| Type | Regional stock exchange |

|---|---|

| Location | San Francisco, California, United States |

| Founded | October 18, 1899 |

| Closed | September 1900 |

| Currency | USD |

The California Oil Exchange was a regional stock exchange in California. It opened in San Francisco on October 18, 1899, with a "large attendance" and 22 listed stocks. The stocks were from the oil districts of Los Angeles, Santa Barbara, and Fresno. Shares sold on the first day included St. Lawrence, San Joaquin, Northfield, Quitable, Big Panoche, Kings County, 100 Eagle, and 200 Stella. [1] It was absorbed by the Los Angeles Stock Exchange in September 1900, [2] when 51 members relinquished their membership in the California Oil Exchange in favor of membership in the other. [3]

Los Angeles, often referred to by its initials L.A., is the commercial, financial, and cultural center of Southern California. Los Angeles is the largest city in the state of California, the second most populous city in the United States after New York City, and one of the world's most populous megacities. With a population of roughly 3.9 million residents within the city limits as of 2020, Los Angeles is known for its Mediterranean climate, ethnic and cultural diversity, being the home of the Hollywood film industry, and its sprawling metropolitan area. The majority of the city proper lies in a basin in Southern California adjacent to the Pacific Ocean in the west and extending partly through the Santa Monica Mountains and north into the San Fernando Valley, with the city bordering the San Gabriel Valley to its east. It covers about 469 square miles (1,210 km2), and is the county seat of Los Angeles County, which is the most populous county in the United States with an estimated 9.86 million residents as of 2022.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007.

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The Pacific Exchange was a regional stock exchange in California, from 1956 to 2006. Its main exchange floor and building were in San Francisco, California, with a branch building in Los Angeles, California.

Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC) uses the term "Penny stock" to refer to a security, a financial instrument which represents a given financial value, issued by small public companies that trade at less than $5 per share. Penny stocks are priced over-the-counter, rather than on the trading floor. The term "penny stock" refers to shares that, prior to the SEC's reclassification, traded for "pennies on the dollar". In 1934, when the United States government passed the Securities Exchange Act to regulate any and all transactions of securities between parties which are "not the original issuer", the SEC at the time disclosed that equity securities which trade for less than $5 per share could not be listed on any national stock exchange or index.

Daniel Steven Peña Sr. is an American businessman.

The phrase curbstone broker or curb-stone broker refers to a broker who conducts trading on the literal curbs of a financial district. Such brokers were prevalent in the 1800s and early 1900s, and the most famous curb market existed on Broad Street in the financial district of Manhattan. Curbstone brokers often traded stocks that were speculative in nature, as well as stocks in small industrial companies such as iron, textiles and chemicals. Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as Emanuel S. Mendels.

Associated Oil Company was an American oil and gas company once headquartered in San Francisco, California and served much of the Pacific West Coast, including Hawaii, as well as the Orient and merged with the Tidewater Oil Company in 1938.

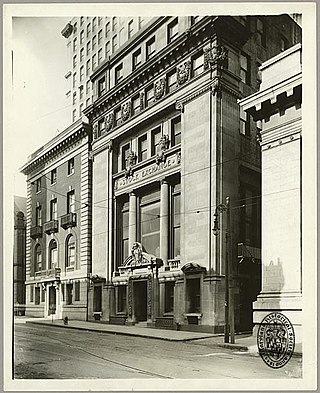

The Pittsburgh Stock Exchange was a large regional stock market located in Pittsburgh, Pennsylvania from November 11, 1864 until closing on August 23, 1974. It was alternatively named the Pittsburgh Coal Exchange starting on May 27, 1870, and the Pittsburgh Oil Exchange on July 21, 1878 with 180 members. On July 25, 1896 the Exchange formally took the name Pittsburgh Stock Exchange though it had been referred to by that name since the spring of 1894. The Exchange, like many modern day exchanges, was forced to close during sharp economic crashes or crises. On December 24, 1969 The Philadelphia-Baltimore-Washington Stock Exchange bought the Pittsburgh Stock Exchange. At its height the exchange traded over 1,200 companies, but by the last trading day in 1974 only Pittsburgh Brewing Company, Williams & Company and Westinghouse remained listed.

The Consolidated Stock Exchange of New York, also known as the New York Consolidated Stock Exchange or Consolidated, was a stock exchange in New York City, New York in direct competition to the New York Stock Exchange (NYSE) from 1885–1926. It was formed from the merger of other smaller exchanges, and was referred to in the industry and press as the "Little Board." By its official formation in 1885, its membership of 2403 was considered the second largest membership of any exchange in the United States.

The New-York Petroleum Exchange and Stock Board was a resource and stock exchange in New York City. Founded as the New-York Petroleum Exchange, in 1884 the exchange reported oil clearances amounting to 2,373,582,000 barrels, averaging 7,782,000 barrels per day. That year the exchange also began trading in stocks, bonds, and other securities. The institution merged with the competing exchange New-York Mining and National Petroleum Exchange on February 28, 1885, forming the Consolidated Stock and Petroleum Exchange.

The Baltimore Stock Exchange was a regional stock exchange based in Baltimore, Maryland. Opened prior to 1881, The exchange's building was destroyed by the Great Baltimore Fire of 1904, and was then located at 210 East Redwood Street in Baltimore's old financial district. In 1918, the exchange had 87 members, with six or seven members at the time serving the United States in World War I. The Baltimore Stock Exchange was acquired by the Philadelphia Stock Exchange in 1949, becoming the Philadelphia-Baltimore Stock Exchange. The Baltimore Stock Exchange Building was sold and renamed the Totman Building.

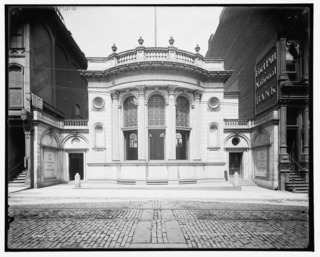

The San Francisco Stock and Bond Exchange was a regional stock exchange based in San Francisco, California, United States. Founded in 1882, in 1928 the exchange purchased and began using the name San Francisco Stock Exchange, while the old San Francisco Stock Exchange was renamed the San Francisco Mining Exchange. The San Francisco Curb Exchange was absorbed by the San Francisco Stock Exchange in 1938. In 1956 the San Francisco Stock Exchange merged with the Los Angeles Oil Exchange to create the Pacific Coast Stock Exchange.

Electrada Corporation, later Sargent Industries, was an American company headquartered in Los Angeles, California, that existed from 1959 to 1984 and operated in the aerospace industry among others. The original Electrada included a mixture of businesses and soon faltered financially; it is most remembered as the corporate birthplace of the ancestor of MARK IV, one of the first, and most successful, packaged software products in the computing industry. After an acquisition in 1966, the company remade itself as Sargent Industries, a maker of parts used for control in aerospace and industrial applications. In this form the company was profitable and eventually was bought in 1984, becoming a subsidiary through several more changes of ownership.

Intermountain Stock Exchange ("ISE") is a defunct stock exchange that formerly operated in Salt Lake City, Utah. Named the Salt Lake Stock and Mining Exchange from its 1888 founding until 1972, the company was acquired by Commodity Exchange, Inc. (COMEX) in 1986, ceased operating and became dormant.

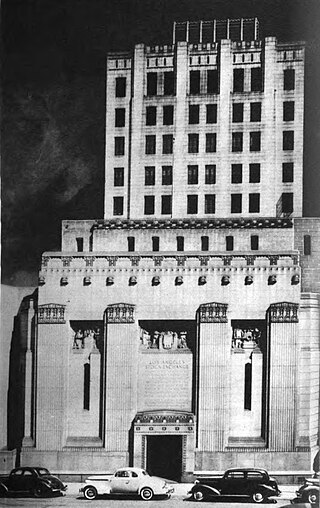

The Los Angeles Oil Exchange was a regional stock exchange in Los Angeles, California. Founded in 1899, in 1900 the name was changed to the Los Angeles Stock Exchange. In 1956, it merged into the Pacific Coast Stock Exchange.

The San Francisco Curb Exchange was a curb exchange opened in 1928, formed out of a re-organization of the San Francisco Stock and Bond Exchange and the San Francisco Mining Exchange. The San Francisco Curb Exchange replaced the Mining Exchange at the 350 Bush Street building. The Curb Exchange later left the building in 1938, when the Curb Exchange was absorbed by the San Francisco Stock Exchange.

The San Francisco Mining Exchange was a regional stock exchange in San Francisco. Formed in 1862 to facilitate the trading of mining stocks as the San Francisco Stock Exchange, the Chicago Tribune described the exchange as "once the West's most flamboyant financial institution." It sold the name San Francisco Stock Exchange to the San Francisco Stock and Bond Exchange in December 1927 and was renamed the San Francisco Mining Exchange. The exchange agreed to deal solely in mining securities as part of the same deal, and also sold its building at 350 Bush Street to the San Francisco Curb Exchange. After years of ups and downs in the mining market, the exchange had "a second life" during the uranium boom of the 1950s. By August 1967, it was located in second-floor offices on Montgomery Street, at which point it was the smallest securities market in the United States and had suffered "years of lingering legal and money ailments." The exchange closed at the age of 105 in August 1967.