Related Research Articles

Commerce is the large-scale organized system of activities, functions, procedures and institutions that directly or indirectly contribute to the smooth, unhindered distribution and transfer of goods and services on a substantial scale and at the right time, place, quantity, quality and price through various channels from the original producers to the final consumers within local, regional, national or international economies. The diversity in the distribution of natural resources, differences of human needs and wants, and division of labour along with comparative advantage are the principal factors that give rise to commercial exchanges.

Regulation is the management of complex systems according to a set of rules and trends. In systems theory, these types of rules exist in various fields of biology and society, but the term has slightly different meanings according to context. For example:

Race to the bottom is a socio-economic phrase to describe either government deregulation of the business environment or reduction in corporate tax rates, in order to attract or retain economic activity in their jurisdictions. While this phenomenon can happen between countries as a result of globalization and free trade, it also can occur within individual countries between their sub-jurisdictions. It may occur when competition increases between geographic areas over a particular sector of trade and production. The effect and intent of these actions is to lower labor rates, cost of business, or other factors over which governments can exert control.

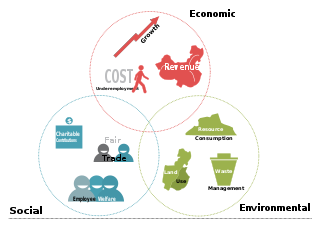

The triple bottom line is an accounting framework with three parts: social, environmental and economic. Some organizations have adopted the TBL framework to evaluate their performance in a broader perspective to create greater business value. Business writer John Elkington claims to have coined the phrase in 1994.

Corporate social responsibility (CSR) or corporate social impact is a form of international private business self-regulation which aims to contribute to societal goals of a philanthropic, activist, or charitable nature by engaging in, with, or supporting professional service volunteering through pro bono programs, community development, administering monetary grants to non-profit organizations for the public benefit, or to conduct ethically oriented business and investment practices. While once it was possible to describe CSR as an internal organizational policy or a corporate ethic strategy similar to what is now known today as Environmental, Social, Governance (ESG); that time has passed as various companies have pledged to go beyond that or have been mandated or incentivized by governments to have a better impact on the surrounding community. In addition, national and international standards, laws, and business models have been developed to facilitate and incentivize this phenomenon. Various organizations have used their authority to push it beyond individual or industry-wide initiatives. In contrast, it has been considered a form of corporate self-regulation for some time, over the last decade or so it has moved considerably from voluntary decisions at the level of individual organizations to mandatory schemes at regional, national, and international levels. Moreover, scholars and firms are using the term "creating shared value", an extension of corporate social responsibility, to explain ways of doing business in a socially responsible way while making profits.

The term "offshore company" or "offshore corporation" is used in at least two distinct and different ways. An offshore company may be a reference to:

Trade justice is a campaign by non-governmental organisations, plus efforts by other actors, to change the rules and practices of world trade in order to promote fairness. These organizations include consumer groups, trade unions, faith groups, aid agencies and environmental groups.

Florida Lime & Avocado Growers, Inc. v. Paul, 373 U.S. 132 (1963), was a 1963 decision of the United States Supreme Court in which the Court declined to invalidate a California law that imposed minimum fat content standards on avocados sold in the state, including those imported from other states. The law prohibited the sale of avocados that did not contain at least 8% oil by weight. Florida, a major avocado producer, employed, for wholesale marketing purposes, a federal standard unrelated to oil content. Most Florida avocados that were marketable at home failed to meet the California standard, because they were a different variety from those sold in California, with a lower fat content. Accordingly, Florida avocado growers brought this suit, arguing (unsuccessfully) that the California law (1) was preempted by federal law, (2) violated equal protection, and (3) unduly burdened and interfered with their right to engage in interstate commerce. The case is widely used in law school casebooks on constitutional law and federal jurisdiction as illustrative of preemption issues.

An ethical bank, also known as a social, alternative, civic, or sustainable bank, is a bank concerned with the social and environmental impacts of its investments and loans. The ethical banking movement includes: ethical investment, impact investment, socially responsible investment, corporate social responsibility, and is also related to such movements as the fair trade movement, ethical consumerism, and social enterprise.

Downward harmonization is an econo-political term describing the act of adapting the trade laws of a country with an established economy "downward" to the trade laws of the country with a developing economy. This "harmonizing" may affect labor laws, human rights laws, minimum-wage, industry standards, quality control, anti-terrorism, etc.

The Regulatory Flexibility Act (RFA) is perhaps the most comprehensive effort by the U.S. federal government to balance the social goals of federal regulations with the needs and capabilities of small businesses and other small entities in American society.

Trading Up: Consumer and Environmental Regulation in a Global Economy is a book by UC Berkeley political scientist and business professor, David Vogel. It examines the impact of free trade on environmental regulations. It analyzes the General Agreement on Tariffs and Trade (GATT), North American Free Trade Agreement (NAFTA), the Canada-United States Free Trade Agreement, and the treaties that created the European Community and Union, and looks at cases including the GATT tuna-dolphin dispute, the EC's beef hormone ban, the Danish bottle case.

Waste management laws govern the transport, treatment, storage, and disposal of all manner of waste, including municipal solid waste, hazardous waste, and nuclear waste, among many other types. Waste laws are generally designed to minimize or eliminate the uncontrolled dispersal of waste materials into the environment in a manner that may cause ecological or biological harm, and include laws designed to reduce the generation of waste and promote or mandate waste recycling. Regulatory efforts include identifying and categorizing waste types and mandating transport, treatment, storage, and disposal practices.

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

Regulatory competition, also called competitive governance or policy competition, is a phenomenon in law, economics and politics concerning the desire of lawmakers to compete with one another in the kinds of law offered in order to attract businesses or other actors to operate in their jurisdiction. Regulatory competition depends upon the ability of actors such as companies, workers or other kinds of people to move between two or more separate legal systems. Once this is possible, then the temptation arises for the people running those different legal systems to compete to offer better terms than their "competitors" to attract investment. Historically, regulatory competition has operated within countries having federal systems of regulation - particularly the United States, but since the mid-20th century and the intensification of economic globalisation, regulatory competition became an important issue internationally.

Economic globalization is one of the three main dimensions of globalization commonly found in academic literature, with the two others being political globalization and cultural globalization, as well as the general term of globalization. Economic globalization refers to the widespread international movement of goods, capital, services, technology and information. It is the increasing economic integration and interdependence of national, regional, and local economies across the world through an intensification of cross-border movement of goods, services, technologies and capital. Economic globalization primarily comprises the globalization of production, finance, markets, technology, organizational regimes, institutions, corporations, and people.

The pollution haven hypothesis posits that, when large industrialized nations seek to set up factories or offices abroad, they will often look for the cheapest option in terms of resources and labor that offers the land and material access they require. However, this often comes at the cost of environmentally unsound practices. Developing nations with cheap resources and labor tend to have less stringent environmental regulations, and conversely, nations with stricter environmental regulations become more expensive for companies as a result of the costs associated with meeting these standards. Thus, companies that choose to physically invest in foreign countries tend to (re)locate to the countries with the lowest environmental standards or weakest enforcement.

The Ozone Transport Commission (OTC) is a multi-state organization founded in 1991 and created under the Clean Air Act. It is responsible for advising EPA on air pollution transport issues and for developing and implementing regional solutions to the ground-level ozone problem in the Northeast and Mid-Atlantic regions, collectively called the Ozone Transport Region (OTR). OTC has no regulatory authority, but assists its members in developing model regulations for implementation at the state level. OTC also manages a regional planning organization MANE-VU, which is charged with regional multi-pollutant air quality planning. In January 2020, operations of OTC were placed under new management by the Northeast States for Coordinated Air Use Management (NESCAUM) and Washington, DC operations were closed.

The Brussels effect is the process of unilateral regulatory globalisation caused by the European Union de facto externalising its laws outside its borders through market mechanisms. Through the Brussels effect, regulated entities, especially corporations, end up complying with EU laws even outside the EU for a variety of reasons.

The global minimum corporate tax rate, or simply the global minimum tax, is a minimum rate of tax on corporate income internationally agreed upon and accepted by individual jurisdictions in the OECD/G20 Inclusive Framework. Each country would be eligible for a share of revenue generated by the tax. The aim is to reduce tax competition between countries and discourage multinational corporations (MNC) from profit shifting that avoids taxes.

References

- ↑ Vogel, David (1995). Trading Up: Consumer and Environmental regulation in a global economy . Harvard University Press. ISBN 9780674900837.

- ↑ A Haas Book Review, Trading Up: Consumer and Environmental Regulation in a Global Economy, http://www.haas.berkeley.edu/groups/pubs/books/vogel/Trading_Up.html

- ↑ Perkins, Richard; Neumayer, Eric (2012). "Does the 'California effect' operate across borders? Trading- and investing-up in automobile emission standards" (PDF). Journal of European Public Policy. 19 (2): 217–237. doi:10.1080/13501763.2011.609725.