The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges.

Osaka Exchange, Inc., renamed from Osaka Securities Exchange Co., Ltd., is the largest derivatives exchange in Japan, in terms of amount of business handled.

The SSE Composite Index also known as SSE Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange.

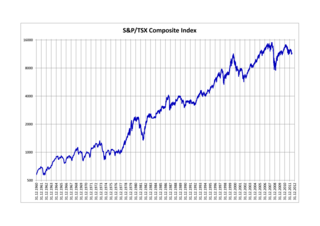

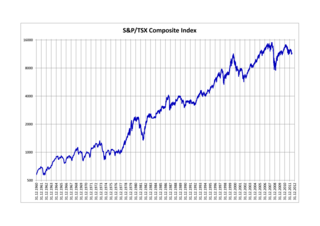

The S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX) with about 250 companies included in it. The Toronto Stock Exchange is made up of over 1,500 companies. It replaces the earlier TSE 300 index. On November 12, 2021 the S&P/TSX Composite Index reached an all-time closing high of 21,768.53. The intraday record high was made on November 16, 2021 at 21,796.16.

The Athens Stock Exchange is the stock exchange of Greece, based in the capital city of Athens. It was founded in 1876. There are currently five markets operating in ATHEX: regulated securities market, regulated derivatives market, Alternative market, carbon market and OTC market. In the regulated securities market investors can trade in stocks, bonds, ETFs and other related securities. On the stock exchange 172 stocks are currently traded representing 166 companies.

A stock fund, or equity fund, is a fund that invests in stocks, also called equity securities. Stock funds can be contrasted with bond funds and money funds. Fund assets are typically mainly in stock, with some amount of cash, which is generally quite small, as opposed to bonds, notes, or other securities. This may be a mutual fund or exchange-traded fund. The objective of an equity fund is long-term growth through capital gains, although historically dividends have also been an important source of total return. Specific equity funds may focus on a certain sector of the market or may be geared toward a certain level of risk.

Indonesia Stock Exchange (IDX) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). During recent years, Indonesia Stock Exchange sees fastest membership growth in Asia. As of September 2021, the Indonesia Stock Exchange had 750 listed companies, and total stock investors were about 6.4 million, compared to 2.5 million at the end of 2019. Indonesia Market Capitalization accounted for 45.2% of its nominal GDP in December 2020.

The S&P/ASX 200 index is a market-capitalization weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia's share market capitalization.

Hanoi Stock Exchange (HNX), formerly the Hanoi Securities Trading Center until 2009, is located in Hanoi, Vietnam, and was launched in March 2005. It handles auctions and trading of stocks and bonds. It was the second securities trading center to open in Vietnam after he Ho Chi Minh City Securities Trading Center.

Ho Chi Minh Stock Exchange (HOSE), formerly known as HCM Securities Trading Center, is a stock exchange in Ho Chi Minh City, Vietnam. It was established in 1998 under Decision No. 127/1998/QD-TTg of the Prime Minister of Vietnam. HCM Securities Trading Center officially opened on July 20, 2000, and had its first trading session on July 28, 2000, with two listed companies and six security company members.

The CBV-Index, or Corporates and Businesses of Vietnam Index, is a market index containing the stocks of 50 leading corporations of Vietnam. Subsets of this index include the CBV 10 and CBV 20.

CBV MidCap is a stock market index indicating 30 out of 60 stock prices of medium-size companies in Vietnam. The medium-size companies are classified as those having total market capital from VND 150 billion to 500 billion with highest liquidity in these medium-capitalization group.

CBV SmallCap is a stock market index indicating the stock prices of 30 out of 73 small-size companies in Vietnam. The small-size companies are classified as those having total market capital from VND 50 billion to 150 billion with highest liquidity in this small-capitalization group.

CBV Vietnam finance indices comprise the only index that reflects the performance of the stock market of Vietnam. They were introduced to the Vietnamese financial market by Bien Viet Securities JSC at the beginning of 2007. The Indices were founded by the Council of Corporates and Businesses of Vietnam.

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

This article gives an overview about Vietnam Securities Indexes.

Woori CBV Securities Corporation is Vietnam provider of financial and investment services. Woori CBV has been well known as the first and largest provider of Vietnam’s financial market indexes and economic indicators. Vietnam Securities Indexes is the first equity index that composes all stocks listed on the two exchanges in Hanoi and Ho Chi Minh City. Vietnam Finance Indexes family is the first family of Vietnam finance indexes to be sponsored and introduced by Bloomberg to global financial institutions. The index system developed by Woori CBV is the world's largest index family for Vietnam with over 450 equity indexes, 50 fixed income indexes, and over 50 indexes in other categories. The company's most known indexes include Vietnam Securities Indexes, Vietnam Bond Indexes, Vietnam Investor Confidence Index, VND Index, Vietnam Consumer Confidence Index.

ASEAN Exchanges is a collaboration of the 7 exchanges from Malaysia, Vietnam, Indonesia, Philippines, Thailand and Singapore to promote the growth of the ASEAN capital market by bringing more ASEAN investment opportunities to more investors.