This page is based on this

Wikipedia article Text is available under the

CC BY-SA 4.0 license; additional terms may apply.

Images, videos and audio are available under their respective licenses.

The Nasdaq Stock Market is an American stock exchange. It is the second-largest stock exchange in the world by market capitalization, behind only the New York Stock Exchange located in the same city. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic and Nasdaq Baltic stock market network and several U.S. stock and options exchanges.

Market capitalization is the market value of a publicly traded company's outstanding shares. Market capitalization is equal to the share price multiplied by the number of shares outstanding. As outstanding stock is bought and sold in public markets, capitalization could be used as an indicator of public opinion of a company's net worth and is a determining factor in some forms of stock valuation.

The S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE, NASDAQ, or the Cboe BZX Exchange.

The Tel Aviv Stock Exchange in Tel Aviv is Israel's only public stock exchange. Legally, the exchange is regulated by the Securities Law (1968), and is under the direct supervision of the Israel Securities Authority (ISA).

The FTSE 250 Index is a capitalisation-weighted index consisting of the 101st to the 350th largest companies listed on the London Stock Exchange. Promotions and demotions to and from the index occur quarterly in March, June, September, and December. The Index is calculated in real-time and published every minute.

The Shanghai Stock Exchange (SSE) is a stock exchange that is based in the city of Shanghai, China. It is one of the two stock exchanges operating independently in the People's Republic of China, the other being the Shenzhen Stock Exchange. Shanghai Stock Exchange is the world's 4th largest stock market by market capitalization at US$5.5 trillion as of April 2018. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors and often manipulated by the decisions of the central government. This is due to tight capital account controls exercised by the Chinese mainland authorities.

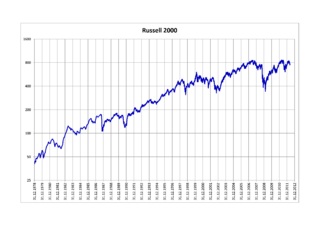

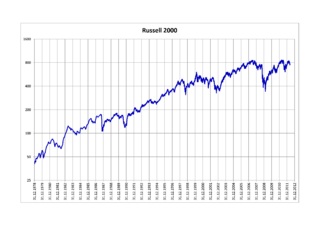

The Russell 2000 Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

Borsa Italiana S.p.A., based in Milan, is Italy's only stock exchange. It manages and organises domestic market, regulating procedures for admission and listing of companies and intermediaries and supervising disclosures for listed companies.

Euronext Paris is France's securities market, formerly known as the Paris Bourse, which merged with the Amsterdam, Lisbon, and Brussels exchanges in September 2000 to form Euronext NV, which is the second largest exchange in Europe behind the United Kingdom's London Stock Exchange Group.

CBV 20 is a stock market index that tracks 20 leading companies with highest total market capital and liquidity in Vietnam Stock Markets. It is part of the broader CBV Index and it also includes CBV 10.

CBV 10 is a stock market index that tracks 10 leading companies with highest total market capital and liquidity in Vietnam Stock Markets. It is part of the broader CBV Index.

CBV Vietnam finance indices comprise the only index that reflects the performance of the stock market of Vietnam. They were introduced to the Vietnamese financial market by Bien Viet Securities JSC at the beginning of 2007. The Indices were founded by the Council of Corporates and Businesses of Vietnam.

The S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices. The index serves as a barometer for the U.S. mid-cap equities sector and is the most widely followed mid-cap index in existence. To be included in the index, a stock must have a total market capitalization that ranges from $1.4 billion to $5.9 billion at the time of addition to the index. As of 29 December 2017, the median market cap was almost $4.1 billion with the market cap of the largest company in the index at more than $13.1 billion and the smallest company at $626 million. The index's market cap covers nearly 7 percent of the total US stock market. The index was launched on June 19, 1991.

The S&P SmallCap 600 Index is a stock market index established by Standard & Poor's. It covers roughly the small-cap range of US stocks, using a capitalization-weighted index. As of 31 January 2017, the market capital of companies included in the S&P SmallCap 600 Index ranged from US$400 million to US$1.8 billion. The index's median market cap was almost $1.1 billion and covered roughly three percent of the total US stock market. These smallcap stocks cover a narrower range of capitalization than the companies covered by the Russell 2000 Smallcap index which range from $169 million to $4 billion. The market valuation for companies in the SmallCap Index and other indices change over times with inflation and the growth of publicly traded companies. The S&P 400 MidCap index combined with the SmallCap 600 compose the S&P 1000, and the S&P 1000 plus the S&P 500 comprise the S&P 1500. The index was launched on October 28, 1994.