Myron Samuel Scholes is a Canadian-American financial economist. Scholes is the Frank E. Buck Professor of Finance, Emeritus, at the Stanford Graduate School of Business, Nobel Laureate in Economic Sciences, and co-originator of the Black–Scholes options pricing model. Scholes is currently the chairman of the Board of Economic Advisers of Stamos Capital Partners. Previously he served as the chairman of Platinum Grove Asset Management and on the Dimensional Fund Advisors board of directors, American Century Mutual Fund board of directors and the Cutwater Advisory Board. He was a principal and limited partner at Long-Term Capital Management and a managing director at Salomon Brothers. Other positions Scholes held include the Edward Eagle Brown Professor of Finance at the University of Chicago, senior research fellow at the Hoover Institution, director of the Center for Research in Security Prices, and professor of finance at MIT's Sloan School of Management. Scholes earned his PhD at the University of Chicago.

In finance, a haircut is the difference between the current market value of an asset and the value ascribed to that asset for purposes of calculating regulatory capital or loan collateral. The amount of the haircut reflects the perceived risk of the asset falling in value in an immediate cash sale or liquidation. The larger the risk or volatility of the asset price, the larger the haircut.

WPP plc is a British multinational communications, advertising, public relations, technology, and commerce holding company headquartered in London, England. It is considered the world's largest advertising company, as of 2019. WPP plc owns many companies, which includes advertising, public relations, media, and market research networks such as AKQA, BCW, Essence Global, Finsbury, Grey, GroupM, Hill+Knowlton Strategies, Kantar Group, Mindshare, Ogilvy, Wavemaker, Wunderman Thompson, and VMLY&R. It is one of the "Big Four" agency companies, alongside Publicis, Interpublic Group of Companies and Omnicom. WPP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has a secondary listing on the New York Stock Exchange.

The Blackstone Group Inc. is an American private equity alternative investment management firm. As the largest alternative investment firm in the world, Blackstone specializes in private equity, credit, and hedge fund investment strategies.

Bain Capital is an American private investment firm based in Boston, Massachusetts. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, and real estate. Bain Capital invests across a range of industry sectors and geographic regions. As of 2018, the firm managed more than $105 billion of investor capital.

Apax Partners LLP is a British private equity firm, headquartered in London, England. The company also operates out of six other offices in New York, Hong Kong, Mumbai, Tel Aviv, Munich and Shanghai. As of December 2017, the firm, including its various predecessors, have raised approximately $51 billion (USD) since 1981. Apax Partners is one of the oldest and largest private equity firms operating on an international basis, ranked the fourteenth largest private equity firm globally.

Oaktree Capital Management is an American global asset management firm specializing in alternative investment strategies. It is the largest distressed securities investor in the world and is one of the largest credit investors in the world.

Roger Bootle is a British economist and a weekly columnist for The Daily Telegraph. He is the chairman of Capital Economics, an independent macroeconomic research consultancy. He and Capital Economics were awarded the Wolfson Economics Prize in 2012.

Legatum Limited, also known as Legatum, is a private investment firm, headquartered in Dubai, United Arab Emirates. Legatum is a partnership that uses its own funds to invest globally. The firm also invests in activities to promote entrepreneurship and free enterprise as well as anti-slavery, health and education initiatives.

The Canada Pension Plan Investment Board, operating as CPP Investments, is a Canadian Crown corporation established by way of the 1997 Canada Pension Plan Investment Board Act to oversee and invest the funds contributed to and held by the Canada Pension Plan (CPP).

Gerson Lehrman Group (GLG) is a New York-based company that offers professional education services. The firm connects its clients with consultants with topical or industry expertise in a variety of fields, as well as executive education, larger team training, and the placement of experts in long-term advisory, operational, and board roles. GLG has a network of over 800,000 consultants

Guggenheim Partners is a global investment and advisory financial services firm that engages in investment banking, asset management, capital markets services, and insurance services. The firm is headquartered in New York City and Chicago with 2,400 staff located in 17 cities throughout the United States, Europe, and Asia. It has more than $275 billion of assets under management. The firm's CEO is Mark Walter. It has six Managing Partners who are key executives, and with a Senior Leadership Team of 13 other executives, oversee the Firm's businesses. The four original founders include Peter Lawson-Johnston II, Solomon R. Guggenheim's great-grandson, J. Todd Morley, Mark R. Walter, and Dominic J. Curcio.

Vasiliki "Vicky" Pryce is a Greek-born British economist, and former Joint Head of the United Kingdom's Government Economic Service. On 7 March 2013, Pryce and her former husband, Chris Huhne, were convicted of perverting the course of justice and sentenced to eight months in prison. After Huhne pleaded guilty, they both served nine weeks in prison.

Roger Allan Jenkins is a British financier who was acquitted on 28 February 2020 by a jury at the Old Bailey, after an investigation for financial fraud that started in 2012, and was subsequently exonerated by the FCA, the banking regulator.

AlixPartners sometimes referred to as Alix Partners is an American consulting firm best known for its work in the turnaround space. Jay Alix founded what became AlixPartners LLP in 1981. The firm has advised on some of the largest Chapter 11 reorganizations including General Motors Co., Kmart, and Enron Corp. The firm has since moved into a more traditional consulting space, grown to a staff of over 1000. AlixPartners is headquartered in New York, and has offices in more than 20 cities around the world.

A Greek withdrawal from the eurozone was a hypothetical scenario under which Greece would withdraw from the Eurozone to deal with the now expired Greek government-debt crisis. This conjecture has been referred to as "Grexit", a portmanteau combining the English words "Greek" and "exit", and which has been expressed in Greek as ελλέξοδος,. The term "Graccident" was coined for the case that Greece exited the EU and the euro unintentionally. These terms first came into use in 2012 and have been revitalised at each of the bailouts made available to Greece since then.

The Wolfson Economics Prize is a £250,000 economics prize, the second largest economics prize in the world after Nobel, which is sponsored by Simon, Lord Wolfson, CEO of retailer Next plc and run in partnership with the think tank Policy Exchange. The Prize invites new thinking to address major economic policy issues that aren't already subject to significant public discourse. The Prize has run in 2012, 2014 and 2017.

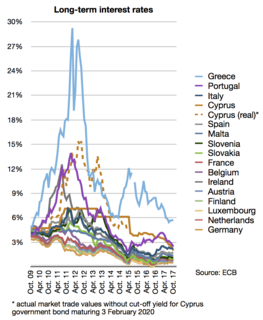

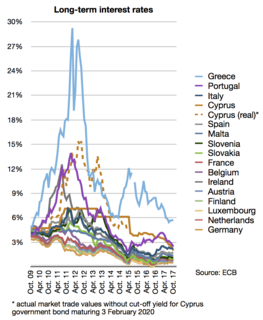

The European debt crisis is an ongoing financial crisis that has made it difficult or impossible for some countries in the euro area to repay or re-finance their government debt without the assistance of third parties.

Pantheon Macroeconomics is an economic research consultancy founded by Wall Street Journal Economic Survey 2014 US forecaster of the year, Ian Shepherdson. The firm is located in Newcastle upon Tyne, England.

Withdrawal from the Eurozone denotes the process whereby a Eurozone member-state, whether voluntarily or forcibly, stops using the euro as its national currency and leaves the Eurozone. As of August 2020, no country has withdrawn from the Eurozone.