Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. Before its bankruptcy on December 2, 2001, Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper company, with claimed revenues of nearly $101 billion during 2000. Fortune named Enron "America's Most Innovative Company" for six consecutive years.

Andrew Stuart "Andy" Fastow is a convicted felon and former financier who was the chief financial officer of Enron Corporation, an energy trading company based in Houston, Texas, until he was fired shortly before the company declared bankruptcy. Fastow was one of the key figures behind the complex web of off-balance-sheet special purpose entities used to conceal Enron's massive losses in their quarterly balance sheets. By unlawfully maintaining personal stakes in these ostensibly independent ghost-entities, he was able to defraud Enron out of tens of millions of dollars.

Portland General Electric (PGE) is a Fortune 1000 public utility based in Portland, Oregon. It distributes electricity to customers in parts of Multnomah, Clackamas, Marion, Yamhill, Washington, and Polk counties - 44% of the inhabitants of Oregon. Founded in 1888 as the Willamette Falls Electric Company, the company has been an independent company for most of its existence, though was briefly owned by the Houston-based Enron Corporation from 1997 until 2006 when Enron divested itself of PGE during its bankruptcy.

Dynegy Inc. is an electric company based in Houston, Texas. It owns and operates a number of power stations in the U.S., all of which are natural gas-fueled or coal-fueled. Dynegy was acquired by Vistra Corp on April 9, 2018. The company is located at 601 Travis Street in Downtown Houston. The company was founded in 1984 as Natural Gas Clearinghouse. It was originally an energy brokerage, buying and selling natural gas supplies. It changed its name to NGC Corporation in 1995 after entering the electrical power generation business.

Charles Watson is the founder of The Natural Gas Clearinghouse. Later renamed Dynegy, the firm was a highly diverse energy trading company that was similar to rival Enron in many respects. Watson attempted to orchestrate a buyout of Enron in late 2001, but withdrew following the restating of Enron's financials. At one time this was the 11th to the largest corporation on the Fortune 500.

Duke Energy Corporation is an American electric power and natural gas holding company headquartered in Charlotte, North Carolina.

George Richard "Rick" Wagoner Jr. is an American businessman and former chair and chief executive officer of General Motors. Wagoner resigned as chairman and CEO at General Motors on March 29, 2009, at the request of the White House. The latter part of Wagoner's tenure as CEO of General Motors found him under heavy criticism as the market valuation of GM went down by more than 90% and the company lost more than US$82 billion. He is a board member of ChargePoint, an electric vehicle infrastructure company.

Chesapeake Energy Corporation is an American exploration and production company, headquartered in Oklahoma City.

Glenn Fletcher Tilton is a retired American oil and airline industry executive. Tilton spent most of his career working for Texaco, and as CEO guided its merger with Chevron Oil in 2001. He was chairman, president, and CEO of UAL Corporation from 2002 to 2010. He stayed on as non-executive chairman of United Continental Holdings Inc., (NYSE:UAL), the parent company of the merged United Airlines, Inc. and Continental Airlines, Inc. from October 1, 2010, until 2012. Tilton was Midwest chairman and a member of the executive committee at JP Morgan Chase (NYSE:JPM), from June 6, 2011, until his retirement in June, 2014.

Calpine Corporation is the largest generator of electricity from natural gas and geothermal resources in the United States, with operations in competitive power markets.

SemGroup Corporation was a publicly-traded company engaged in natural gas, petroleum, and propane pipeline transport. It was organized in Delaware and headquartered in Tulsa, Oklahoma. In December 2019, the company was acquired by Energy Transfer LP.

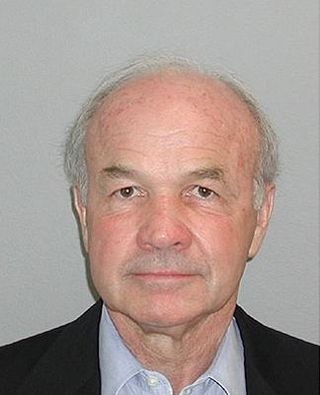

Kenneth Lee Lay was an American businessman who was the founder, chief executive officer and chairman of Enron. He was heavily involved in the eponymous accounting scandal that unraveled in 2001 into the largest bankruptcy ever to that date. Lay was indicted by a grand jury and was found guilty of 10 counts of securities fraud at trial. Lay died in July 2006 while vacationing in his house near Aspen, Colorado, three months before his scheduled sentencing. A preliminary autopsy reported Lay died of a heart attack caused by coronary artery disease. His death resulted in a vacated judgment.

Weatherford International plc, an American–Irish public limited company, together with its subsidiaries, is a multinational oilfield service company and one of the largest companies in the world in oil services. Weatherford is a company providing equipment and services used in the drilling, evaluation, completion, production, and intervention of oil and natural gas wells. Many of the company's businesses, including those of predecessor companies, have been operating for more than 50 years.

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. When news of widespread fraud within the company became public in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen – then one of the five largest audit and accountancy partnerships in the world – was effectively dissolved. In addition to being the largest bankruptcy reorganization in U.S. history at that time, Enron was cited as the biggest audit failure.

Macquarie Group Limited is an Australian global financial services group. Headquartered and listed in Australia, Macquarie employs more than 20,000 staff in 34 markets, is the world's largest infrastructure asset manager and Australia's top ranked mergers and acquisitions adviser, with more than A$871 billion in assets under management.

Archie Wallace Dunham is the former chairman emeritus and former independent non-executive chairman of Chesapeake Energy in Oklahoma City. He served as president and chief executive officer of Conoco Inc. from January 1996 to August 2002, then as chairman of ConocoPhillips, following the merger of Conoco Inc. and Phillips Petroleum Company, until his retirement on September 30, 2004.

James Eugene Rogers Jr. was an American businessman and author. He was president and CEO of Duke Energy, the largest electrical utility in the U.S., from April, 2006 until July 1, 2013. He stayed on as Chairman of the Board until retiring the following December. His book, Lighting the World, which explores the issues involved in bringing electricity to over 1.2 billion people on earth who lack it, was published August 25, 2015 by St. Martin's Press. The book asserts that access to electricity should be recognized as a basic human right.

Lynn J. Good is chair, president and chief executive officer of Duke Energy, a Fortune 500 company. Good is an Ohio native and graduated from Miami University where she earned a BS in Systems Analysis and in Accounting (1981).

Mark Paul Frissora is an American business executive. He has been the CEO and president of The Hertz Corporation, and was the CEO and president of Caesars Entertainment until 2019.

Michael C. "Mike" Linn is an American attorney and businessman from Houston, Texas. He is the founder of Linn Energy, a defunct company that was engaged in hydrocarbon exploration.