The CBV-Index, or Corporates and Businesses of Vietnam Index, is a market index containing the stocks of 50 leading corporations of Vietnam. Subsets of this index include the CBV 10 (10 leading companies with highest total market capital and liquidity) and CBV 20 (top 20 such companies).

Vietnam, officially the Socialist Republic of Vietnam, is the easternmost country on the Indochina Peninsula. With an estimated 94.6 million inhabitants as of 2016, it is the 15th most populous country in the world. Vietnam is bordered by China to the north, Laos and Cambodia to the west, part of Thailand to the southwest, and the Philippines, Malaysia, and Indonesia across the South China Sea to the east and southeast. Its capital city has been Hanoi since the reunification of North and South Vietnam in 1976, while its most populous city is Ho Chi Minh City.

The CBV-Index, or CBV LargeCap, together with CBV MidCap and CBV SmallCap form the broader CBV Total. All stocks in these indices are traded on the two Vietnam stock markets, Ha Noi and Ho Chi Minh City Securities Trading Centers. It was created by BienViet Securities J.S.C., and first published on January 1, 2007.

CBV MidCap is a stock market index indicating 30 out of 60 stock prices of medium-size companies in Vietnam. The medium-size companies are classified as those having total market capital from VND 150 billion to 500 billion with highest liquidity in these medium-capitalization group.

CBV SmallCap is a stock market index indicating the stock prices of 30 out of 73 small-size companies in Vietnam. The small-size companies are classified as those having total market capital from VND 50 billion to 150 billion with highest liquidity in this small-capitalization group.

CBV Total is a stock market index indicating the performance of Vietnam's stock markets. It shows all stocks that are listed in the two Vietnam trading markets, the Hanoi Securities Trading Center and Hochiminh Stock Exchange.

History

At the beginning of 2007, CBV-Index was introduced to the financial market of Vietnam by Bien Viet Securities. The Index was known as the first and only index that reflects the performance of the whole stock market of Vietnam, covering securities listed on the only two exchanges, Hanoi Securities Trading Center and Hochiminh Stock Exchange. Unlike indexes made by exchange houses as VN-Index and Hastc-Index, which are all market cap weighted, CBV Index was the first free-float market cap weighted index of Vietnam equity market. In March, 2007, CBV 20 and CBV 10 which form the part of CBV-Index was published in order to meet the demand for Index investors in Vietnam. CBV MidCap, CBV SmallCap for Mid-Cap and Small-Cap companies also came out at the same time. In April, 2007, the Council of Corporates and Businesses of Vietnam Indices was founded.

Methodology

CBV-Index measures the change of average stock market prices using float adjusted market capitalization method.

The percentage of shares available for public investors- public float (IWF- Investable Weight Factor) will be calculated using the following formula:

:::{| style="vertical-aligne: middle; border-collapse: collapse; text-align: center" cellspacing=1 |rowspan="2" | IWF = | style="border-bottom: 1px solid black" | Number of shares available for public |- | style="border-top: 1px solid black" | total number of listed shares |}

Then, float adjusted market capitalization index will be calculated according to the following formula:

Pi is market price of share i, Qi is the number of listed shares. IWF if the percentage of shares available for public investors, Divisor (D) is the index divisor. Divisor D will be adjusted so that CBV index will not be affected as the result of issuance of additional shares, addition of newly listed companies or removal of listed companies in CBV index.

The S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE, NASDAQ, or the Cboe BZX Exchange.

The Tel Aviv Stock Exchange is Israel's only public stock exchange. Legally, the exchange is regulated by the Securities Law (1968), and is under the direct supervision of the Israel Securities Authority (ISA).

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all US-stocks actively traded in the United States. As of June 30, 2018, the index contained only 3,486 components. The index is intended to measure the performance of most publicly traded companies headquartered in the United States, with readily available price data,. Hence, the index includes a majority of the common stocks and REITs traded primarily through New York Stock Exchange, NASDAQ, or the American Stock Exchange. Limited partnerships and ADRs are not included. It can be tracked by following the ticker ^W5000.

The Bucharest Stock Exchange (BVB) is the stock exchange of Romania located in Bucharest. As of November 2017, there are 88 companies listed on BVB's regulated market and 299 companies listed on AeRO market with a total market capitalization of €35.6 billion. Starting 2014 and up to date, the main index BET went up by 19.9%, thus exceeding the maximum of the last 9 years.

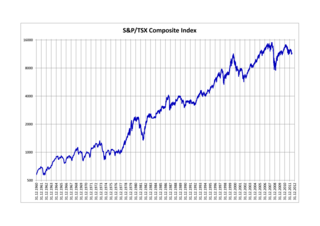

The S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX) with about 250 companies included in it. The Toronto Stock Exchange is made up of over 1,500 companies. It replaces the earlier TSE 300 index. On April 18, 2019, the S&P/TSX Composite Index reached an all-time closing high of 16,612.81, surpassing the previous record of 16,567.42 set July 12, 2018. The intraday record high was also made on April 18, 2019 at 16,615.08.

The S&P/ASX 200 index is a market-capitalization weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia’s sharemarket capitalisation.

Ho Chi Minh City Stock Exchange or Ho Chi Minh Stock Exchange, located in Ho Chi Minh City, is the largest stock exchange in Vietnam. Established in 2000 as the Ho Chi Minh City Securities Trading Center (HoSTC), it is an administrative agency of the State Securities Commission, along with the Hanoi Securities Trading Center. The stock exchange is located at 45-47 Ben Chuong Duong, District 1, Ho Chi Minh City, Vietnam. The current top executive of HSX, with the title of Deputy Chairman, is Mr. Tran Dac Sinh.

A capitalization-weighted index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

The Dow Jones Global Titans 50 Index is a float-adjusted index of 50 of the largest and best known blue chip companies traded on the New York Stock Exchange, American Stock Exchange, Nasdaq, Euronext, London Stock Exchange, and Tokyo Stock Exchange. The index represents the biggest and most liquid stocks traded in individual countries. It was created by Dow Jones Indexes to reflect the globalization of international blue chip securities in the wake of mergers and the creation of mega-corporations.

Amman Stock Exchange (ASE) is a stock exchange private institution in Jordan. It is named "Amman" after the country's capital city, Amman.

CBV Vietnam finance indices comprise the only index that reflects the performance of the stock market of Vietnam. They were introduced to the Vietnamese financial market by Bien Viet Securities JSC at the beginning of 2007. The Indices were founded by the Council of Corporates and Businesses of Vietnam.

CBV Vietnam bond Indexes is a listing of bonds or fixed income instruments and a statistic reflecting the composite value of its components. It is used as a benchmark to evaluate the market value of all Vietnamese bonds.

The Vietnam Investor Confidence Index measures the attitude of both Vietnamese local and foreign investors to risk.

Woori CBV Securities Corporation is Vietnam provider of financial and investment services. Woori CBV has been well known as the first and largest provider of Vietnam’s financial market indexes and economic indicators. Vietnam Securities Indexes is the first equity index that composes all stocks listed on the two exchanges in Hanoi and Ho Chi Minh City. Vietnam Finance Indexes family is the first family of Vietnam finance indexes to be sponsored and introduced by Bloomberg to global financial institutions. The index system developed by Woori CBV is the world's largest index family for Vietnam with over 450 equity indexes, 50 fixed income indexes, and over 50 indexes in other categories. The company's most known indexes include Vietnam Securities Indexes, Vietnam Bond Indexes, Vietnam Investor Confidence Index, VND Index, Vietnam Consumer Confidence Index.

VN30 Equal Weight Index tracks the total performance of the top 30 large-cap, liquid stocks listed on the Ho Chi Minh City stock exchange along with two popular indices in Vietnam: VN Index and VN30 Index. All index constituents are equal-weighted to help investors deal with liquidity, foreign ownership and state-owned enterprise constraints when investing in Vietnam.