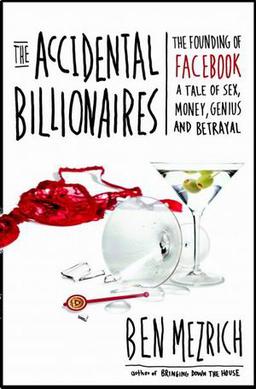

Ben Mezrich is an American author.

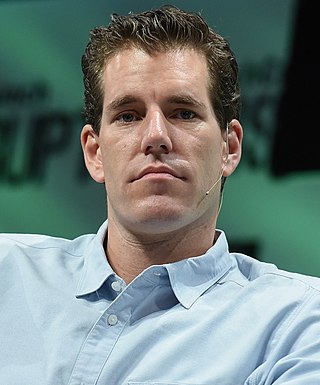

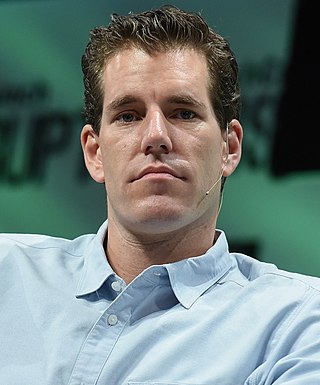

Tyler Howard Winklevoss is an American investor, founder of Winklevoss Capital Management and Gemini cryptocurrency exchange, and former Olympic rower. Winklevoss co-founded HarvardConnection along with his brother Cameron Winklevoss and a Harvard classmate of theirs, Divya Narendra. In 2004, the Winklevoss brothers sued Mark Zuckerberg, claiming he stole their ConnectU idea to create the social networking service site Facebook. As a rower, Winklevoss competed in the men's pair rowing event at the 2008 Summer Olympics with his identical twin brother and rowing partner, Cameron.

Cameron Howard Winklevoss is an American cryptocurrency investor, former Olympic rower, and cofounder of Winklevoss Capital Management and Gemini cryptocurrency exchange. He competed in the men's pair rowing event at the 2008 Summer Olympics with his rowing partner and identical twin brother, Tyler Winklevoss. Winklevoss and his brother are known for co-founding HarvardConnection along with Harvard classmate Divya Narendra. In 2004, the Winklevoss twins sued Facebook founder Mark Zuckerberg, claiming he stole their ConnectU idea to create the social networking site Facebook. In addition to ConnectU, Winklevoss also co-founded the social media website Guest of a Guest with Rachelle Hruska.

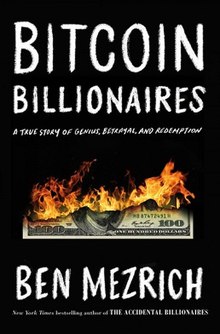

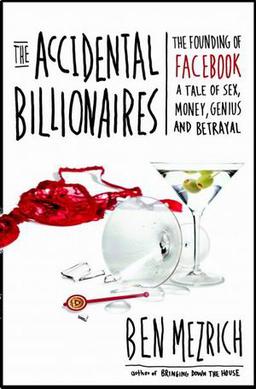

The Accidental Billionaires: The Founding of Facebook, a Tale of Sex, Money, Genius, and Betrayal is a 2009 book by Ben Mezrich about the founding of Facebook, adapted by Aaron Sorkin for the 2010 film The Social Network. Co-founder Eduardo Saverin served as Mezrich's main consultant, although he declined to speak with him while the book was being researched. After Zuckerberg and Saverin settled their lawsuit, Saverin broke off contact with the author.

The Bitcoin Foundation is an American organization that was formerly a nonprofit corporation. It was founded in September 2012 in an effort to restore the reputation of Bitcoin after several scandals, and to try to promote its development and uptake. The organization is modeled on the Linux Foundation and was funded mainly through grants made by for-profit companies that depend on the bitcoin technology.

Charles Shrem IV is an American entrepreneur and bitcoin advocate. He co-founded the now-defunct startup company BitInstant, and is a founding member of the Bitcoin Foundation. In 2014 he was sentenced to two years in prison for aiding and abetting the operation of an unlicensed money-transmitting business related to the Silk Road marketplace. He was released from prison in 2016. In 2017, he joined Jaxx and served as its chief operating officer, and founded cryptocurrency advisory CryptoIQ.

Winklevoss Capital is a family office founded in 2012 by Tyler Winklevoss and Cameron Winklevoss. The firm invests across multiple asset classes including seed funding and infrastructure to early-stage startups. The company is headquartered in New York's Flatiron District.

Blockchain.com is a cryptocurrency financial services company. The company began as the first Bitcoin blockchain explorer in 2011 and later created a cryptocurrency wallet that accounted for 28% of bitcoin transactions between 2012 and 2020. It also operates a cryptocurrency exchange and provides institutional markets lending business and data, charts, and analytics.

Circle is a peer-to-peer payments technology company that now manages stablecoin USDC, a cryptocurrency the value of which is pegged to the U.S. dollar. It was founded by Jeremy Allaire and Sean Neville in October 2013. Circle is headquartered in Boston, Massachusetts. USDC, the second largest stablecoin worldwide, is designed to hold at or near a stable price of $1. The majority of its stablecoin collateral is held in short-term U.S. government securities.

Roger Keith Ver is an early investor in Bitcoin, Bitcoin-related startups and an early promoter of Bitcoin, and sometimes known as Bitcoin Jesus. He now primarily promotes Bitcoin Cash as Ver sees it as fulfilling the intended and original purpose of the "Bitcoin White Paper", first published in 2008 by Satoshi Nakamoto, in which Nakamoto referred to Bitcoin as a peer-to-peer electronic cash system.

Blockstream is a blockchain technology company led by co-founder Adam Back, headquartered in Victoria, Canada, with offices and staff worldwide. The company develops products and services for the storage and transfer of cryptocurrency.

Gemini Trust Company, LLC (Gemini) is an American cryptocurrency exchange and custodian bank. It was founded in 2014 by Cameron and Tyler Winklevoss.

Digital Currency Group (DCG) is a venture capital company focusing on the digital currency market. It is located in Stamford, Connecticut. The company has the subsidiaries Foundry, Genesis, Grayscale Investments, and Luno. It also formerly owned CoinDesk.

ShapeShift, founded in 2014 by Erik Voorhees was a cryptocurrency exchange headquartered in Switzerland that turned into a permissionless DAO operating on the blockchain. Its decentralized application empowers users to trade the Bitcoin, Ethereum, and 10,000+ crypto assets across 14 chains.

Nathaniel Popper is a journalist for The New York Times covering finance and technology from San Francisco. He previously worked for the Los Angeles Times,TheForward, Let’s Go Travel Guides and The Boston Globe. He studied history and literature at Harvard University, where he also played Junior Varsity Hockey.

An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding, although a private ICO which does not seek public investment is also possible. In an ICO, a quantity of cryptocurrency is sold in the form of "tokens" ("coins") to speculators or investors, in exchange for legal tender or other cryptocurrencies such as Bitcoin or Ether. The tokens are promoted as future functional units of currency if or when the ICO's funding goal is met and the project successfully launches.

Bitcoin was designed by its pseudonymous inventor, Satoshi Nakamoto, to work as a currency, but its status as a currency is disputed. Economists define money as a store of value, a medium of exchange and a unit of account, and agree that bitcoin does not currently meet all these criteria.

Brian Armstrong is an American business executive, billionaire, and investor who is CEO of cryptocurrency platform Coinbase. He received media attention for his policy of keeping the workplace free of political activism.

BitMEX is a cryptocurrency exchange and derivative trading platform. It is owned and operated by HDR Global Trading Limited, which is registered in the Seychelles.

Paxos Trust Company is a New York–based financial institution and technology company specializing in blockchain. The company's product offerings include a cryptocurrency brokerage service, asset tokenization services, and settlement services. ItBit, a bitcoin exchange run by Paxos, was the first bitcoin exchange to be licensed by the New York State Department of Financial Services, granting the company the ability to be the custodian and exchange for customers in the United States.