Related Research Articles

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to repay the principal of the bond at the maturity date as well as interest over a specified amount of time. Interest is usually payable at fixed intervals.

A performance bond, also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. The term is also used to denote a collateral deposit of good faith money, intended to secure a futures contract, commonly known as margin.

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The lien exists for both real property and personal property. In the realm of real property, it is called by various names, including, generically, construction lien. The term "lien" comes from a French root, with a meaning similar to link; it is related to "liaison". Mechanic's liens on property in the United States date from the 18th century.

Design–bid–build, also known as Design–tendertraditional method or hardbid, is a project delivery method in which the agency or owner contracts with separate entities for the design and construction of a project.

In finance, a surety, surety bond or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party a certain amount if a second party fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. The person or company providing the promise is also known as a "surety" or as a "guarantor".

A general contractor, main contractor or prime contractor is responsible for the day-to-day oversight of a construction site, management of vendors and trades, and the communication of information to all involved parties throughout the course of a building project.

Construction management (CM) is a professional service that uses specialized, project management techniques to oversee the planning, design, and construction of a project, from its beginning to its end. The purpose of Construction management is to control a project's time / delivery, cost and quality—sometimes referred to as a project management triangle or "triple constraints." CM is compatible with all project delivery systems, including design-bid-build, design-build, CM At-Risk and Public Private Partnerships. Professional construction managers may be reserved for lengthy, large-scale, high budget undertakings, called capital projects.

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. They are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling; see Project finance model. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien on all of these assets and are able to assume control of a project if the project company has difficulties complying with the loan terms.

R v Ron Engineering and Construction (Eastern) Ltd, of 1981 is the leading Supreme Court of Canada decision on the law of tendering for contracts. The case concerned the issue of whether the acceptance of a call for tenders for a construction job could constitute a binding contract. The Court held that indeed in many cases the submission of an offer in response to a call for tenders constitutes a contract separate from the eventual contract for the construction. With the release of the decision, the tendering process practiced in Canada was fundamentally changed.

Industrial marketing is the marketing of goods and services by one business to another. Industrial goods are those an industry uses to produce an end product from one or more raw material. The term, industrial marketing has largely been replaced by the term B2B marketing.

Construction bidding is the process of submitting a proposal (tender) to undertake, or manage the undertaking of a construction project. The process starts with a cost estimate from blueprints and material take offs.

Construction law is a branch of law that deals with matters relating to building construction, engineering, and related fields. It is in essence an amalgam of contract law, commercial law, planning law, employment law and tort. Construction law covers a wide range of legal issues including contract, negligence, bonds and bonding, guarantees and sureties, liens and other security interests, tendering, construction claims, and related consultancy contracts. Construction law affects many participants in the construction industry, including financial institutions, surveyors, quantity surveyors, architects, builders, engineers, construction workers, and planners.

Fast-track building construction is construction industry jargon for a project delivery strategy to start construction before the design is complete. The purpose is to shorten the time to completion.

The Miller Act requires prime contractors on some government construction contracts to post bonds guaranteeing both the performance of their contractual duties and the payment of their subcontractors and material suppliers.

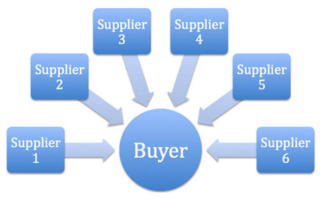

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

Suicide bidding is a response to a tendering exercise in which a potential supplier, anxious to win business, submits a proposal to carry out the work for less than it will cost. These procurement processes are typically modelled as reverse sealed-bid auctions with the lowest bid winning.

Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. A retention is money withheld by one party in a contract to act as security against incomplete or defective works. They have their origin in the British construction industry Railway Mania of the 1840s but are now common across the industry, featuring in the majority of construction contracts. A typical retention rate is 5% of which half is released at completion and half at the end of the defects liability period. There has been criticism of the practice for leading to uncertainty on payment dates, increasing tensions between parties and putting monies at risk in cases of insolvency. There have been several proposals to replace the practice with alternative systems.

An invitation to tender is a formal, structured procedure for generating competing offers from different potential suppliers or contractors looking to obtain an award of business activity in works, supply, or service contracts, often from companies who have been previously assessed for suitability by means of a supplier questionnaire (SQ) or pre-qualification questionnaire (PQQ).

A construction contract is a mutual or legally binding agreement between two parties based on policies and conditions recorded in document form. The two parties involved are one or more property owners and one or more contractors. The owner, often referred to as the 'employer' or the 'client', has full authority to decide what type of contract should be used for a specific development to be constructed and to set out the legally-binding terms and conditions in a contractual agreement. A construction contract is an important document as it outlines the scope of work, risks, duties and legal rights of both the contractor and the owner.

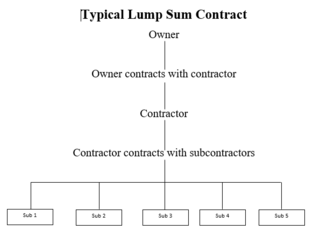

A lump sum contract in construction is one type of construction contract, sometimes referred to as stipulated-sum, where a single price is quoted for an entire project based on plans and specifications and covers the entire project and the owner knows exactly how much the work will cost in advance. This type of contract requires a full and complete set of plans and specifications and includes all the indirect costs plus the profit and the contractor will receive progress payments each month minus retention. The flexibility of this contract is very minimal and changes in design or deviation from the original plans would require a change order paid by the owner. In this contract the payment is made according to the percentage of work completed. The lump sum contract is different from guaranteed maximum price in a sense that the contractor is responsible for additional costs beyond the agreed price, however, if the final price is less that the agreed price then the contractor will gain and benefit from the savings.

References

- ↑ "Bid Bond". Association of Corporate Treasurers. Archived from the original on 26 February 2009. Retrieved 2009-02-23.