Related Research Articles

Emissions trading is a market-oriented approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants. The concept is also known as cap and trade (CAT) or emissions trading scheme (ETS). One prominent example is carbon emission trading for CO2 and other greenhouse gases which is a tool for climate change mitigation. Other schemes include sulfur dioxide and other pollutants.

Renewable Energy Certificates (RECs), also known as Green tags, Renewable Energy Credits, Renewable Electricity Certificates, or Tradable Renewable Certificates (TRCs), are tradable, non-tangible energy certificates in the United States that represent proof that 1 megawatt-hour (MWh) of electricity was generated from an eligible renewable energy resource and was fed into the grid. Solar renewable energy certificates (SRECs) are RECs that are specifically generated by solar energy.

The Clean Development Mechanism (CDM) is a United Nations-run carbon offset scheme allowing countries to fund greenhouse gas emissions-reducing projects in other countries and claim the saved emissions as part of their own efforts to meet international emissions targets. It is one of the three Flexible Mechanisms defined in the Kyoto Protocol. The CDM, defined in Article 12 of the Protocol, was intended to assist non-Annex I countries achieve sustainable development and reduce their carbon footprints, and to assist Annex I countries achieve compliance with greenhouse gas emissions reduction commitments.

Carbon offsetting is a carbon trading mechanism that enables entities to compensate for offset greenhouse gas emissions by investing in projects that reduce, avoid, or remove emissions elsewhere. When an entity invests in a carbon offsetting program, it receives carbon credit or offset credit, which account for the net climate benefits that one entity brings to another. After certification by a government or independent certification body, credits can be traded between entities. One carbon credit represents a reduction, avoidance or removal of one metric tonne of carbon dioxide or its carbon dioxide-equivalent (CO2e).

Microgeneration is the small-scale production of heat or electric power from a "low carbon source," as an alternative or supplement to traditional centralized grid-connected power.

The Gold Standard (GS), or Gold Standard for the Global Goals, is a standard and logo certification mark program, for non-governmental emission reductions projects in the Clean Development Mechanism (CDM), the Voluntary Carbon Market and other climate and development interventions. It is published and administered by the Gold Standard Foundation, a non-profit foundation headquartered in Geneva, Switzerland. It was designed with an intent to ensure that carbon credits are real, verifiable, and that projects make measurable contributions to sustainable development. The objective of the GS is to add branding, with a quality label, to carbon credits generated by projects which can then be bought and traded by countries that have a binding legal commitment according to the Kyoto Protocol, businesses, or other organizations for carbon offsetting purposes.

A Renewable Portfolio Standard (RPS) is a regulation that requires the increased production of energy from renewable energy sources, such as wind, solar, biomass, and geothermal, which have been adopted in 38 of 50 U.S. states and the District of Columbia. The United States federal RPS is called the Renewable Electricity Standard (RES). Several states have clean energy standards, which also allow for resources that do not produce emissions, such as large hydropower and nuclear power.

Voluntary Emission Reductions or Verified Emission Reductions (VERs) are a type of carbon offset exchanged in the voluntary or over-the-counter market for carbon credits. Verified Emission Reductions are usually certified through a voluntary certification process.

Certified emission reductions (CERs) originally designed a type of emissions unit issued by the Clean Development Mechanism (CDM) Executive Board for emission reductions achieved by CDM projects and verified by a DOE under the rules of the Kyoto Protocol.

Carbon emission trading (also called carbon market, emission trading scheme (ETS) or cap and trade) is a type of emissions trading scheme designed for carbon dioxide (CO2) and other greenhouse gases (GHGs). A form of carbon pricing, its purpose is to limit climate change by creating a market with limited allowances for emissions. Carbon emissions trading is a common method that countries use to attempt to meet their pledges under the Paris Agreement, with schemes operational in China, the European Union, and other countries.

ecosecurities is a company specialized in carbon markets and greenhouse gas (GHG) mitigation projects worldwide. ecosecurities specializes in sourcing, developing and financing projects on renewable energy, energy efficiency, forestry and waste management with a positive environmental impact.

Bullfrog Power, an Envest company, is a Canadian green energy retailer operating in Canada. Bullfrog offers green electricity from renewable energy sources such as wind, solar, and low-impact hydro, as well as green fuel and green natural gas, a renewable biogas product that serves as an alternative to fossil fuel-based natural gas. Bullfrog only sources electricity from generation sources that meet or exceed the federal government's Environmental Choice Program EcoLogo standard for renewable electricity. Bullfrog's green natural gas product is produced at facilities that have met environmental standards as defined by ICF International.

Commodity Exchange Bratislava (CEB) (Slovak: Komoditná burza Bratislava, a.s. is a Slovakian commodities exchange that is the only commodity market for trading commodities in Slovakia. The exchange is based in Bratislava.

A low-carbon fuel standard (LCFS) is an emissions trading rule designed to reduce the average carbon intensity of transportation fuels in a given jurisdiction, as compared to conventional petroleum fuels, such as gasoline and diesel. The most common methods for reducing transportation carbon emissions are supplying electricity to electric vehicles, supplying hydrogen fuel to fuel cell vehicles and blending biofuels, such as ethanol, biodiesel, renewable diesel, and renewable natural gas into fossil fuels. The main purpose of a low-carbon fuel standard is to decrease carbon dioxide emissions associated with vehicles powered by various types of internal combustion engines while also considering the entire life cycle, in order to reduce the carbon footprint of transportation.

Personal carbon credits are carbon credits created and owned by individuals who reduce their green house gas (GHG) emissions by a real and verifiable amount. Individuals cause GHG emissions from a variety of direct and indirect activities including transportation use, electrical use and home heating and cooling. Verifiable reductions in GHG emissions are aggregated into 1 metric ton increments and they become personal Carbon Credits. There are many firms that are creating applications to efficiently measure and track these emissions, while providing options to purchase and offset personal emissions.

A green bond is a fixed-income financial instruments (bond) which is used to fund projects that have positive environmental benefits. When referring to climate change mitigation projects they are also known as climate bonds. Green bonds follow the Green Bond Principles stated by the International Capital Market Association (ICMA), and the proceeds from the issuance of which are to be used for the pre-specified types of projects. The categories of eligible green projects include for example: Renewable energy, energy efficiency, pollution prevention and control, environmentally sustainable management of living natural resources and land use, terrestrial and aquatic biodiversity, clean transportation, climate change adaptation.

Pedro Moura Costa is an entrepreneur involved in environmental finance with a focus on the international efforts for greenhouse gas (GHG) emission reductions. Of particular relevance, he was the founder and President of EcoSecurities Group Plc., one of the leading project developers for the international carbon markets, and has written widely about the policy and science of climate change mitigation, including contributions to the Intergovernmental Panel on Climate Change (IPCC) reports.

The Verified Carbon Standard (VCS), formerly the Voluntary Carbon Standard, is a standard for certifying carbon credits to offset emissions. VCS is administered by Verra, a 501(c)(3) organization. Verra is a certifier of voluntary carbon offsets. As of 2024, more than 2,300 projects were registered under the Verified Carbon Standard (VCS), spanning various sectors such as AFOLU, energy, transport, waste, manufacturing industries, and others. These projects have collectively issued over 1.3 billion credits, with more than 776 million credits retired to date.

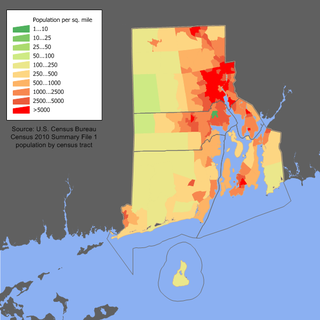

Solar power in Rhode Island has become economical due to new technological improvements and a variety of regulatory actions and financial incentives, particularly a 30% federal tax credit, available through 2016, for any size project. A typical residential installation could pay for itself in utility bill savings in 14 years, and generate a profit for the remainder of its 25 year life. Larger systems, from 10 kW to 5 MW, receive a feed-in tariff of up to 33.45¢/kWh.

Global Carbon Council (GCC), formerly known as Global Carbon Trust (GCT), is MENA region's first voluntary carbon offsetting program. It facilitates global stakeholders in implementing climate actions through provision of voluntary carbon offsetting program.

References

- ↑ "CEB VER Solar Market". Carbonplace.eu. Archived from the original on 2013-04-29. Retrieved 2013-08-17.

- ↑ "CEB VER Solar v 1.0 methodology" (PDF). En.ver.kbb.sk. Archived from the original (PDF) on 2016-03-03. Retrieved 2013-08-17.