Leafly is a website focused on cannabis use and education. The company says it has more than 120 million annual visitors and over 10 million monthly active users. Leafly provides a wide range of information on cannabis including 1.5 million consumer product reviews, more than 9,000 cannabis articles and resources, and over 5,000 verified strains in its database. Leafly additionally provides 4,500+ retailers and 8,000+ cannabis brands with e-commerce tools such as digital storefronts, embedded menus, point-of-sale integrations, targeted advertising, and more. The company is headquartered in Seattle, Washington and from 2012 to 2019 was owned by Privateer Holdings, a private equity firm focused on the emerging legal cannabis industry. Leafly is now a publicly traded company with 160 employees.

Privateer Holdings is an American private equity company that invests in the legal cannabis industry. It is headquartered in Seattle, Washington and employs more than 350 people in seven countries.

Canopy Growth Corporation, formerly Tweed Marijuana Inc., is a cannabis company based in Smiths Falls, Ontario.

Wikileaf Technologies is a Seattle business providing data services to the cannabis industry and information to consumers. The company provides price indexes and cannabis strain reviews and information.

MassRoots is a social network for the cannabis community. As of June 2016, it had an estimated 900,000 users. MassRoots for Business, the company’s advertising portal, has an estimated 1,000 clients as of June 2015. In 2014, MassRoots was one of the first cannabis-related companies to go public through a Registration Statement on Form S-1 and trades under the ticker “MSRT” and in August 2015, MassRoots submitted an application to up-list its stock to the Nasdaq.

Cannabis in Washington relates to a number of legislative, legal, and cultural events surrounding the use of cannabis. On December 6, 2012, Washington became the first U.S. state to legalize recreational use of marijuana and the first to allow recreational marijuana sales, alongside Colorado. The state had previously legalized medical marijuana in 1998. Under state law, cannabis is legal for medical purposes and for any purpose by adults over 21.

The cannabis industry is composed of legal cultivators and producers, consumers, independent industrial standards bodies, ancillary products and services, regulators and researchers concerning cannabis and its industrial derivative, hemp. The cannabis industry has been inhibited by regulatory restrictions for most of recent history, but the legal market has emerged rapidly as more governments legalize medical and adult use. Uruguay became the first country to legalize recreational marijuana through legislation in December, 2013. Canada became the first country to legalize private sales of recreational marijuana with Bill C-45 in 2018.

Ashar Aziz is a Pakistani–American electrical engineer, business executive, and philanthropist. He is best known as the founder of Silicon Valley–based cybersecurity company FireEye. A former billionaire, Aziz had an estimated net worth of over $233 million as of 2015.

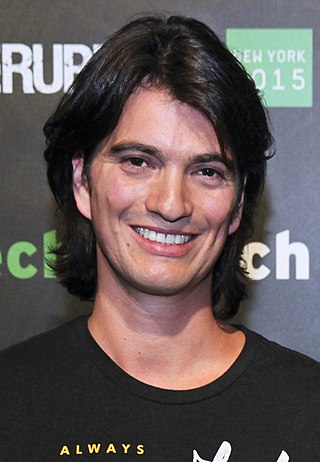

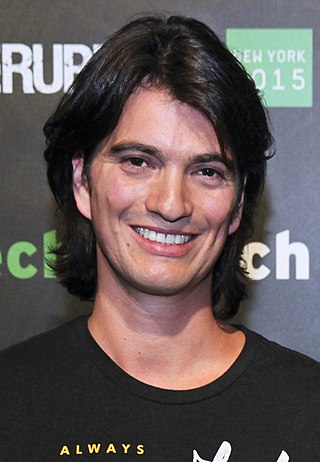

Adam Neumann is an Israeli-American billionaire businessman and investor. In 2010, he co-founded WeWork with Miguel McKelvey, where he was CEO from 2010 to 2019. In 2019, he co-founded a family office dubbed 166 2nd Financial Services with his wife, Rebekah Neumann, to manage their personal wealth, investing over a billion dollars in real estate and venture startups.

Aphria Inc., headquartered in Leamington, Ontario, was an international producer and distributor of medicinal and recreational cannabis. The company operated through retail and wholesale channels in Canada and internationally.

Aurora Cannabis Inc. is a Canadian licensed cannabis producer, headquartered in Edmonton. It trades on the Toronto Stock Exchange and Nasdaq as ACB. As of September 2018, Aurora Cannabis had eight licensed production facilities, five sales licences, and operations in 25 countries. It had a funded capacity of over 625,000 kilograms of cannabis production per annum with the bulk of capacity based in Canada and a growing presence in international markets, particularly Denmark and Latin America. The company began trading on the NYSE on October 23, 2018, using the ticker ACB.

BZAM Ltd., formerly The Green Organic Dutchman Holdings Ltd. (TGOD), is a Canadian recreational cannabis company headquartered in Mississauga, Ontario. TGOD's initial public offering on the Toronto Stock Exchange (TSX), completed on May 2, 2018, was the industry's largest to date, and raised over CAD$115 million. In September 2021, the company's stock moved from the TSX to the Canadian Securities Exchange. The CSE suspended trading of BZAM's stocks on May 8, 2024 pursuant to a cease trade order from the Ontario Securities Commission, and BZAM was delisted from the CSE on September 11, 2024.

Tilray Brands, Inc. is an American pharmaceutical, cannabis-lifestyle and consumer packaged goods company, incorporated in the United States, headquartered in New York City. Tilray also has operations in Canada, Australia, New Zealand, and Latin America, with growing facilities in Germany and Portugal.

Christian Groh is an American businessman, and one of the co-founders of Privateer Holdings, along with Brendan Kennedy and Michael Blue.

Michael Blue is an American billionaire businessman, the managing partner and one of the co-founders of Privateer Holdings, along with Brendan Kennedy and Christian Groh.

Acreage Holdings is a public company domiciled in British Columbia, Canada, holding a portfolio of cannabis cultivation, processing and dispensing operations in the United States.

Eric S Yuan is a Chinese-American billionaire businessman, engineer, and the chief executive officer and founder of Zoom Video Communications, of which he owns 22%.

Global X Investments Canada Inc. is a financial services company that offers exchange-traded funds. On May 1, 2024, the company changed its name from Horizons ETFs to Global X Investments Canada Inc. In April 2017, Global X began offering the first cannabis industry focused exchange-traded fund (ETF), Global X Marijuana Life Sciences Index ETF. The company is also the fourth-largest ETF provider in Canada, with more than CAD$30 billion in assets as of April 2023.

The Green Rush (2012–present) is an ongoing global economic event that began on December 6, 2012, when cannabis was legalized in the US state of Washington; Colorado's legalization took effect four days later. While still illegal federally in the United States, the actions of these two state governments signaled the opening of a market projected to be worth US$48+ billion globally by 2027. As of 2019 the cannabis industry had created over 250,000 jobs. However, cannabis companies have been a mixed investment success, with many experiencing plunging stock prices, massive layoffs, and failure to meet investor expectations.

Tony Xu is a Chinese-American billionaire businessman and the co-founder and chief executive officer (CEO) of DoorDash. Born in Nanjing, China, Xu immigrated to the United States with his parents at the age of four. He earned degrees from the University of California, Berkeley and Stanford University's Graduate School of Business. Earlier in his career, Xu interned at Square, Inc., and worked for McKinsey & Company, eBay, and PayPal. He was included in Fortune's "40 Under 40" list in 2020.