Related Research Articles

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person, organization or corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process.

A cash register, sometimes called a till or automated money handling system, is a mechanical or electronic device for registering and calculating transactions at a point of sale. It is usually attached to a drawer for storing cash and other valuables. A modern cash register is usually attached to a printer that can print out receipts for record-keeping purposes.

This page is an index of accounting topics.

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer, and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt, as proof of transaction, which is usually printed but can also be dispensed with or sent electronically.

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, revenue is a subsection of the equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.

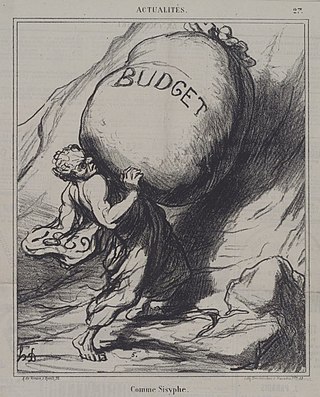

A budget is a calculation plan, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms.

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 is the International Accounting Standard that deals with cash flow statements.

A receipt is a document acknowledging that a person has received money or property in payment following a sale or other transfer of goods or provision of a service. All receipts must have the date of purchase on them. If the recipient of the payment is legally required to collect sales tax or VAT from the customer, the amount would be added to the receipt, and the collection would be deemed to have been on behalf of the relevant tax authority. In many countries, a retailer is required to include the sales tax or VAT in the displayed price of goods sold, from which the tax amount would be calculated at the point of sale and remitted to the tax authorities in due course. Similarly, amounts may be deducted from amounts payable, as in the case of taxes withheld from wages. On the other hand, tips or other gratuities that are given by a customer, for example in a restaurant, would not form part of the payment amount or appear on the receipt.

In business practice, cash account refers to a business-to-business or business-to-consumer account which is conducted on an immediate payment basis i.e. no credit is offered. It may also refer to an account held with a financial firm, in which a client deposits cash to buy stocks, bonds and other securities.

A general journal is a daybook or subsidiary journal in which transactions relating to adjustment entries, opening stock, depreciation, accounting errors etc. are recorded. The source documents for general journal entries may be journal vouchers, copies of management reports and invoices. Journals are prime entry books, and may also be referred to as books of original entry, from when transactions were written in a journal before they were manually posted to accounts in the general ledger or a subsidiary ledger.

The imprest system is a form of financial accounting. The most common is petty cash. The basic characteristic of an imprest system is that a fixed amount is reserved, which after a certain period or when circumstances require, because money was spent, will be replenished. This replenishment will come from another account, e.g. petty cash may be replenished by cashing a cheque drawn on a bank account or using an ATM.

Single-entry bookkeeping, also known as, single-entry accounting, is a method of bookkeeping that relies on a one-sided accounting entry to maintain financial information. The primary bookkeeping record in single-entry bookkeeping is the cash book, which is similar to a checking account register, except all entries are allocated among several categories of income and expense accounts. Separate account records are maintained for petty cash, accounts payable and receivable, and other relevant transactions such as inventory and travel expenses. To save time and avoid the errors of manual calculations, single-entry bookkeeping can be done today with do-it-yourself bookkeeping software.

A journal entry is the act of keeping or making records of any transactions either economic or non-economic.

A suspense account is an account used temporarily to carry doubtful entries and discrepancies pending their analysis and permanent classification.

Cash flow forecasting is the process of obtaining an estimate of a company's future cash levels, and its financial position more generally. A cash flow forecast is a key financial management tool, both for large corporates, and for smaller entrepreneurial businesses. The forecast is typically based on anticipated payments and receivables. Several forecasting methodologies are available.

Special journals are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases. For example, when a company purchases merchandise from a vendor, and then in turn sells the merchandise to a customer, the purchase is recorded in one journal and the sale is recorded in another.

A sales journal is a specialized accounting journal and it is also a prime entry book used in an accounting system to keep track of the sales of items that customers(debtors) have purchased on account by charging a receivable on the debit side of an accounts receivable account and crediting revenue on the credit side. It differs from the cash receipts journal in that the latter will serve to book sales when cash is received. The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales. Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal.

The history of accounting or accountancy can be traced to ancient civilizations.

References

- ↑ Jerry J. Weygandt; Paul D. Kimmel; Donald E. Kieso (5 January 2010). Accounting Principles. John Wiley and Sons. p. 608. ISBN 978-0-470-57725-7 . Retrieved 3 April 2012.