Related Research Articles

In economics and finance, arbitrage is the practice of taking advantage of a difference in prices in two or more markets – striking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive.

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money.

The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money. It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications.

Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk.

In economics and finance, present value (PV), also known as present discounted value(PDV), is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has interest-earning potential, a characteristic referred to as the time value of money, except during times of negative interest rates, when the present value will be equal or more than the future value. Time value can be described with the simplified phrase, "A dollar today is worth more than a dollar tomorrow". Here, 'worth more' means that its value is greater than tomorrow. A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day's worth of interest, making the total accumulate to a value more than a dollar by tomorrow. Interest can be compared to rent. Just as rent is paid to a landlord by a tenant without the ownership of the asset being transferred, interest is paid to a lender by a borrower who gains access to the money for a time before paying it back. By letting the borrower have access to the money, the lender has sacrificed the exchange value of this money, and is compensated for it in the form of interest. The initial amount of borrowed funds is less than the total amount of money paid to the lender.

In mathematics, a negative number is the opposite of a positive real number. Equivalently, a negative number is a real number that is less than zero. Negative numbers are often used to represent the magnitude of a loss or deficiency. A debt that is owed may be thought of as a negative asset. If a quantity, such as the charge on an electron, may have either of two opposite senses, then one may choose to distinguish between those senses—perhaps arbitrarily—as positive and negative. Negative numbers are used to describe values on a scale that goes below zero, such as the Celsius and Fahrenheit scales for temperature. The laws of arithmetic for negative numbers ensure that the common-sense idea of an opposite is reflected in arithmetic. For example, −(−3) = 3 because the opposite of an opposite is the original value.

Terius Gray, better known by his stage name Juvenile, is an American rapper best known for his work with Birdman's Cash Money Records in the late 1990s and early 2000s, both solo and as a member of the label's then-flagship group, Hot Boys.

This page is an index of accounting topics.

In finance, a forward contract, or simply a forward, is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract, making it a type of derivative instrument. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.

Financial accounting is a branch of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. This involves the preparation of financial statements available for public use. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes.

In financial accounting, free cash flow (FCF) or free cash flow to firm (FCFF) is the amount by which a business's operating cash flow exceeds its working capital needs and expenditures on fixed assets. It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its operations. As such, it is an indicator of a company's financial flexibility and is of interest to holders of the company's equity, debt, preferred stock and convertible securities, as well as potential lenders and investors.

Liquidity risk is a financial risk that for a certain period of time a given financial asset, security or commodity cannot be traded quickly enough in the market without impacting the market price.

In finance, a foreign exchange option is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. See Foreign exchange derivative.

Capital budgeting in corporate finance, corporate planning and accounting is an area of capital management that concerns the planning process used to determine whether an organization's long term capital investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm's capitalization structures. It is the process of allocating resources for major capital, or investment, expenditures. An underlying goal, consistent with the overall approach in corporate finance, is to increase the value of the firm to the shareholders.

In mathematics, the sign of a real number is its property of being either positive, negative, or 0. Depending on local conventions, zero may be considered as having its own unique sign, having no sign, or having both positive and negative sign. In some contexts, it makes sense to distinguish between a positive and a negative zero.

Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment, or to reach the break-even point.

Foreign relations between Cyprus and the United Kingdom are positive. Cyprus gained its independence from the United Kingdom in 1960, after 82 years of British control; the two countries now enjoy warm relations, though the continuing British sovereignty of Akrotiri and Dhekelia in Cyprus continues to divide Cypriots. The countries are both members of the United Nations and Commonwealth of Nations.

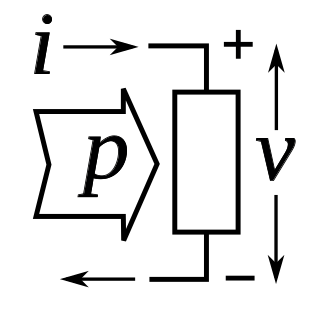

In electrical engineering, the passive sign convention (PSC) is a sign convention or arbitrary standard rule adopted universally by the electrical engineering community for defining the sign of electric power in an electric circuit. The convention defines electric power flowing out of the circuit into an electrical component as positive, and power flowing into the circuit out of a component as negative. So a passive component which consumes power, such as an appliance or light bulb, will have positive power dissipation, while an active component, a source of power such as an electric generator or battery, will have negative power dissipation. This is the standard definition of power in electric circuits; it is used for example in computer circuit simulation programs such as SPICE.

References

- ↑ Koster, Lisa. "Cash Flow Sign Convention – Using signs (negatives) in Formulas".

{{cite journal}}: Cite journal requires|journal=(help)