Related Research Articles

The economy of the United Kingdom is a highly developed social market economy. It is the sixth-largest national economy in the world measured by nominal gross domestic product (GDP), tenth-largest by purchasing power parity (PPP), and twenty second-highest by nominal GDP per capita, constituting 3.1% of nominal world GDP. By PPP terms, the UK constitutes 2.3% of world GDP.

Business is the practice of making one's living or making money by producing or buying and selling products. It is also "any activity or enterprise entered into for profit."

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by international organizations such as the World Bank, the European Union, the United Nations, and the World Trade Organization (WTO).

Financial services are economic services provided by the finance industry, which together encompass a broad range of service sector firms that provide financial management, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises.

3i Group plc is a British multinational private equity and venture capital company based in London, England. 3i is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

In the United Kingdom, public holidays are days on which most businesses and non-essential services are closed. Many retail businesses do open on some of the public holidays. There are restrictions on trading on Sundays, Easter Day and Christmas Day in England and Wales and on New Year's Day and Christmas Day in Scotland. Public holidays defined by statute are called bank holidays, but this term can also be used to include common law holidays, which are held by convention. The term "public holidays" can refer exclusively to common law holidays.

National Savings and Investments (NS&I), formerly called the Post Office Savings Bank and National Savings, is a state-owned savings bank in the United Kingdom. It is both a non-ministerial government department and an executive agency of HM Treasury. The aim of NS&I has been to attract funds from individual savers in the UK for the purpose of funding the government's deficit. NS&I attracts savers through offering savings products with tax-free elements on some products, and a 100% guarantee from HM Treasury on all deposits. As of 2017, approximately 9% of the government's debt is met by funds raised through NS&I, around half of which is from the Premium Bond offering.

Shriti Vadera, Baroness Vadera, is a Ugandan-born British investment banker, and has been chair of Prudential plc since January 2021, having joined the board in May 2020. Until September 2009, she was a government minister jointly for the Department for Business, Innovation and Skills and the Cabinet Office. She was chair of Santander UK from March 2015 to October 2020, the first woman to head a major British bank.

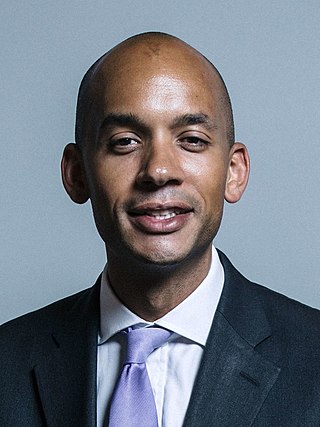

Chuka Harrison Umunna is a British businessman and former politician who served as Member of Parliament (MP) for Streatham from 2010 until 2019. A former member of the Labour Party, he was part of the Shadow Cabinet from 2011 to 2015. He left Labour in February 2019, when he resigned to form The Independent Group, later Change UK, along with six other MPs. Later in 2019, he left Change UK and, after a short time as an independent MP, joined the Liberal Democrats. In the 2019 general election, he was unsuccessful in being re-elected as an MP and did not return to the House of Commons.

RIT Capital Partners plc, formerly Rothschild Investment Trust, is a large British investment trust dedicated to investments in quoted securities and quoted special situations. Established in 1961, the company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. Lord Rothschild has been president and Sir James Leigh-Pemberton chairman since September 2019.

Rachel Jane Reeves is a British politician and economist serving as Shadow Chancellor of the Exchequer since 2021. A member of the Labour Party, she has been Member of Parliament for Leeds West since 2010.

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010. It was the first budget of the Conservative-Liberal Democrat coalition formed after the general election of May 2010. The government dubbed it an "emergency budget", and stated that its purpose was to reduce the national debt accumulated under the Labour government.

Green Investment Group Limited (GIG) is a specialist in green infrastructure principal investment, project delivery and the management of portfolio assets, and related services.

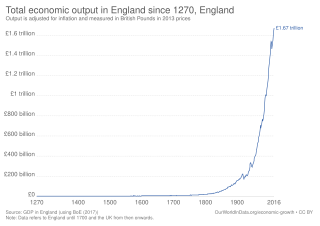

The economic history of the United Kingdom relates the economic development in the British state from the absorption of Wales into the Kingdom of England after 1535 to the modern United Kingdom of Great Britain and Northern Ireland of the early 21st century.

Aldermore Bank is a retail bank which provides financial services to small and medium-sized businesses. It was founded in 2009 and listed on the London Stock Exchange in March 2015. It was a constituent of the FTSE 250 Index until it was acquired by South African banking conglomerate First Rand in March 2018.

Capital for Enterprise Limited (CfEL) was a limited company in the United Kingdom owned by the Department for Business, Innovation and Skills (BIS). CfEL was responsible for managing BIS's financial schemes, such as venture capital funds and loan guarantees, aimed at helping small and medium enterprises (SMEs). It invested over £1.8 billion from its formation and alongside private capital provided £6.5 billion in credit for SMEs. It ceased operating independently on 1 October 2013 and became part of the British Business Bank.

British Business Bank plc (BBB) is a state-owned economic development bank established by the UK Government. Its aim is to increase the supply of credit to small and medium enterprises (SMEs) as well as providing business advice services. It is structured as a public limited company and is owned by the Department for Business and Trade. The bank has its headquarters in Sheffield.

People's Quantitative Easing (PQE) is a policy proposed by Jeremy Corbyn during the 2015 Labour leadership election in August. It would require the Bank of England to create money to finance government investment via a National Investment Bank.

BGF, established in 2011 as the Business Growth Fund, is an investment company that provides growth capital for small and mid-sized businesses in the UK and Ireland.

References

- R Skidelsky, Blueprint for a British Investment Bank (2013)