A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many of the new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

In economics, cash is money in the physical form of currency, such as banknotes and coins.

The Canadian dollar is the currency of Canada. It is abbreviated with the dollar sign $. There is no standard disambiguating form, but the abbreviations Can$, CA$ and C$ are frequently used for distinction from other dollar-denominated currencies. It is divided into 100 cents (¢).

The króna or krona is the currency of Iceland. Iceland is the second-smallest country by population, after the Seychelles, to have its own currency and monetary policy.

A banknote—also called a bill, paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to redeem the notes for legal tender when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authorities.

The 2¢ Large Queen on laid paper is the rarest postage stamp of Canada. Printed in 1868, it was not discovered until 1925, and so far only three have been found, all used. Many more could exist as at least one sheet must have been printed, and possibly many sheets; however, they may all have been destroyed, or lie unrecognised in stamp collections or on cover.

The Currency Act or Paper Bills of Credit Act is one of several Acts of the Parliament of Great Britain that regulated paper money issued by the colonies of British America. The Acts sought to protect British merchants and creditors from being paid in depreciated colonial currency. The policy created tension between the colonies and Great Britain and was cited as a grievance by colonists early in the American Revolution. However, the consensus view among modern economic historians and economists is that the debts by colonists to British merchants were not a major cause of the Revolution. In 1995, a random survey of 178 members of the Economic History Association found that 92% of economists and 74% of historians disagreed with the statement, "The debts owed by colonists to British merchants and other private citizens constituted one of the most powerful causes leading to the Revolution."

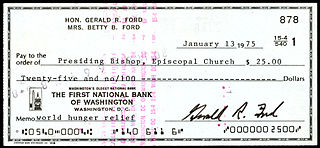

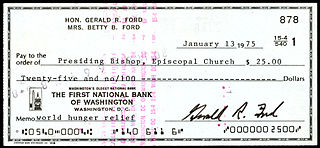

A cheque, or check, is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

The early Canadian banking system was regulated entirely by the colonial government. Primitive forms of banking emerged early in the colonial period to solve the drain of wealth caused by the application of mercantilist theory. The drain of wealth translated into a complete lack of gold or silver bullion in the colonies, and thus, a complete lack of forms of economic exchange and payment.

The cash was a currency denomination used in China in imperial times. It was the chief denomination until the introduction of the yuan in the late 19th century.

Canada has an extensive history with regard to its currencies. Prior to European contact, indigenous peoples in Canada used items such as wampum and furs for trading purposes, which continued when trade with Europeans began. During the period of French colonization, coins were introduced, as well as one of the first examples of paper currency by a western government. During the period of British colonization, additional coinage was introduced, as well as banknotes. The Canadian colonies gradually moved away from the British pound and adopted currencies linked to the United States dollar. With Confederation in 1867, the Canadian dollar was established. By the mid-20th century, the Bank of Canada was the sole issuer of paper currency, and banks ceased to issue banknotes.

The livre was the currency of New France, the French colony in modern-day Canada. It was subdivided into 20 sols, each of 12 deniers. The New France livre was a French colonial currency, distinguished by the use of paper money.

Banknotes of the Canadian dollar are the banknotes or bills of Canada, denominated in Canadian dollars. Currently, they are issued in $5, $10, $20, $50, and $100 denominations. All current notes are issued by the Bank of Canada, which released its first series of notes in 1935. The Bank of Canada has contracted the Canadian Bank Note Company to produce the Canadian notes since then. The current series of polymer banknotes were introduced into circulation between November 2011 and November 2013. Banknotes issued in Canada can be viewed at the Bank of Canada Museum in Ottawa.

The 1937 Canadian banknote series is the second series of banknotes of the Canadian dollar issued by the Bank of Canada. The banknotes were issued into circulation on 19 July 1937, at which time the Bank of Canada began gradually removing banknotes from the 1935 series from circulation. The $1000 banknote was issued several years later, as it was primarily used by chartered banks, which had a sufficient supply of the 1935 Series $1000 banknote.

The pound was the currency of New Brunswick until 1860. It was divided into 20 shillings, each of 12 pence, with the dollar circulating at a value of 5/–.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

Fiat money is a type of currency that is not backed by a commodity, such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was quite rare until the 20th century, but there were some situations where banks or governments stopped honoring redeemability of demand notes or credit notes, usually temporarily. In modern times, fiat money is generally authorized by government regulation.

The Bank of Canada Museum, formerly known as the Currency Museum, opened in 1980 on the ground floor of the Bank of Canada building in Ottawa, Ontario, Canada. Temporarily closed in 2013 for major building renovations, the museum reopened in a new space on July 1, 2017, in a new building, with a completely new design and concept. It is, however, connected to the main building through the Bank of Canada's underground conference centre.

Card money was in use in New France in the seventeenth and eighteenth centuries. Official money cards were embossed with a fleur-de-lis and the signatures of the intendant, governor, and treasurer. Private cards would also use the fleur-de-lis and the signature of its debtor. Card money was generally issued, at least initially, in emergency situations when minted currency was in low supply, however over time "playing cards" became more popular and the standard tender. An estimated two million livres in card money is thought to have circulated prior to the British take over of New France territory in the 1760s.