A capital market is a financial market in which long-term debt or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties.

Ovintiv Inc., formerly Encana Corporation, is a hydrocarbon exploration and production company organized in Delaware and headquartered in Denver, United States. It was founded and headquartered in Calgary, Alberta, and was the largest energy company and largest natural gas producer in Canada. The company was rebranded as Ovintiv and relocated to Denver in 2019–20.

Seed money, sometimes known as seed funding or seed capital, is a form of securities offering in which an investor invests capital in a startup company in exchange for an equity stake or convertible note stake in the company. The term seed suggests that this is a very early investment, meant to support the business until it can generate cash of its own, or until it is ready for further investments. Seed money options include friends and family funding, seed venture capital funds, angel funding, and crowdfunding.

Corruption in the post-colonial government of Kenya has a history which spans the era of the founding president Jomo Kenyatta, to Daniel arap Moi's KANU, Mwai Kibaki's PNU government and the current Uhuru Kenyatta's Jubilee Party government. In the Corruption Perceptions Index 2020 Kenya is ranked 124th out of 180 countries for corruption, tied with Bolivia, Kyrgyzstan, Mexico, and Pakistan.

Rift Valley Railways (RVR) was a consortium established to manage the parastatal railways of Kenya and Uganda. The consortium won the bid for private management of the century-old Uganda Railway in 2005. The Kenya-Uganda railway had previously been run by the East African Railways and Harbours Corporation over the period 1948–77. In 2014, RVR moved 1,334 million net tonne kilometers of rail freight, up from 1,185 million net tonne kilometers the previous year. Both Kenya and Uganda terminated their contracts with RVR in mid-2017, with control of their national rail networks reverting to the Kenya Railways Corporation and the Uganda Railways Corporation, respectively.

Jacob "Kobi" Alexander is an Israeli-American businessman. He is the founder and the former CEO of New York-based Comverse Technology. In 2006, he was charged with multiple counts of fraud and related offenses pertaining to irregularities in trading of Comverse stock; he subsequently fled to Namibia, a nation which has no extradition treaty with the US.

EFG Hermes Holding S.A.E. is an Egyptian financial services company present in the Middle East, North Africa, Sub-Saharan Africa, and South Asia regions and specializes in securities brokerage, asset management, investment banking, private equity and research in addition to finance lease, factoring, microfinance, Financial technology, mortgage, and insurance. EFG Hermes serves a range of clients including sovereign wealth funds, endowments, corporations, financial institutions, high-net-worth clients and individual customers. EFG Hermes is listed on the Egyptian Exchange (EGX) and London (LSE) stock exchanges. EFG Hermes has offices in Egypt, the United Arab Emirates (UAE), the Kingdom of Saudi Arabia (KSA), Pakistan, Oman, Kuwait, Jordan, Kenya, Nigeria, UK, United States and Bangladesh with over 4500 people from 25 nationalities. They serve clients from the Middle East, North Africa, Europe and the United States.

The Canadian Securities Administrators is an umbrella organization of Canada's provincial and territorial securities regulators whose objective is to improve, coordinate, and harmonize regulation of the Canadian capital markets.

Melvin Reginald Knight was the Minister of Energy of Alberta and a Progressive Conservative member of the Legislative Assembly of Alberta.

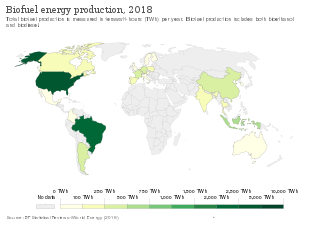

China has set the goal of attaining one percent of its renewable energy generation through bioenergy in 2020.

Dynamotive Energy Systems Corporation is a Canadian based Renewable Energy Company which specializes in fast pyrolysis, a process which creates a product named BioOil. Its only other residue is char.

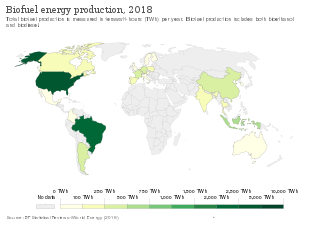

The use of biofuels varies by region. The world leaders in biofuel development and use are Brazil, United States, France, Sweden and Germany.

Land grabbing is the contentious issue of large-scale land acquisitions: the buying or leasing of large pieces of land by domestic and transnational companies, governments, and individuals.

Enerkem is a Montreal-based cleantech company. Founded in 2000, the Enerkem technology converts pretreated municipal solid waste into transportation fuels and chemicals.

Energy in Hawaii is a mixture of fossil fuel and renewable resources. It is complicated by the state's isolated location and lack of fossil fuel resources. The state relies heavily on imports of petroleum and coal for power. Renewable energy production is increasing. Hawaii has the highest share of petroleum use in the United States, with about 62% of electricity coming from oil in 2017. As of 2016, 26.6% of electricity was from renewable sources, including solar, wind, hydro and geothermal.

Equity crowdfunding is the online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. Because equity crowdfunding involves investment into a commercial enterprise, it is often subject to securities and financial regulation. Equity crowdfunding is also referred to as crowdinvesting, investment crowdfunding, or crowd equity.

Cylance Inc. is an American software firm that develops antivirus programs and other kinds of computer software that prevents, rather than reactively detect, viruses and malware. The company is based in Irvine, California. Cylance has been described as “the first company to apply artificial intelligence, algorithms, and machine learning to cyber security.”

Amir Bramly is an Israeli investor and business man convicted of money laundering and fraud. He is the founder and former manager of Rubicon Business Group and "Kela Fund", and former partner in Hagshama fund. At the height of his career, Bramly controlled dozens of companies, and received intense media coverage both of his own dealings and as an interviewed expert.

An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding, however a private ICO which does not seek public investment is also possible. In an ICO, a quantity of cryptocurrency is sold in the form of "tokens" ("coins") to speculators or investors, in exchange for legal tender or other cryptocurrencies such as Bitcoin or Ethereum. The tokens are promoted as future functional units of currency if or when the ICO's funding goal is met and the project successfully launches.

The Capital Markets Union (CMU) is an economic policy initiative launched by the former president of the European Commission, Jean-Claude Junker in the initial exposition of his policy agenda on 15 July 2014. The main target was to create a single market for capital in the whole territory of the EU by the end of 2019. The reasoning behind the idea was to address the issue that corporate finance relies on debt and the fact that capitals markets in Europe were not sufficiently integrated so as to protect the EU and especially the Eurozone from future crisis. The Five Presidents Report of June 2015 proposed the CMU in order to complement the Banking union of the European Union and eventually finish the Economic and Monetary Union (EMU) project. The CMU is supposed to attract 2000 billion dollars more on the European capital markets, on the long-term.