Washington Mutual, Inc. was an American savings bank holding company based in Seattle. It was the parent company of WaMu Bank, which was the largest savings and loan association in the United States until its collapse in 2008.

The ING Group is a Dutch multinational banking and financial services corporation headquartered in Amsterdam. Its primary businesses are retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services. With total assets of US$967.8 billion, it is one of the biggest banks in the world, and consistently ranks among the largest banks globally.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

TD Banknorth, formerly Banknorth, was a wholly owned subsidiary of the Toronto-Dominion Bank which conducted banking and insurance activities, primarily serving the northeastern area of the United States, headquartered in Portland, Maine. The bank became TD Bank, N.A. on May 31, 2008.

BDO Unibank, Inc., commonly known as Banco de Oro (BDO), is a Philippine banking company based in Mandaluyong. In terms of total assets, the firm is the largest bank in the Philippines and 15th largest in Southeast Asia as of March 31, 2016. BDO Unibank is also a member of SM Group. It is also the largest bank in the country by market capitalization.

Old National Bank is an American regional bank with nearly 200 retail branches operated by Old National Bancorp and based in Chicago and Evansville, Indiana. With assets at $23.0 billion and 162 banking centers, Old National Bancorp is the largest financial services bank holding company headquartered in Indiana and one of the top 100 banking companies in the U.S. Its primary banking footprint is in Illinois, Indiana, Kentucky, Michigan, Minnesota, and Wisconsin.

Great Western Bank was a large retail bank that operated primarily in the Western United States. Great Western's headquarters were in Chatsworth, California. At one time, Great Western was one of the largest savings and loan in the United States, second only to Home Savings of America. The bank was acquired by Washington Mutual in 1997 for $6.8 billion.

H.F. Ahmanson & Co. was a California holding company named after Howard F. Ahmanson Sr. It was best known as the parent of Home Savings of America, once one of the largest savings and loan associations in the United States.

Beal Bank is an American bank, which was founded by Texas-based entrepreneur D. Andrew "Andy" Beal. It includes two separately chartered banks, Beal Bank and Beal Bank USA. Each entity is insured by the Federal Deposit Insurance Corporation (FDIC).

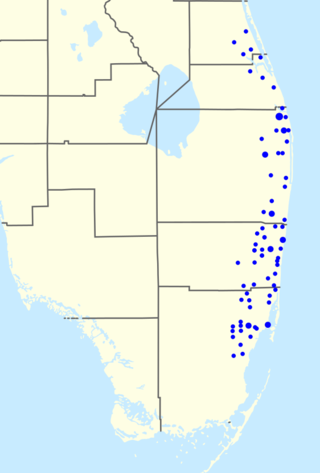

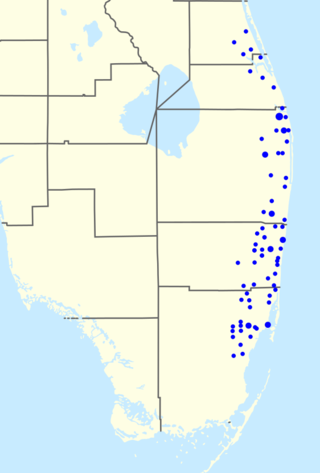

BankAtlantic was a US bank that operated in the state of Florida until it was acquired in 2012 by BB&T Corporation. It provided consumer and business banking services to communities throughout Florida.

First Niagara Bank was a Federal Deposit Insurance Corporation-insured regional banking corporation headquartered in Buffalo, New York. Its parent company, First Niagara Financial Group, Inc. was the 44th-largest bank in the United States with assets of over $37.1 billion as of June 30, 2013.

People's United Financial, Inc., was an American bank holding company that owned People's United Bank. The bank operated 403 branches in Connecticut, southeastern New York State, Massachusetts, Vermont, Maine, and New Hampshire. It was the second-largest full-service bank in New England, one of the largest in the northeast, and the 46th-largest in the United States.

Hudson City Bancorp, Inc., based in Paramus, in the U.S. state of New Jersey, was a bank-holding company for Hudson City Savings Bank, its only subsidiary, then the largest savings bank in New Jersey and one of the oldest banks in the United States, with US$50 billion in assets. It is now a fully publicly held entity and a member S&P 500 stock market Index. In 2005, its US$3.93 billion secondary offering of common stock was the largest in United States banking history. At the time, it was also the seventh largest domestic public offering in United States history The bank avoided the excesses of the housing boom and was labeled "best bank of 2007" by Forbes. M&T Bank agreed to acquire Hudson City on August 27, 2012.

Before Uganda's independence in 1962, the main banks in Uganda were Barclays ; Grindlays, Standard Bank and the Bank of Baroda from India. The currency was issued by the East African Currency Board, a London-based body. In 1966, the Bank of Uganda (BoU), which controlled the issue of currency and managed foreign exchange reserves, became the central bank and national banking regulator. The government-owned Uganda Commercial Bank and the Uganda Development Bank were launched in the 1960s. The Uganda Development Bank is a state-owned development finance institution, which channeled loans from international sources into Ugandan enterprises and administered most of the development loans made to Uganda.

Old Stone Bank was a popular Rhode Island banking institution that was founded in Providence in 1819 as a mutual savings bank that was called Providence Institution for Savings.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

Bank United Corporation, headquartered in Houston, Texas, was a broad-based financial services provider and the largest publicly traded depository institution headquartered in Texas before its merger with Washington Mutual in 2001. Bank United Corp. conducted its business through its wholly owned subsidiary, Bank United, a federally chartered savings bank. The company operated a 155-branch community banking network in Texas, including 77 in the Dallas/Fort Worth Metroplex, 66 in the greater Houston area, five in Midland, four in Austin, and three in San Antonio; operated 19 SBA lending offices in 14 states; was a national middle market commercial bank with 23 regional offices in 16 states; originated mortgage loans through 11 wholesale offices in 10 states; operated a national mortgage servicing business serving approximately 324,000 customers, and managed an investment portfolio. As of June 30, 2000, Bank United Corp. had assets of $18.2 billion, deposits of $8.8 billion, and stockholder's equity of $823 million.

Capitec Bank is a South African retail bank. As of August 2017 the bank was the second largest retail bank in South Africa, based on number of customers, with 120,000 customers opening new accounts per month.

Equitable Bank is a Canadian bank that specializes in residential and commercial real estate lending, as well as personal banking through its digital arm, EQ Bank. Founded in 1970 as The Equitable Trust Company, it became a Schedule I Bank in 2013 and has since grown to become Canada's seventh largest bank by assets.