A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

Electronic Funds Transfer at Point Of Sale, abbreviated as EFTPOS, is the technical term referring to a type of payment transaction where electronic funds transfers (EFT) are processed at a point of sale (POS) system or payment terminal usually via payment methods such as payment cards. EFTPOS technology was developed during the 1980s.

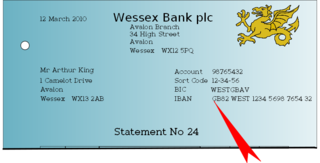

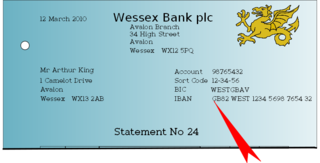

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. By July 2024, 88 countries were using the IBAN numbering system.

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to non-financial organization, the code may also be known as Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

The Beijing Municipal Administration & Communication Card, more commonly known as the Yikatong, is a stored-value contactless smart card used in Beijing, China, for public transportation and related uses. It is similar to Hong Kong's Octopus card, Singapore's CEPAS, the OMNY Card in New York City, United States, or the Oyster card used by Transport for London in London, England.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible. A payment system is an operational network which links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

The history of Chinese currency spans more than 3000 years from ancient china to imperial china and modern China. Currency of some type has been used in China since the Neolithic age which can be traced back to between 3000 and 4500 years ago. The history of China's monetary system traces back to the Shang Dynasty, where cowrie shells served as early currency. Cowry shells are believed to have been the earliest form of currency used in Central China, and were used during the Neolithic period. By the Warring States Period, diverse metal currencies like knife and spade coins emerged. These early currencies, starting as a commodity exchange to cowrie shells, copper coins, paper money and modern chinese currencies and digital currencies shows how centralized power developed the most influential monetary system in the world.

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of bank codes varies. In some countries the bank codes can be viewed over the internet, but mostly in the local language.

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and formerly in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland they have been deprecated and replaced by the Single European Payment Area (SEPA) systems and infrastructure.

Electronic funds transfer (EFT) is the transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems.

Payment and settlement systems are used for financial transactions in India. Covered by the Payment and Settlement Systems Act of 2007, legislated in December 2007, they are regulated by the Reserve Bank of India (RBI) and the Board for Regulation and Supervision of Payment and Settlement Systems.

The Clearing House Automated Transfer System, or CHATS, is a real-time gross settlement (RTGS) system for the transfer of funds in Hong Kong. It is operated by Hong Kong Interbank Clearing Limited (HKICL), a limited-liability private company jointly owned by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Association of Banks. Transactions in four currency denominations may be settled using CHATS: Hong Kong dollar, renminbi, euro, and US dollar. In 2005, the value of Hong Kong dollar CHATS transactions averaged HK$467 billion per day, which amounted to a third of Hong Kong's annual Gross Domestic Product (GDP); the total value of transactions that year was 84 times the GDP of Hong Kong. CHATS has been referred by authors at the Bank for International Settlements to as "the poster child of multicurrency offshore systems".

The Cross-border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. CIPS is backed by the People's Bank of China and was launched in 2015 as part of a policy effort to internationalize the use of China’s currency.

A central bank digital currency is a digital currency issued by a central bank, rather than by a commercial bank. It is also a liability of the central bank and denominated in the sovereign currency, as is the case with physical banknotes and coins.

A QR code payment is a mobile payment method where payment is performed by scanning a QR code from a mobile app. This is an alternative to doing electronic funds transfer at point of sale using a payment terminal. This avoids a lot of the infrastructure traditionally associated with electronic payments such as payment cards, payment networks, payment terminal and merchant accounts.

Faster Payment System is a real-time gross settlement payment system in Hong Kong that connects traditional banks and electronic payment and digital wallet operators. Users are able to perform instant money transfer or make payment to merchants by using the recipient's phone number, e-mail or QR code that contains the user's numeric identifier. Using the "traditional way" of full name and account number to make interbank transfer is also allowed.

Digital renminbi, or Digital Currency Electronic Payment, is a central bank digital currency issued by China's central bank, the People's Bank of China. It is the first digital currency to be issued by a major economy, undergoing public testing as of April 2021. The digital RMB is legal tender and has equivalent value with other forms of renminbi, also known as the Chinese yuan (CNY), such as bills and coins.

The China National Clearing Center is a public institution within the People's Bank of China that runs several of China's key financial market infrastructures.