Related Research Articles

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Additionally, it is designed to try to keep GDP growth at 2%–3% and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilise the economy over the course of the business cycle.

Supply-side economics is a macroeconomic theory postulating that economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

In economics, the fiscal multiplier is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change in national income arising from any autonomous change in spending. When this multiplier exceeds one, the enhanced effect on national income may be called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased income and hence increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in aggregate output that is a multiple of the initial change.

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression.

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes.

In economic policy, austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditors and credit rating agencies and make borrowing easier and cheaper as a result.

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

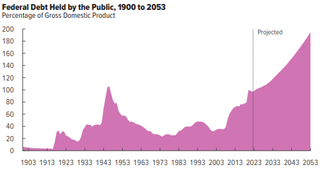

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

Kansas, like many other states, is facing a $186 million gap for fiscal year 2009 and according to early estimates approximately $1 billion deficit for fiscal year 2010. However, more recent estimates place FY 2010's shortfall at $654 million.

Governor Kathleen Sebelius recommended $600 million in budget cuts for FY 2010 which includes eliminating programs, closing facilities, freezing new hires, and reducing spending. However, in light of the federal economic stimulus package Sebelius amended her recommended budget to "prevent harm" to the state. "Budget cuts deeper than what I have already recommended are not necessary, and would in fact do great harm to our state’s economy and employment levels," said Sebelius. However, state officials said their target for reductions in fiscal 2010 is greater than the Governor's recommendations - $625 million. According to the Governor's recommended budget, the proposed cuts could reduce the projected FY2010 shortfall $103 million, however that estimate depends on $57 million in revenue from state-owned casinos that haven’t yet been built.

The economic impact of illegal immigration to the United States is challenging to measure and politically contentious. Research shows that unauthorized immigrants increase the size of the U.S. economy/contribute to economic growth, enhance the welfare of natives, contribute more in tax revenue than they collect, reduce American firms' incentives to offshore jobs and import foreign-produced goods, and benefit consumers by reducing the prices of goods and services.

Tax policy and economic inequality in the United States discusses how tax policy affects the distribution of income and wealth in the United States. Income inequality can be measured before- and after-tax; this article focuses on the after-tax aspects. Income tax rates applied to various income levels and tax expenditures primarily drive how market results are redistributed to impact the after-tax inequality. After-tax inequality has risen in the United States markedly since 1980, following a more egalitarian period following World War II.

The 2013 United States federal budget is the budget to fund government operations for the fiscal year 2013, which began on October 1, 2012, and ended on September 30, 2013. The original spending request was issued by President Barack Obama in February 2012.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

The Expansionary Fiscal Contraction (EFC) hypothesis predicts that, under certain circumstances, a major reduction in government spending that changes future expectations about taxes and government spending will expand private consumption, resulting in overall economic expansion. This hypothesis was introduced by Francesco Giavazzi and Marco Pagano in 1990 in a paper that used the fiscal restructurings of Denmark and Ireland in the 1980s as examples.

The United States fiscal cliff refers to the combined effect of several previously-enacted laws that came into effect simultaneously in January 2013, increasing taxes and decreasing spending.

The 1993 Canadian budget was a Canadian federal budget for the Government of Canada presented by Minister of Finance Don Mazankowski in the House of Commons of Canada on 26 April 1993. It was the fifth budget after the 1988 Canadian federal election and would be the last before the 1993 Canadian federal election.

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts".

As a result of the Budget Control Act of 2011, a set of automatic spending cuts to United States federal government spending in particular of outlays were initially set to begin on January 1, 2013. They were postponed by two months by the American Taxpayer Relief Act of 2012 until March 1 when this law went into effect.

References

- "Freeze before Cuts." Science News 93 (1968): 556.

- Mervis, Jeffrey; Bhattacharjee, Yudhijit; Kaiser, Jocelyn; Lawler, Andrew (27 Feb 2008). "U.S. Science Faces a Flat 2009". ScienceNow. AAAS. Retrieved 29 Sep 2008.

- Mitchell, Joan (1974). "Review of In Pursuit of Price Stability. The Wage-Price Freeze of 1971 by A. R. Weber". The Economic Journal . 84 (335): 666–668. doi:10.2307/2231061. JSTOR 2231061.

- Schick, Allen (1964). "Control Patterns in State Budget Execution". Public Administration Review . 24 (2): 97–106. doi:10.2307/973452. JSTOR 973452.

- Turner, Joseph (19 December 2008). "Gregoire's Budget: Freeze, cut". The News Tribune. Archived from the original on March 20, 2012. Retrieved 27 February 2009.

- White, Joseph (1995). "Budget Endgame". The Brookings Review. 13 (4): 50. doi:10.2307/20080603. JSTOR 20080603.

- Wolk, Los; Yamada, Mariko (27 February 2008). "State budget freeze halts YCRCD conservation projects". Yolo County Resource Conservation District. Archived from the original on 2009-02-28.