The Big Four are the four largest professional services networks in the world, the global accounting networks Deloitte, Ernst & Young (EY), KPMG, and PricewaterhouseCoopers (PwC). The four are often grouped because they are comparable in size relative to the rest of the market, both in terms of revenue and workforce; they are considered equal in their ability to provide a wide scope of professional services to their clients; and, among those looking to start a career in professional services, particularly accounting, they are considered equally attractive networks to work in, because of the frequency with which these firms engage with Fortune 500 companies.

The Bank of Credit and Commerce International (BCCI) was an international bank founded in 1972 by Agha Hasan Abedi, a Pakistani financier. The bank was registered in Luxembourg with head offices in Karachi and London. A decade after opening, BCCI had over 400 branches in 78 countries and assets in excess of US$20 billion, making it the seventh largest private bank in the world.

KPMG International Limited is a multinational professional services network, and one of the Big Four accounting organizations.

Financial statements are formal records of the financial activities and position of a business, person, or other entity.

Deloitte Touche Tohmatsu Limited, commonly referred to as Deloitte, is an international professional services network headquartered in London, England. Deloitte is the largest professional services network by revenue and number of professionals in the world and is considered one of the Big Four accounting firms along with EY, KPMG and PricewaterhouseCoopers (PWC).

Reliance Capital Limited is an Indian diversified financial services holding company promoted by Reliance Anil Dhirubhai Ambani Group. Reliance Capital, a constituent of Nifty Midcap 50 and MSCI Global Small Cap Index, is a part of the Reliance Group. It is amongst India's leading and most valuable financial services companies in the private sector. As on 31 March 2017, the net worth of the company stood at Rs 16,548 crore, while its total assets as on the date stood at Rs 82,209 crore. In Fortune India 500 list of 2018, Reliance Capital was ranked as the 77th largest corporation in India with 5th rank in 'Non-Banking Finance' category.

A going concern is a business that is assumed will meet its financial obligations when they become due. It functions without the threat of liquidation for the foreseeable future, which is usually regarded as at least the next 12 months or the specified accounting period. The presumption of going concern for the business implies the basic declaration of intention to keep operating its activities at least for the next year, which is a basic assumption for preparing financial statements that comprehend the conceptual framework of the IFRS. Hence, a declaration of going concern means that the business has neither the intention nor the need to liquidate or to materially curtail the scale of its operations.

Cash Converters International Limited is an Australian ASX-listed personal finance and secondhand retail company headquartered in Perth, Western Australia.

First Bank of Nigeria Limited is a Nigerian multinational bank and financial services company in Lagos, Nigeria. It is the premier bank in West Africa. The First Bank of Nigeria Limited operates as a parent company, with the subsidiaries 'FBN Bank' in the Republic of Congo, Ghana, The Gambia, Guinea, Sierra-Leone and Senegal; FBN Bank UK Limited in the United Kingdom with a branch in Paris; First Bank Representative Office in Beijing to capture trade-related business between geographies. First Bank also operates First Pension Custodian Nigeria Limited, Nigeria's foremost pension custodian. The teeming customers of the First Bank Group are serviced from a network of over 700 business locations across Africa. To promote financial inclusion and reach the unbanked, First Bank has an extensive Agent Banking network, with over 53,000 locations across Nigeria. The Bank specializes in retail banking and has the largest client base in West Africa, with over 18 million customers. For eight consecutive years First Bank Nigeria received the Best Retail Bank in Nigeria award by The Asian Banker.

Grant Thornton is the world's sixth-largest by revenue and sixth-largest by number of employees professional services network of independent accounting and consulting member firms which provide assurance, tax and advisory services to privately held businesses, public interest entities, and public sector entities. Grant Thornton International Ltd. is a not-for-profit, non-practising, international umbrella membership entity organised as a private company limited by guarantee. Grant Thornton International Ltd. is incorporated in London, England, and has no share capital.

First City Monument Bank (FCMB), a member of FCMB Group Plc, is a financial services holding company headquartered in Lagos. FCMB Group Plc has nine subsidiaries divided among three business groups: commercial and retail banking, investment banking, and asset and wealth management. As of December 2020, the Group's total assets were valued at US $5 billion.

In 2003, multinational Italian dairy and food corporation Parmalat collapsed with a €14 billion hole in its accounts, in what remains Europe's biggest bankruptcy. The Parmalat bankruptcy greatly affected football team AC Parma, in which Parmalat was the major shareholder.

The Financial Supervisory Service (FSS) is South Korea's integrated financial regulator that examines and supervises financial institutions under the broad oversight of the Financial Services Commission (FSC), the government regulatory authority staffed by civil servants.

Modelzone is a scale model brand owned by British retailer WHSmith, under which scale models and related products are sold in selected WHSmith stores and online.

Vantis plc was an accountancy firm based in London, England, providing accounting, tax and business advice to owner-managed businesses, listed companies, not for profit organisations, high-net-worth individuals and other professionals. It was placed in administration on 29 June 2010 and promptly broken up, with the various offices and businesses being sold as going concerns.

The 2009 General Motors Chapter 11 sale of the assets of automobile manufacturer General Motors and some of its subsidiaries was implemented through Chapter 11, Title 11, United States Code in the United States bankruptcy court for the Southern District of New York. The United States government-endorsed sale enabled the NGMCO Inc. to purchase the continuing operational assets of the old GM. Normal operations, including employee compensation, warranties, and other customer services were uninterrupted during the bankruptcy proceedings. Operations outside of the United States were not included in the court filing.

FRP Advisory is a business advisory firm based in the United Kingdom, providing restructuring, corporate finance, debt advisory, forensic accounting and pensions services and is one of the UK’s largest specialists in the area of corporate restructuring.

Auto Windscreens is a United Kingdom automotive glazing company specialising in windscreen repair and replacement. It is owned by Auto Windscreesn Services Limited, and is headquartered in Chesterfield, Derbyshire. Working predominantly with insurers, brokers and fleet management customers, the company operates a nationwide fitting centre network that utilises a mobile fleet of trained technicians.

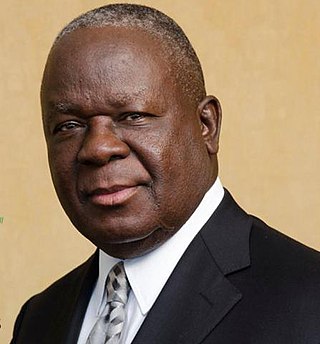

Samuel Kisakye Sejjaaka is a Ugandan accountant, academic and businessman. He is Principal and Country Team Leader at MAT ABACUS Business School. Between 1993 and 2014, he lectured at Uganda's oldest tertiary institution, Makerere University and rose to the position of Deputy Principal. In December 2014, he retired from the institution at age 50. He then helped establish Abacus Business School, Uganda's premier executive education institution. In 2019, Abacus Business school merged with the Management Accountancy Training Company (MAT) to form MAT ABACUS Business School.

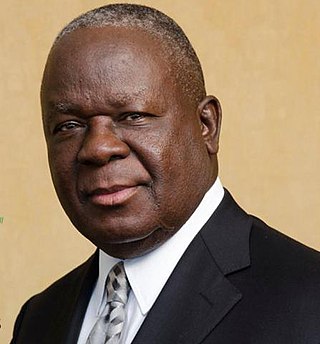

Felix Mlusu is a Malawian corporate executive and financier who served as the 22nd Minister of Finance in the Government of the Republic of Malawi from 2020 to 2022. Prior to his role in the Treasury he was Managing Director and Group Chief Executive Officer of NICO Holdings from 1994 until his retirement on 31st December 2016.