Related Research Articles

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to collectively fund government spending, public expenditures, or as a way to regulate and buffer negative externalities. Tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a consumer's ordinal preferences over a choice set, but is not necessarily comparable across consumers or possessing a cardinal interpretation. This concept of utility is personal and based on choice rather than on pleasure received, and so requires fewer behavioral assumptions than the original concept.

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is indifferent. That is, any combinations of two products indicated by the curve will provide the consumer with equal levels of utility, and the consumer has no preference for one combination or bundle of goods over a different combination on the same curve. One can also refer to each point on the indifference curve as rendering the same level of utility (satisfaction) for the consumer. In other words, an indifference curve is the locus of various points showing different combinations of two goods providing equal utility to the consumer. Utility is then a device to represent preferences rather than something from which preferences come. The main use of indifference curves is in the representation of potentially observable demand patterns for individual consumers over commodity bundles.

Logistics is a part of supply chain management that deals with the efficient forward and reverse flow of goods, services, and related information from the point of origin to the point of consumption according to the needs of customers. Logistics management is a component that holds the supply chain together. The resources managed in logistics may include tangible goods such as materials, equipment, and supplies, as well as food and other consumable items.

Critical chain project management (CCPM) is a method of planning and managing projects that emphasizes the resources required to execute project tasks. It was developed by Eliyahu M. Goldratt. It differs from more traditional methods that derive from critical path and PERT algorithms, which emphasize task order and rigid scheduling. A critical chain project network strives to keep resources levelled, and requires that they be flexible in start times.

The theory of constraints (TOC) is a management paradigm that views any manageable system as being limited in achieving more of its goals by a very small number of constraints. There is always at least one constraint, and TOC uses a focusing process to identify the constraint and restructure the rest of the organization around it. TOC adopts the common idiom "a chain is no stronger than its weakest link". That means that organizations and processes are vulnerable because the weakest person or part can always damage or break them, or at least adversely affect the outcome.

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods include: income level, cultural factors, product information and physio-psychological factors.

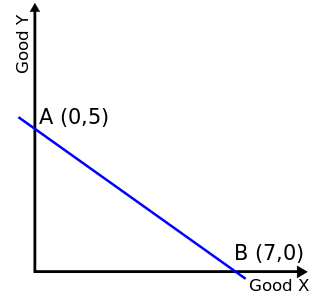

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. Consumer theory uses the concepts of a budget constraint and a preference map as tools to examine the parameters of consumer choices. Both concepts have a ready graphical representation in the two-good case. The consumer can only purchase as much as their income will allow, hence they are constrained by their budget. The equation of a budget constraint is where is the price of good X, and is the price of good Y, and m is income.

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

In economics and particularly in consumer choice theory, the income-consumption curve is a curve in a graph in which the quantities of two goods are plotted on the two axes; the curve is the locus of points showing the consumption bundles chosen at each of various levels of income.

In economics and particularly in consumer choice theory, the substitution effect is one component of the effect of a change in the price of a good upon the amount of that good demanded by a consumer, the other being the income effect.

Output in economics is the "quantity of goods or services produced in a given time period, by a firm, industry, or country", whether consumed or used for further production. The concept of national output is essential in the field of macroeconomics. It is national output that makes a country rich, not large amounts of money.

Utility maximization was first developed by utilitarian philosophers Jeremy Bentham and John Stuart Mill. In microeconomics, the utility maximization problem is the problem consumers face: "How should I spend my money in order to maximize my utility?" It is a type of optimal decision problem. It consists of choosing how much of each available good or service to consume, taking into account a constraint on total spending (income), the prices of the goods and their preferences.

In mathematics and economics, a corner solution is a special solution to an agent's maximization problem in which the quantity of one of the arguments in the maximized function is zero. In non-technical terms, a corner solution is when the chooser is either unwilling or unable to make a trade-off between goods.

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept of tax incidence is that the tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply. As a general policy matter, the tax incidence should not violate the principles of a desirable tax system, especially fairness and transparency. The concept of tax incidence is used in political science and sociology to analyze the level of resources extracted from each income social stratum in order to describe how the tax burden is distributed among social classes. That allows one to derive some inferences about the progressive nature of the tax system, according to principles of vertical equity.

A relative price is the price of a commodity such as a good or service in terms of another; i.e., the ratio of two prices. A relative price may be expressed in terms of a ratio between the prices of any two goods or the ratio between the price of one good and the price of a market basket of goods. Microeconomics can be seen as the study of how economic agents react to changes in relative prices, and of how relative prices are affected by the behavior of those agents. The difference and change of relative prices can also reflect the development of productivity.

Value and Capital is a book by the British economist John Richard Hicks, published in 1939. It is considered a classic exposition of microeconomic theory. Central results include:

Frederick Madison Allen was a physician who is best remembered for his carbohydrate-restricted low-calorie diet for sufferers of diabetes mellitus. He was known for pioneering the "starvation diet".

Bliss point may refer to:

References

- ↑ Binger, B.; Hoffman, E. (1998). Microeconomics with Calculus (2nd ed.). Addison-Wesley. p. 113. ISBN 0-321-01225-9.

- ↑ Nason, J. (1991). "The Permanent Income Hypothesis when the Bliss Point is Stochastic" (PDF). Federal Reserve Bank of Minneapolis Discussion Paper 46.