The Bank of Mexico, abbreviated BdeM or Banxico, is Mexico's central bank, monetary authority and lender of last resort. The Bank of Mexico is autonomous in exercising its functions, and its main objective is to achieve stability in the purchasing power of the national currency.

PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders. The company operates as a payment processor for online vendors, auction sites and many other commercial users, for which it charges a fee.

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website. The online banking system will typically connect to or be part of the core banking system operated by a bank to provide customers access to banking services in place of traditional branch banking. Online banking significantly reduces the banks' operating cost by reducing reliance on a branch network, and offers greater convenience to customers in time saving in coming to a branch and the convenience of being able to perform banking transactions even when branches are closed. Internet banking provides personal and corporate banking services offering features such as viewing account balances, obtaining statements, checking recent transactions, transferring money between accounts, and making payments.

Bank of the Philippine Islands is a universal bank in the Philippines. It is the first bank in both the Philippines and Southeast Asia. It is the fourth largest bank in terms of assets, the second largest bank in terms of market capitalization, and one of the most profitable banks in the Philippines.

Banco Santander, S.A., doing business as Santander Group, is a Spanish multinational financial services company based in Madrid and Santander in Spain. Additionally, Santander maintains a presence in all global financial centres as the 16th-largest banking institution in the world. Although known for its European banking operations, it has extended operations across North and South America, and more recently in continental Asia. It is considered a systemically important bank by Financial Stability Board.

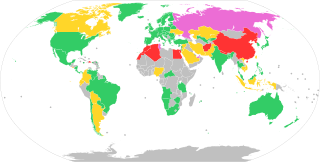

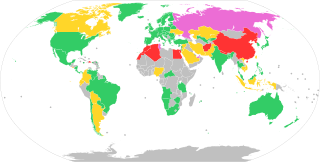

The legal status of cryptocurrencies varies substantially from one jurisdiction to another, and is still undefined or changing in many of them. Whereas, in the majority of countries the usage of cryptocurrency isn't in itself illegal, its status and usability as a means of payment varies, with differing regulatory implications.

Open banking is a financial services term as part of financial technology that refers to:

- The use of open APIs that enable third-party developers to build applications and services around the financial institution.

- Greater financial transparency options for account holders ranging from open data to private data.

- The use of open source technology to achieve the above.

Banco Bilbao Vizcaya Argentaria, S.A., better known by its initialism BBVA, is a Spanish multinational financial services company based in Madrid and Bilbao, Spain. It is one of the largest financial institutions in the world, and is present mainly in Spain, South America, North America, Turkey, and Romania.

Stellar, or Stellar Lumens, is an open source, decentralized protocol for digital currency to fiat money low-cost transfers which allows cross-border transactions between any pair of currencies. The Stellar protocol is supported by a Delaware nonprofit corporation, the Stellar Development Foundation, though this organization does not enjoy 501(c)(3) tax-exempt status with the IRS.

Starling Bank is a digital challenger bank based in the United Kingdom, which focuses on current and business account products. Headquartered in London, Starling Bank is a licensed and regulated bank, founded by former Allied Irish Banks COO, Anne Boden, in January 2014. Since its founding, it has received over £500m of funding. The company received its banking licence from the Prudential Regulation Authority and the Financial Conduct Authority in July 2016.

Nemea Bank was a pan-European direct bank incorporated in Malta, providing banking and investment services to individuals, businesses, institutions and high net worth individuals based in the 31 countries of the European Economic Area (EEA). The bank is currently under administration and its license was withdrawn by the ECB on the 23rd March 2017.

Revolut is a British financial technology company that offers banking services. Headquartered in London, it was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. It offers accounts featuring currency exchange, debit cards, virtual cards, Apple Pay, interest-bearing "vaults", commission-free stock trading, crypto, commodities, and other services.

Monzo Bank Ltd, is an online bank based in the United Kingdom. Monzo was one of the earliest of a number of new app-based challenger banks in the UK.

Tandem Money is a UK company that owns Tandem Bank, a British challenger bank. Tandem Bank operates as an internet bank, with a web app.

N26 is a German neobank headquartered in Berlin, Germany. N26 was founded in Munich in 2013 in a Rocket Internet Incubator and currently operates in various member states of the Single Euro Payments Area (SEPA). It provides a free basic current account and a debit card, with overdraft and investment products and premium accounts available for a monthly fee.

Solarisbank is a Berlin-based fintech company that offers Banking-as-a-Service Platform with its German banking license.

Volt Bank was an Australian consumer neobank, the first such bank to be issued with a restricted ADI licence by APRA. In June 2022, the bank announced it would permanently close its deposit-taking business and voluntarily return its banking licence, citing funding issues.

Brubank is an Argentine digital bank. Headquartered in Buenos Aires, Brubank is a financial technology company offering mobile banking, as well as other financial services. It is recognized as the first entirely digital bank in Argentina.

Panama has a substantial financial services sector. The sector grew up providing trade finance for trade passing through the Panama Canal, and later evolved into money laundering for the drug trade under Manuel Noriega.

Digital banks in the Philippines are a new formal category of banks which were only approved by the Bangko Sentral ng Pilipinas (BSP), the country's central bank, in 2020. The first such banks launched in the Philippines were Tonik, Overseas Filipino Bank, and UnionDigital of UnionBank Corp. Several more banks were approved by the BSP before 2021, when it announced that it would stop approving the establishment of further digital banks for three years, in order to strengthen the industry and assure healthy competition among its players.