of greater specification.

The economy of Chile has shifted substantially over time from the heterogeneous economies of the diverse indigenous peoples to an early husbandry-oriented economy and finally to one of raw material export and a large service sector. Chile's recent economic history has been the focus of an extensive debate, as it pioneered neoliberal economic policies.

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments may either be accompanied by that government's formal declaration that it will not pay its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments.

The Great Recession was a period of marked general decline observed in national economies globally, i.e. a recession, that occurred in the late 2000s. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

The Mexican Weekend marked the beginning of the Latin American debt crisis. In August 1982, Mexican Secretary of Finance Jesús Silva Herzog Flores flew to Washington, D.C., to declare Mexico's foreign debt unmanageable, and announce that his country was in danger of defaulting.

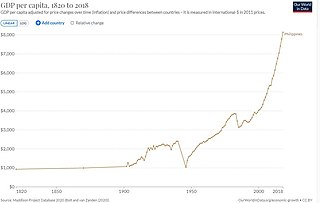

The economic history of the Philippines chronicles the long history of economic policies in the nation over the years.

Stephany Griffith-Jones is an economist specializing in international finance and development. Her expertise lies in the reform of the international financial system, particularly in financial regulation, global governance, and international capital flows. Currently, she serves as a member of the Governor Board at the Central Bank of Chile. She has held various positions throughout her career, including financial markets director at the Initiative for Policy Dialogue based at Columbia University, associate fellow at the Overseas Development Institute, and professorial fellow at the Institute of Development Studies at Sussex University.

Luiz Carlos Bresser-Pereira is a Brazilian economist and social scientist. He teaches at the Getulio Vargas Foundation in São Paulo. Since 1981, he has been the editor of the Brazilian Journal of Political Economy.

References

- Buiter, W. and Srinivasan, T.N. (1987) "Rewarding the Profligate and Punishing the Prudent and Poor: Some Recent Proposals for Debt Relief", World Development Journal, Vol. 15, No. 3, pp411–417.

- Bogdanowicz-Bindert, C A, (1986) "The Debt Crisis: The Baker Plan Revisited", Journal of Interamerican Studies and World Affairs, Vol. 28, No. 3, pp. 33–45.

- Rudolph, Barbara, "Enter The Brady Plan", Time, 20 March 1989.

- Riding, Alan, "Baker's debt plan gets Latin scrutiny", New York Times, December 16, 1985.