Medicare is a national health insurance program in the United States, begun in 1966 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disability status as determined by the Social Security Administration, as well as people with end stage renal disease and amyotrophic lateral sclerosis.

Medicare is the publicly-funded universal health care insurance scheme in Australia operated by Services Australia. Medicare is the main source of payment of health care in Australia, either partially or fully covering the cost of most primary health care services for eligible citizens, residents and some visitors. Residents are entitled to a rebate for treatment by medical practitioners, eligible midwives, nurse practitioners and allied health professionals who have been issued a Medicare provider number, and they can also obtain free treatment in state public hospitals.

The Health Insurance Portability and Accountability Act of 1996 was enacted by the 104th United States Congress and signed by President Bill Clinton in 1996. It was created primarily to modernize the flow of healthcare information, stipulate how Personally Identifiable Information maintained by the healthcare and healthcare insurance industries should be protected from fraud and theft, and address limitations on healthcare insurance coverage.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) is a law passed by the U.S. Congress on a reconciliation basis and signed by President Ronald Reagan that, among other things, mandates an insurance program which gives some employees the ability to continue health insurance coverage after leaving employment. COBRA includes amendments to the Employee Retirement Income Security Act of 1974 (ERISA). The law deals with a great variety of subjects, such as tobacco price supports, railroads, private pension plans, emergency department treatment, disability insurance, and the postal service, but it is perhaps best known for Title X, which amends the Internal Revenue Code and the Public Health Service Act to deny income tax deductions to employers for contributions to a group health plan unless such plan meets certain continuing coverage requirements. The violation for failing to meet those criteria was subsequently changed to an excise tax.

Two-tier healthcare is a situation in which a basic government-provided healthcare system provides basic care, and a secondary tier of care exists for those who can pay for additional, better quality or faster access. Most countries have both publicly and privately funded healthcare, but the degree to which it creates a quality differential depends on the way the two systems are managed, funded, and regulated.

Tricare, formerly known as the Civilian Health and Medical Program of the Uniformed Services (CHAMPUS), is a health care program of the United States Department of Defense Military Health System. Tricare provides civilian health benefits for U.S Armed Forces military personnel, military retirees, and their dependents, including some members of the Reserve Component. Tricare is the civilian care component of the Military Health System, although historically it also included health care delivered in military medical treatment facilities.

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to cover the difference or "gap" between the expenses reimbursed to providers by Medicare Parts A and B for the preceding named services and the total amount allowed to be charged for those services by the United States Centers for Medicare and Medicaid Services (CMS).

The Balanced Budget Act of 1997,, was an omnibus legislative package enacted by the United States Congress, using the budget reconciliation process, and designed to balance the federal budget by 2002. This act was enacted during Bill Clinton's second term of his presidency.

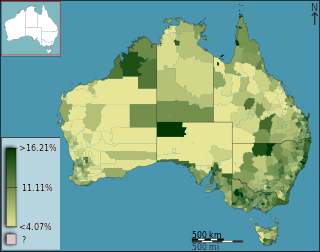

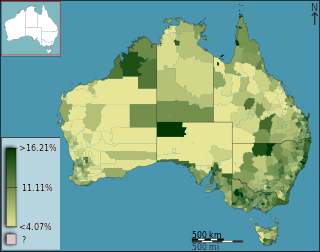

Australia has a highly developed health care structure, though because of its vast size, services are not evenly distributed. Health care is delivered in Australia by both government and private companies which are often covered by Medicare. Health care in Australia is largely funded by the government at national, state and local governmental levels, as well as by private health insurance; but the cost of health care is also borne by not-for-profit organisations, with a significant cost being borne by individual patients or by charity. Some services are provided by volunteers, especially remote and mental health services.

Retirement Insurance Benefits or old-age insurance benefits are a form of social insurance payments made by the U.S. Social Security Administration paid based upon the attainment of old age. Benefit payments are made on the 3rd of the month, or the 2nd, 3rd, or 4th Wednesday of the month, based upon the date of birth and entitlement to other benefits.

Medicare Advantage is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company and receives coverage for inpatient hospital and outpatient services. Typically, the plan also includes prescription drug coverage. Many plans also offer additional benefits, such as dental coverage or gym memberships. By contrast, under so-called "Original Medicare", a Medicare beneficiary pays a monthly premium to the federal government and receives coverage for Part A and Part B services, but must purchase other coverage separately.

Healthcare reform in the United States has a long history. Reforms have often been proposed but have rarely been accomplished. In 2010, landmark reform was passed through two federal statutes enacted in 2010: the Patient Protection and Affordable Care Act (PPACA), signed March 23, 2010, and the Health Care and Education Reconciliation Act of 2010, which amended the PPACA and became law on March 30, 2010.

The healthcare reform debate in the United States has been a political issue focusing upon increasing medical coverage, decreasing costs, insurance reform, and the philosophy of its provision, funding, and government involvement.

Healthcare rationing in the United States exists in various forms. Access to private health insurance is rationed on price and ability to pay. Those unable to afford a health insurance policy are unable to acquire a private plan except by employer-provided and other job-attached coverage, and insurance companies sometimes pre-screen applicants for pre-existing medical conditions. Applicants with such conditions may be declined cover or pay higher premiums and/or have extra conditions imposed such as a waiting period.

The Empowering Patients First Act is legislation sponsored by Rep. Tom Price, first introduced as H.R. 3400 in the 111th Congress. The bill was initially intended to be a Republican alternative to the America's Affordable Health Choices Act of 2009, but has since been positioned as a potential replacement to the Patient Protection and Affordable Care Act (PPACA). The bill was introduced in the 112th Congress as H.R. 3000, and in the 113th Congress as H.R. 2300. As of October 2014, the bill has 58 cosponsors. An identical version of the bill has been introduced in the Senate by Senator John McCain as S. 1851.

There were a number of different health care reforms proposed during the Obama administration. Key reforms address cost and coverage and include obesity, prevention and treatment of chronic conditions, defensive medicine or tort reform, incentives that reward more care instead of better care, redundant payment systems, tax policy, rationing, a shortage of doctors and nurses, intervention vs. hospice, fraud, and use of imaging technology, among others.

An Accountable Care Organization (ACO) is a healthcare organization that ties provider reimbursements to quality metrics and reductions in the cost of care. ACOs in the United States are formed from a group of coordinated health-care practitioners. They use alternative payment models, normally, capitation. The organization is accountable to patients and third-party payers for the quality, appropriateness and efficiency of the health care provided. According to the Centers for Medicare and Medicaid Services, an ACO is "an organization of health care practitioners that agrees to be accountable for the quality, cost, and overall care of Medicare beneficiaries who are enrolled in the traditional fee-for-service program who are assigned to it".

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

The Path to Prosperity: Restoring America's Promise was the Republican Party's budget proposal for the Federal government of the United States in the fiscal year 2012. It was succeeded in March 2012 by "The Path to Prosperity: A Blueprint for American Renewal", the Republican budget proposal for 2013. Representative Paul Ryan, Chairman of the House Budget Committee, played a prominent public role in drafting and promoting both The Path to Prosperity proposals, and they are therefore often referred to as the Ryan budget, Ryan plan or Ryan proposal.

Health care finance in the United States discusses how Americans obtain and pay for their healthcare, and why U.S. healthcare costs are the highest in the world based on various measures.