Tobacco smoking is the practice of burning tobacco and ingesting the resulting smoke. The smoke may be inhaled, as is done with cigarettes, or simply released from the mouth, as is generally done with pipes and cigars. The practice is believed to have begun as early as 5000–3000 BC in Mesoamerica and South America. Tobacco was introduced to Eurasia in the late 17th century by European colonists, where it followed common trade routes. The practice encountered criticism from its first import into the Western world onwards but embedded itself in certain strata of a number of societies before becoming widespread upon the introduction of automated cigarette-rolling apparatus.

Rolling paper is a specialty paper used for making cigarettes. Rolling papers are packs of several cigarette-size sheets, often folded inside a cardboard wrapper. They are also known as 'blanks', which are used to encase tobacco or cannabis. It may be flavoured.

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state, and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such, often remain "hidden" in the price of a product or service rather than being listed separately.

A sin tax is an excise tax specifically levied on certain goods deemed harmful to society and individuals, such as alcohol, tobacco, drugs, candy, soft drinks, fast foods, coffee, sugar, gambling, and pornography. In contrast to Pigovian taxes, which are to pay for the damage to society caused by these goods, sin taxes increase the price in an effort to decrease the use of these goods. Increasing a sin tax is often more popular than increasing other taxes. However, these taxes have often been criticized for burdening the poor and disproportionately taxing the physically and mentally dependent.

Kretek are cigarettes of Indonesian origin, made with a blend of tobacco, cloves, and other flavors. They are available filtered or unfiltered. The word "kretek" itself is an onomatopoetic term for the crackling sound of burning cloves.

An indirect tax is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., the effect and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect.

Taxation in Indonesia includes income tax, value added tax and carbon tax.

In British slang, a booze cruise is a brief trip from Britain to France or Belgium with the intent of taking advantage of lower prices, and buying personal supplies of (especially) alcohol or tobacco in bulk quantities. This is a legally allowed process not to be confused with smuggling.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. It is therefore a fee that must be paid in order to consume certain products. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

In the United States, cigarettes are taxed at both the federal and state levels, in addition to any state and local sales taxes and local cigarette-specific taxes. Cigarette taxation has appeared throughout American history and is still a contested issue today.

About a quarter of adults in Turkey smoke. Smoking in Turkey is banned in government offices, workplaces, bars, restaurants, cafés, shopping malls, schools, hospitals, and all forms of public transport, including trains, taxis and ferries. Turkey's smoking ban includes provisions for violators, where anyone caught smoking in a designated smoke-free area faces a fine of 188 Turkish lira (~€9.29/$9.90/£8.22) and bar owners who fail to enforce the ban could be fined from 560 liras for a first offence up to 5,600 liras. The laws are enforced by the Ministry of Agriculture and Forestry of Turkey.

There are approximately 61.4 million smokers in Indonesia, among a population of 273 million people. Around 63% of men and 5% of women report smoking, equating to 34% of the population. The majority, 88% of Indonesian smokers, use clove-flavoured kreteks. Kretek manufacturers directly employ over 180,000 people in Indonesia and an additional 10 million indirectly. Indonesia is the fifth largest tobacco market in the world, and in 2008 over 165 billion cigarettes were sold in the country.

Smoking in Albania is prevalent as about 40% of Albanians smoke regularly. In Europe, only Turkey has a higher smoking rate than Albania. Albanians annually spend more than €300 million on tobacco products. Zog I of Albania was reported to smoke 200 cigarettes a day. Albania adopted tough anti-smoking laws in 2007, but they are not strictly enforced. Smoking prevalence is increasing, especially among females ages 13 to 15. The smoking rate for teens between the ages of 13 and 15 is currently 15%.

Taxation in Oklahoma takes many forms. Individuals and corporations in Oklahoma are required to pay taxes or fee charges to both levels of government: state and local. Taxes are collected by the government to support the provisions of public services. The Oklahoma Constitution vested the authority to levy taxes with the Oklahoma Legislature while the Oklahoma Tax Commission is the primary Executive agency responsible for collecting taxes.

The illicit cigarette trade is defined as "the production, import, export, purchase, sale, or possession of tobacco goods which fail to comply with legislation" by the intergovernmental Financial Action Task Force (FTFA). Illicit cigarette trade activities fall under 3 categories:

- Contraband: cigarettes smuggled from abroad without domestic duty paid;

- Counterfeit: cigarettes manufactured without authorization of the trademark holders, with intent to deceive consumers and to avoid paying duty;

- Illicit whites: brands manufactured legitimately in one country, but smuggled and sold in another without duties being paid.

Tobacco Industry is a road map of the regulations relating to all tobacco products in Indonesia. Tobacco Industry (TI) contains guidelines and industry classification and the products produced by the tobacco industry in Indonesia, including regulations, policies ribbon and excise, tobacco industry strategies, so on and so forth. Tobacco Industry was first coined by the Directorate General of Agro and Chemical Industry Department in 2009. Tobacco Industry has a significant role for state revenue through taxes and excise, employments, and protection against multiple impacts of tobacco farmers and others. The development of the TI also consider public health in addition to concern on, so that the industry can grow well. TP is a labor-intensive industry, so to the present of TI and its association with upstream form the procurement of raw materials, particularly tobacco, cloves, and other industries are potential labor-absorbing industrial.

The Tax Reform for Acceleration and Inclusion Law, officially designated as Republic Act No. 10963, is the initial package of the Comprehensive Tax Reform Program (CTRP) signed into law by President Rodrigo Duterte on December 19, 2017.

Excise in Indonesia is a policy in Indonesia which mandates levies on certain goods that have certain characteristics, such as cigarettes, e-cigarettes, alcohol, and other tobacco and alcohol derivative products. In Indonesia, Directorate General of Customs and Excise, Ministry of Finance of the Republic of Indonesia is responsible for collecting excise.

Low Cost Green Car (LCGC) (Indonesian: Kendaraan Bermotor Roda Empat Hemat Energi dan Harga Terjangkau (KBH2), lit. 'Energy Efficient and Affordable Four-Wheeler Motor Vehicles') is an Indonesian automobile regulation which exempts low-cost and energy-efficient cars from luxury sales tax to ensure affordability, provided that they are assembled locally with a minimum amount of local components. The introduction of LCGC in Indonesia was meant to encourage the motorcycle owners/public transportation users to be able to afford their first cars, to reduce fuel subsidy and to compete with Thailand-imported cars, thus creating more jobs locally. In some aspects, the regulation is similar to the Japanese kei car category and the Thai Eco Car program which also reduce taxes for small and efficient cars.

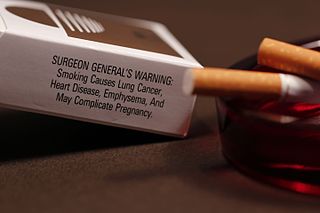

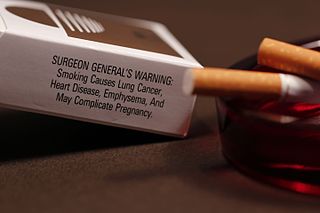

Cigarette advertising in Indonesia is presently allowed, and as of 2021, Indonesia is the only country in the world to allow cigarette advertising. However, it is prohibited to show cigarettes and advertising must include smoking warning messages. In Indonesia itself, such advertisements are known under the name iklan rokok in Indonesian. In 2003, cigarette advertising and promotions in Indonesia was valued at $250 million. In addition to television and outdoor advertisements, sporting events sponsored by cigarette brands or companies also occur.