In economics, hot money is the flow of funds from one country to another in order to earn a short-term profit on interest rate differences and/or anticipated exchange rate shifts. These speculative capital flows are called "hot money" because they can move very quickly in and out of markets, potentially leading to market instability.

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges, whereas mutual funds are bought and sold from the issuer based on their price at day's end.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

In macroeconomics and international finance, the capital account, also known as the capital and financial account records the net flow of investment transaction into an economy. It is one of the two primary components of the balance of payments, the other being the current account. Whereas the current account reflects a nation's net income, the capital account reflects net change in ownership of national assets.

Zhou Xiaochuan is a Chinese economist. Zhou served as the Governor of the People's Bank of China from 2002 to 2018.

PIMCO is an American investment management firm focusing on active fixed income management worldwide. PIMCO manages investments in many asset classes such as fixed income, equities, commodities, asset allocation, ETFs, hedge funds, and private equity. PIMCO is one of the largest investment managers, actively managing more than $2 trillion in assets for central banks, sovereign wealth funds, pension funds, corporations, foundations and endowments, and individual investors around the world. PIMCO’s headquarters are in Newport Beach, California; the firm has over 3,100 employees working in 22 offices throughout the Americas, Europe, and Asia.

GIC Private Limited is a Singaporean sovereign wealth fund that manages the country's foreign reserves. Established by the Government of Singapore in 1981 as the Government of Singapore Investment Corporation, of which "GIC" is derived from as an acronym, its mission is to preserve and enhance the international purchasing power of the reserves, with the aim to achieve good long-term returns above global inflation over the investment time horizon of 20 years.

The bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the financial crisis of 2007-2008. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets.

The State Administration of Foreign Exchange (SAFE) of the People's Republic of China is an administrative agency under the State Council tasked with drafting rules and regulations governing foreign exchange market activities, and managing the state foreign-exchange reserves, which at the end of December 2016 stood at $3.01 trillion for the People's Bank of China. The current director is Pan Gongsheng.

The foreign exchange reserves of China are the state of foreign exchange reserves held by the People's Republic of China, comprising cash, bank deposits, bonds, and other financial assets denominated in currencies other than China's national currency. In December 2022, China's foreign exchange reserves totaled US$3.12 trillion, which is the highest foreign exchange reserves of any country.

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

China Investment Corporation is a sovereign wealth fund that manages part of the People's Republic of China's foreign exchange reserves. China's largest sovereign wealth fund, CIC was established in 2007 with about US$200 billion of assets under management, a number that grew to US$941 billion in 2017 and US$1.2 trillion in 2021.

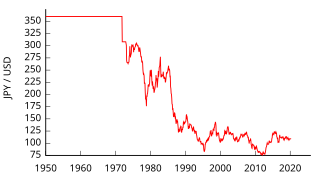

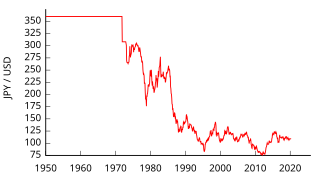

Endaka or Endaka Fukyo is a state in which the value of the Japanese yen is high compared to other currencies. Since the economy of Japan is highly dependent on exports, this can cause Japan to fall into an economic recession.

Currency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

Hong Ki-myung, also known as Kim Hong, is a South Korean financier.

The Moscow Exchange is the largest exchange in Russia, operating trading markets in equities, bonds, derivatives, the foreign exchange market, money markets, and precious metals. The Moscow Exchange also operates Russia's central securities depository, the National Settlement Depository (NSD), and the country's largest clearing service provider, the National Clearing Centre. The exchange was formed in 2011 in a merger of the Moscow Interbank Currency Exchange and the Russian Trading System.

Since the late-2000s, the People's Republic of China (PRC) has sought to internationalize its official currency, the Renminbi (RMB). RMB internationalization accelerated in 2009 when China established the dim sum bond market and expanded Cross-Border Trade RMB Settlement Pilot Project, which helps establish pools of offshore RMB liquidity. The RMB was the 8th-most-traded currency in the world in 2013 and the 7th-most-traded in early 2014. By the end of 2014, RMB ranked 5th as the most traded currency, according to SWIFT's report, at 2.2% of SWIFT payment behind JPY (2.7%), GBP (7.9%), EUR (28.3%) and USD (44.6%). In February 2015, RMB became the second most used currency for trade and services, and reached the ninth position in forex trading. The RMB Qualified Foreign Institutional Investor (RQFII) quotas were also extended to five other countries — the UK, Singapore, France, Korea, Germany, and Canada, each with the quotas of ¥80 billion except Canada and Singapore (¥50bn). Previously, only Hong Kong was allowed, with a ¥270 billion quota.

India has large foreign-exchange reserves; holdings of cash, bank deposits, bonds, and other financial assets denominated in currencies other than India's national currency, the Indian rupee. The reserves are managed by the Reserve Bank of India for the Indian government and the main component is foreign currency assets.

The Exchange Fund of Hong Kong is the primary investment arm and de facto sovereign wealth fund of the Hong Kong Monetary Authority. First established in 1935 in order to provide backing to the issuance of Hong Kong dollar banknotes, over the years the role of the Fund has continually expanded to now include management of fiscal reserves, foreign currency reserves, real estate investments, and private equity.