In the United States, Medicaid is a government program that provides health insurance for adults and children with limited income and resources. The program is partially funded and primarily managed by state governments, which also have wide latitude in determining eligibility and benefits, but the federal government sets baseline standards for state Medicaid programs and provides a significant portion of their funding.

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with end stage renal disease and amyotrophic lateral sclerosis. It was begun in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS).

The healthcare industry is an aggregation and integration of sectors within the economic system that provides goods and services to treat patients with curative, preventive, rehabilitative, and palliative care. It encompasses the creation and commercialization of products and services conducive to the preservation and restoration of well-being. The contemporary healthcare sector comprises three fundamental facets, namely services, products, and finance. It can be further subdivided into numerous sectors and categories and relies on interdisciplinary teams of highly skilled professionals and paraprofessionals to address the healthcare requirements of both individuals and communities.

Prescription drug list prices in the United States continually are among the highest in the world. The high cost of prescription drugs became a major topic of discussion in the 21st century, leading up to the American health care reform debate of 2009, and received renewed attention in 2015. One major reason for high prescription drug prices in the United States relative to other countries is the inability of government-granted monopolies in the American health care sector to use their bargaining power to negotiate lower prices, and the American payer ends up subsidizing the world's R&D spending on drugs.

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. Under the program, drug benefits are provided by private insurance plans that receive premiums from both enrollees and the government. Part D plans typically pay most of the cost for prescriptions filled by their enrollees. However, plans are later reimbursed for much of this cost through rebates paid by manufacturers and pharmacies.

Long-term care (LTC) is a variety of services which help meet both the medical and non-medical needs of people with a chronic illness or disability who cannot care for themselves for long periods. Long-term care is focused on individualized and coordinated services that promote independence, maximize patients' quality of life, and meet patients' needs over a period of time.

Health care prices in the United States of America describe market and non-market factors that determine pricing, along with possible causes as to why prices are higher than in other countries.

An out-of-pocket expense, or out-of-pocket cost (OOP), is the direct payment of money that may or may not be later reimbursed from a third-party source. For example, when operating a vehicle, gasoline, parking fees and tolls are considered out-of-pocket expenses for a trip. Car insurance, oil changes, and interest are not, since the outlay of cash covers expenses accrued over a longer period of time. The services rendered and other in-kind expenses are not considered out-of-pocket expenses; the same goes for depreciation of capital goods or depletion.

The Medicare for All Act, also known as the Expanded and Improved Medicare for All Act or United States National Health Care Act, is a bill first introduced in the United States House of Representatives by Representative John Conyers (D-MI) in 2003, with 38 co-sponsors. In 2019, the original 16-year-old proposal was renumbered, and Pramila Jayapal (D-WA) introduced a broadly similar, but more detailed, bill, HR 1384, in the 116th Congress. As of November 3, 2019, it had 116 co-sponsors still in the House at the time, or 49.8% of House Democrats.

The United States federal budget is divided into three categories: mandatory spending, discretionary spending, and interest on debt. Also known as entitlement spending, in US fiscal policy, mandatory spending is government spending on certain programs that are required by law. Congress established mandatory programs under authorization laws. Congress legislates spending for mandatory programs outside of the annual appropriations bill process. Congress can only reduce the funding for programs by changing the authorization law itself. This normally requires a 60-vote majority in the Senate to pass. Discretionary spending on the other hand will not occur unless Congress acts each year to provide the funding through an appropriations bill.

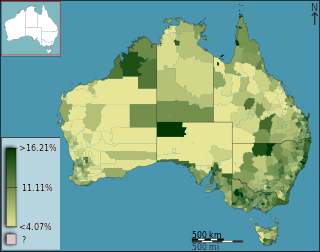

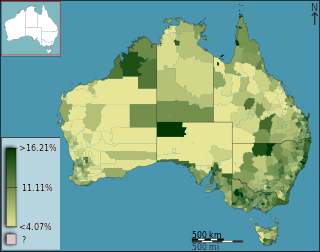

Health care in Australia operates under a shared public-private model underpinned by the Medicare system, the national single-payer funding model. State and territory governments operate public health facilities where eligible patients receive care free of charge. Primary health services, such as GP clinics, are privately owned in most situations, but attract Medicare rebates. Australian citizens, permanent residents, and some visitors and visa holders are eligible for health services under the Medicare system. Individuals are encouraged through tax surcharges to purchase health insurance to cover services offered in the private sector, and further fund health care.

In the United States, health insurance helps pay for medical expenses through privately purchased insurance, social insurance, or a social welfare program funded by the government. Synonyms for this usage include "health coverage", "health care coverage", and "health benefits". In a more technical sense, the term "health insurance" is used to describe any form of insurance providing protection against the costs of medical services. This usage includes both private insurance programs and social insurance programs such as Medicare, which pools resources and spreads the financial risk associated with major medical expenses across the entire population to protect everyone, as well as social welfare programs like Medicaid and the Children's Health Insurance Program, which both provide assistance to people who cannot afford health coverage.

Healthcare reform in the United States has a long history. Reforms have often been proposed but have rarely been accomplished. In 2010, landmark reform was passed through two federal statutes: the Patient Protection and Affordable Care Act (PPACA), signed March 23, 2010, and the Health Care and Education Reconciliation Act of 2010, which amended the PPACA and became law on March 30, 2010.

The United States spends approximately $2.3 trillion on federal and state social programs including cash assistance, health insurance, food assistance, housing subsidies, energy and utilities subsidies, and education and childcare assistance. Similar benefits are sometimes provided by the private sector either through policy mandates or on a voluntary basis. Employer-sponsored health insurance is an example of this.

The American Hospital Association (AHA) is a health care industry trade group. It includes nearly 5,000 hospitals and health care providers.

The healthcare reform debate in the United States has been a political issue focusing upon increasing medical coverage, decreasing costs, insurance reform, and the philosophy of its provision, funding, and government involvement.

The Alberta Health Insurance Act was an act passed by the Alberta Legislature in February 1935. It was the first Canadian health insurance act to provide some public funding for medical services, and as such is considered to be an early step toward the provision of medicare in Canada.

There were a number of different health care reforms proposed during the Obama administration. Key reforms address cost and coverage and include obesity, prevention and treatment of chronic conditions, defensive medicine or tort reform, incentives that reward more care instead of better care, redundant payment systems, tax policy, rationing, a shortage of doctors and nurses, intervention vs. hospice, fraud, and use of imaging technology, among others.

Healthcare in the United States is largely provided by private sector healthcare facilities, and paid for by a combination of public programs, private insurance, and out-of-pocket payments. The U.S. is the only developed country without a system of universal healthcare, and a significant proportion of its population lacks health insurance. The United States spends more on healthcare than any other country, both in absolute terms and as a percentage of GDP; however, this expenditure does not necessarily translate into better overall health outcomes compared to other developed nations. Coverage varies widely across the population, with certain groups, such as the elderly and low-income individuals, receiving more comprehensive care through government programs such as Medicaid and Medicare.

Health care finance in the United States discusses how Americans obtain and pay for their healthcare, and why U.S. healthcare costs are the highest in the world based on various measures.