Electronic funds transfer at point of sale is an electronic payment system involving electronic funds transfers based on the use of payment cards, such as debit or credit cards, at payment terminals located at points of sale. EFTPOS technology was developed during the 1980s. In Australia and New Zealand, it is also the brand name of a specific system used for such payments; these systems are mainly country-specific and do not interconnect. In Singapore, it is known as NETS.

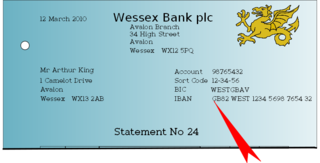

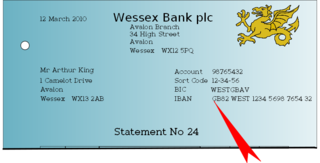

The International Bank Account Number (IBAN) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. As of May 2020, 77 countries were using the IBAN numbering system.

Nordea Bank Abp, commonly referred to as Nordea, is a European financial services group operating in northern Europe and based in Helsinki, Finland. The name is a blend of the words "Nordic" and "idea". The bank is the result of the successive mergers and acquisitions of the Finnish, Swedish, Danish, and Norwegian banks of Merita Bank, Nordbanken, Unidanmark, and Christiania Bank og Kreditkasse that took place between 1997 and 2001. The Nordic countries are considered Nordea's home market, having finalised the sales of their Baltic operations in 2019. Nordea is listed on Nasdaq Nordic exchanges in Helsinki, Copenhagen, and Stockholm and Nordea ADR is listed in the US.

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques (checks) and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

In the United States, an ABA routing transit number is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's bank for debit to the drawer's account.

PlusGirot(formerly PostGirot) is a Swedish money transaction system, owned by Nordea. PlusGirot is one of two proprietary clearing systems used for regular transactions such as bill payments in Sweden.

A giro transfer, often shortened to giro, is a payment transfer from one bank account to another bank account and initiated by the payer, not the payee. The debit card has a similar model. Giros are primarily used in Europe; although electronic payment systems exist in the United States, it is not possible to perform third-party transfers with them. In the European Union, there is the Single Euro Payments Area (SEPA), which allows electronic giro or debit card payments in euros to be executed to any euro bank account in the area.

A cheque, or check, is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

A Bank State Branch is the name used in Australia for a bank code, which is a branch identifier. The BSB is normally used in association with the account number system used by each financial institution. The structure of the BSB + account number does not permit for account numbers to be transferable between financial institutions. While similar in structure, the New Zealand and Australian systems are only used in domestic transactions and are incompatible with each other. For international transfers, a SWIFT code is used in addition to the BSB and account number.

National Girobank was a British public sector financial institution run by the General Post Office that opened for business in October 1968. It started life as National Giro then National Girobank and finally Girobank plc before being absorbed into Alliance & Leicester plc in 2003.

A direct debit or direct withdrawal is a financial transaction in which one organisation withdraws funds from a payer's bank account. Formally, the organisation that calls for the funds instructs their bank to collect an amount directly from another's bank account designated by the payer and pay those funds into a bank account designated by the payee. Before the payer's banker will allow the transaction to take place, the payer must have advised the bank that they have authorized the payee to directly draw the funds. It is also called pre-authorized debit (PAD) or pre-authorized payment (PAP). After the authorities are set up, the direct debit transactions are usually processed electronically.

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of bank codes varies. In some countries the bank codes can be viewed over the internet, but mostly in the local language.

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organisations and to identify accounts, while in the Republic of Ireland they have been deprecated and replaced by the SEPA systems and infrastructure.

Cash management refers to a broad area of finance involving the collection, handling, and usage of cash. It involves assessing market liquidity, cash flow, and investments.

The Chip Authentication Program (CAP) is a MasterCard initiative and technical specification for using EMV banking smartcards for authenticating users and transactions in online and telephone banking. It was also adopted by Visa as Dynamic Passcode Authentication (DPA). The CAP specification defines a handheld device with a smartcard slot, a numeric keypad, and a display capable of displaying at least 12 characters. Banking customers who have been issued a CAP reader by their bank can insert their Chip and PIN (EMV) card into the CAP reader in order to participate in one of several supported authentication protocols. CAP is a form of two-factor authentication as both a smartcard and a valid PIN must be present for a transaction to succeed. Banks hope that the system will reduce the risk of unsuspecting customers entering their details into fraudulent websites after reading so-called phishing emails.

New Zealand bank account numbers in NZD follow a standardised format of 16 digits:

Vipps is a Norwegian mobile payment application designed for smartphones developed by DNB. Vipps was released May 30, 2015 and, having reached 1 million users by November 5, 2015, Vipps became Norway's largest payment application. Although Vipps was developed by DNB, customers of any Norwegian bank can use it. Vipps is a member of the European Mobile Payment Systems Association.

In a cashless society, financial transactions are not conducted with physical banknotes or coins, but instead with digital information. Cashless societies have existed from the time when human society came into existence, based on barter and other methods of exchange, and cashless transactions have also become possible in modern times using credit cards, debit cards, mobile payments, and digital currencies such as bitcoin. However, this article focuses on the term "cashless society" in the sense of a move towards a society in which cash is replaced by its digital equivalent—in other words, legal tender (money) exists, is recorded, and is exchanged only in electronic digital form.

Swish is a mobile payment system in Sweden. The service was launched in 2012 by six large Swedish banks, in cooperation with Bankgirot and the Central Bank of Sweden. It had 8 million users as of July 2022. Swish is a member of the European Mobile Payment Systems Association.