Puerto Rico, officially the Commonwealth of Puerto Rico, is a Caribbean island and unincorporated territory of the United States. It is located in the northeast Caribbean Sea, approximately 1,000 miles (1,600 km) southeast of Miami, Florida, between the Dominican Republic and the U.S. Virgin Islands, and includes the eponymous main island and several smaller islands, such as Mona, Culebra, and Vieques. It has roughly 3.2 million residents, and its capital and most populous city is San Juan. Spanish and English are the official languages of the executive branch of government, though Spanish predominates.

The government of Puerto Rico is a republican form of government with separation of powers, subject to the jurisdiction and sovereignty of the United States. Article I of the Constitution of Puerto Rico defines the government and its political power and authority pursuant to U.S. Pub.L. 82–447. Said law mandated the establishment of a local constitution due to Puerto Rico's political status as a commonwealth of the United States. Ultimately, the powers of the government of Puerto Rico are all delegated by the United States Congress and lack full protection under the U.S. Constitution. Because of this, the head of state of Puerto Rico is the President of the United States.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

The Jones–Shafroth Act —also known as the Jones Act of Puerto Rico, Jones Law of Puerto Rico, or as the Puerto Rican Federal Relations Act of 1917— was an Act of the United States Congress, signed by President Woodrow Wilson on March 2, 1917. The act superseded the Foraker Act and granted U.S. citizenship to anyone born in Puerto Rico on or after April 11, 1899. It also created the Senate of Puerto Rico, established a bill of rights, and authorized the election of a Resident Commissioner to a four-year term. The act also exempted Puerto Rican bonds from federal, state, and local taxes regardless of where the bondholder resides.

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

The 2006 Puerto Rico budget crisis was a political, economic, and social crisis that saw much of the government of Puerto Rico shut down after it ran out of funds near the end of the 2005–2006 fiscal year. The shut down lasted for two weeks from 1 May 2006 through 14 May 2006, leaving nearly 100,000 public employees without pay and closing more than 1,500 public schools.

The Government Development Bank for Puerto Rico (GDB) —Spanish: Banco Gubernamental de Fomento para Puerto Rico (BGF)— is the government bond issuer, intragovernmental bank, fiscal agent, and financial advisor of the government of Puerto Rico. The bank, along with its subsidiaries and affiliates, serves as the principal entity through which Puerto Rico channels its issuance of bonds. As an overview, the different executive agencies of the government of Puerto Rico and its government-owned corporations either issue bonds with the bank as a proxy, or owe debt to the bank itself.

Alfredo Salazar is an economist by education and a banker by profession. He is currently retired. He entered into public service and ran for an elected position affiliated with the Popular Democratic Party of Puerto Rico (PDP). He ran for the office of Resident Commissioner of Puerto Rico in the United States Congress in the 2008 elections. Prior to running for Congress, he served as Chairman and President of the Puerto Rico Government Development Bank (GDB) and financial advisor to the then governor of Puerto Rico, Aníbal Acevedo Vilá. He had previously served as President of the Puerto Rico Industrial Development Company and GDB president during the first administration of Gov. Rafael Hernández Colón in the mid seventies and Head of the Economic Development Administration during Hernández Colón third administration.

The 2007 Texas Constitutional Amendment Election took place 6 November 2007.

Department of Revenue of Kentucky v. Davis, 553 U.S. 328 (2008), is a United States Supreme Court case in which the Court upheld a Kentucky law that provides a preferential tax break to Kentucky residents who invest in bonds issued by the state and its municipalities. The Court held in a 7-2 vote that the State of Kentucky does not engage in unconstitutional discrimination against interstate commerce by exempting the interest on its bonds from residents' taxable income while taxing the interest earned on the bonds of other states. The case has national implications because thirty-six (36) states have tax schemes similar to the one at issue in Kentucky.

The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum. The main drivers of Puerto Rico's economy are manufacturing, primarily pharmaceuticals, textiles, petrochemicals, and electronics; followed by the service industry, notably finance, insurance, real estate, and tourism. The geography of Puerto Rico and its political status are both determining factors on its economic prosperity, primarily due to its relatively small size as an island; its lack of natural resources used to produce raw materials, and, consequently, its dependence on imports; as well as its relationship with the United States federal government, which controls its foreign policies while exerting trading restrictions, particularly in its shipping industry.

Academic and Professional Background (1982-1992)

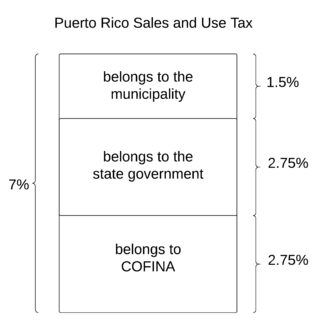

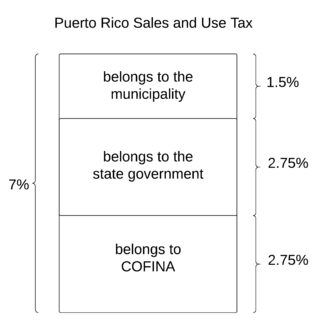

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Payment of taxes to the federal government, both personal and corporate, is done through the federal Internal Revenue Service (IRS), while payment of taxes to the Commonwealth government is done through the Puerto Rico Department of Treasury.

An industrial revenue bond (IRB), also formerly known as an Industrial Development Bond (IDB), is a unique type of revenue bond organized by a state or local government. The bond issue is sponsored by a government entity but the proceeds are directed to a private, for-profit business.

The executive branch of the government of Puerto Rico is responsible for executing the laws of Puerto Rico, as well as causing them to be executed. Article IV of the Constitution of Puerto Rico vests the executive power on the Governor—whom by its nature forms the executive branch.

The Puerto Rico Urgent Interest Fund Corporation —Spanish: Corporación del Fondo de Interés Apremiante (COFINA)— is a government-owned corporation of Puerto Rico that issues government bonds and uses other financing mechanisms to pay and refinance the public debt of Puerto Rico. The Corporation is a subsidiary of the Government Development Bank and was created by Law No. 291 of 2006. Bonds issued by COFINA are called Puerto Rico Sales Tax Revenue Bonds.

The Puerto Rican government-debt crisis was a financial crisis affecting the government of Puerto Rico. The crisis began in 2014 when three major credit agencies downgraded several bond issues by Puerto Rico to "junk status" after the government was unable to demonstrate that it could pay its debt. The downgrading, in turn, prevented the government from selling more bonds in the open market. Unable to obtain the funding to cover its budget imbalance, the government began using its savings to pay its debt while warning that those savings would eventually be exhausted. To prevent such a scenario, the United States Congress enacted a law known as PROMESA, which appointed an oversight board with ultimate control over the Commonwealth's budget. As the PROMESA board began to exert that control, the Puerto Rican government sought to increase revenues and reduce its expenses by increasing taxes while curtailing public services and reducing government pensions. These measures provoked social distrust and unrest, further compounding the crisis. In August 2018, a debt investigation report of the Financial Oversight and management board for Puerto Rico reported the Commonwealth had $74 billion in bond debt and $49 billion in unfunded pension liabilities as of May 2017. Puerto Rico officially exited bankruptcy on March 15, 2022.

The Municipal Finance Corporation —Spanish: Corporación de Financiamiento Municipal (COFIM)— is a government-owned corporation of Puerto Rico that issues government bonds and uses other financing mechanisms to pay or refinance, directly or indirectly, in whole or in part, the debts of the municipalities of Puerto Rico payable or backed by the Puerto Rican municipal sales and use tax. The corporation is an affiliate of the Government Development Bank and is identical to COFINA, save that its funds come from the municipal aspect of the sales tax rather than from the state one.