Related Research Articles

In probability theory and statistics, the negative binomial distribution is a discrete probability distribution that models the number of failures in a sequence of independent and identically distributed Bernoulli trials before a specified (non-random) number of successes occurs. For example, we can define rolling a 6 on a dice as a success, and rolling any other number as a failure, and ask how many failure rolls will occur before we see the third success. In such a case, the probability distribution of the number of failures that appear will be a negative binomial distribution.

The Pareto distribution, named after the Italian civil engineer, economist, and sociologist Vilfredo Pareto, is a power-law probability distribution that is used in description of social, quality control, scientific, geophysical, actuarial, and many other types of observable phenomena; the principle originally applied to describing the distribution of wealth in a society, fitting the trend that a large portion of wealth is held by a small fraction of the population. The Pareto principle or "80-20 rule" stating that 80% of outcomes are due to 20% of causes was named in honour of Pareto, but the concepts are distinct, and only Pareto distributions with shape value of log45 ≈ 1.16 precisely reflect it. Empirical observation has shown that this 80-20 distribution fits a wide range of cases, including natural phenomena and human activities.

Price skimming is a price setting strategy that a firm can employ when launching a product or service for the first time. By following this price skimming method and capturing the extra profit a firm is able to recoup its sunk costs quicker as well as profit off of a higher price in the market before new competition enters and lowers the market price. It has become a relatively common practice for managers in new and growing market, introducing prices high and dropping them over time.

RFM is a method used for analyzing customer value and segmenting customers which is commonly used in database marketing and direct marketing. It has received particular attention in the retail and professional services industries.

Probability is a measure of the likeliness that an event will occur. Probability is used to quantify an attitude of mind towards some proposition whose truth is not certain. The proposition of interest is usually of the form "A specific event will occur." The attitude of mind is of the form "How certain is it that the event will occur?" The certainty that is adopted can be described in terms of a numerical measure, and this number, between 0 and 1 is called the probability. Probability theory is used extensively in statistics, mathematics, science and philosophy to draw conclusions about the likelihood of potential events and the underlying mechanics of complex systems.

In probability theory, a compound Poisson distribution is the probability distribution of the sum of a number of independent identically-distributed random variables, where the number of terms to be added is itself a Poisson-distributed variable. The result can be either a continuous or a discrete distribution.

In statistics, Poisson regression is a generalized linear model form of regression analysis used to model count data and contingency tables. Poisson regression assumes the response variable Y has a Poisson distribution, and assumes the logarithm of its expected value can be modeled by a linear combination of unknown parameters. A Poisson regression model is sometimes known as a log-linear model, especially when used to model contingency tables.

The Bass model or Bass diffusion model was developed by Frank Bass. It consists of a simple differential equation that describes the process of how new products get adopted in a population. The model presents a rationale of how current adopters and potential adopters of a new product interact. The basic premise of the model is that adopters can be classified as innovators or as imitators, and the speed and timing of adoption depends on their degree of innovation and the degree of imitation among adopters. The Bass model has been widely used in forecasting, especially new products' sales forecasting and technology forecasting. Mathematically, the basic Bass diffusion is a Riccati equation with constant coefficients equivalent to Verhulst—Pearl Logistic growth.

Andrew Ehrenberg was a statistician and marketing scientist. For over half a century, he made contributions to data reduction/analysis and presentation, and to understanding buyer behaviour and how advertising works.

Double jeopardy is an empirical law in marketing where, with few exceptions, the lower-market-share brands in a market have both far fewer buyers in a time period and also lower brand loyalty.

Gerald Goodhardt was a marketing scientist.

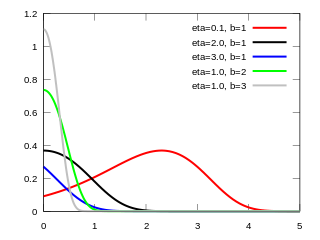

In probability and statistics, the log-logistic distribution is a continuous probability distribution for a non-negative random variable. It is used in survival analysis as a parametric model for events whose rate increases initially and decreases later, as, for example, mortality rate from cancer following diagnosis or treatment. It has also been used in hydrology to model stream flow and precipitation, in economics as a simple model of the distribution of wealth or income, and in networking to model the transmission times of data considering both the network and the software.

Search costs are a facet of transaction costs or switching costs and include all the costs associated with the searching activity conducted by a prospective seller and buyer in a market. Rational consumers will continue to search for a better product or service until the marginal cost of searching exceeds the marginal benefit. Search theory is a branch of microeconomics that studies decisions of this type.

In probability and statistics, the Gompertz distribution is a continuous probability distribution, named after Benjamin Gompertz. The Gompertz distribution is often applied to describe the distribution of adult lifespans by demographers and actuaries. Related fields of science such as biology and gerontology also considered the Gompertz distribution for the analysis of survival. More recently, computer scientists have also started to model the failure rates of computer code by the Gompertz distribution. In Marketing Science, it has been used as an individual-level simulation for customer lifetime value modeling. In network theory, particularly the Erdős–Rényi model, the walk length of a random self-avoiding walk (SAW) is distributed according to the Gompertz distribution.

A customer review is an evaluation of a product or service made by someone who has purchased and used, or had experience with, a product or service. Customer reviews are a form of customer feedback on electronic commerce and online shopping sites. There are also dedicated review sites, some of which use customer reviews as well as or instead of professional reviews. The reviews may themselves be graded for usefulness or accuracy by other users.

In probability theory, a beta negative binomial distribution is the probability distribution of a discrete random variable equal to the number of failures needed to get successes in a sequence of independent Bernoulli trials. The probability of success on each trial stays constant within any given experiment but varies across different experiments following a beta distribution. Thus the distribution is a compound probability distribution.

In probability and statistics, the Gamma/Gompertz distribution is a continuous probability distribution. It has been used as an aggregate-level model of customer lifetime and a model of mortality risks.

In probability theory and statistics, the discrete Weibull distribution is the discrete variant of the Weibull distribution. The Discrete Weibull Distribution, first introduced by Toshio Nakagawa and Shunji Osaki, is a discrete analog of the continuous Weibull distribution, predominantly used in reliability engineering. It is particularly applicable for modeling failure data measured in discrete units like cycles or shocks. This distribution provides a versatile tool for analyzing scenarios where the timing of events is counted in distinct intervals, making it distinctively useful in fields that deal with discrete data patterns and reliability analysis.

References

- ↑ McCarthy, Daniel. "Buy 'Til You Die - A Walkthrough" (PDF). Buy ’Til You Die - A Walkthrough. Retrieved 21 March 2019.

- 1 2 3 Fader; et al. (Spring 2005). ""Counting Your Customers" the Easy Way: An Alternative to the Pareto/NBD Model" (PDF). Marketing Science. 24 (2): 275–284. doi:10.1287/mksc.1040.0098 . Retrieved 21 March 2019.

- ↑ Fader; et al. (November–December 2010). "Customer-Base Analysis in a Discrete-Time Noncontractual Setting" (PDF). Marketing Science. 29 (6): 1086–1108. doi:10.1287/mksc.1100.0580 . Retrieved 21 March 2019.

- ↑ Schmittlein, David; Morrison, Donald; Colombo, Richard. "Counting Your Customers: Who-Are They and What Will They Do Next?". Management Science. 33 (1): 1–24. doi:10.1287/mnsc.33.1.1.