Related Research Articles

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

AARP, formerly the American Association of Retired Persons, is an interest group in the United States focusing on issues affecting those over the age of fifty. The organization, which is headquartered in Washington, D.C., said it had more than 38 million members as of 2018. The magazine and bulletin it sends to its members are the two largest-circulation publications in the United States.

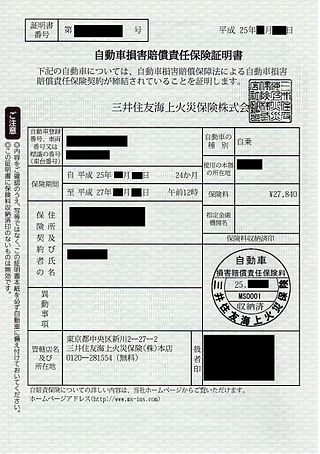

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

Home insurance, also commonly called homeowner's insurance, is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one's home, its contents, loss of use, or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

State Farm Insurance is a group of mutual insurance companies throughout the United States with corporate headquarters in Bloomington, Illinois. Founded in 1922, it is the largest property, casualty, and auto insurance provider in the United States.

Insurance fraud is any act committed to defraud an insurance process. It occurs when a claimant attempts to obtain some benefit or advantage they are not entitled to, or when an insurer knowingly denies some benefit that is due. According to the United States Federal Bureau of Investigation, the most common schemes include premium diversion, fee churning, asset diversion, and workers compensation fraud. Perpetrators in the schemes can be insurance company employees or claimants. False insurance claims are insurance claims filed with the fraudulent intention towards an insurance provider.

The term managed care or managed healthcare is used in the United States to describe a group of activities intended to reduce the cost of providing health care and providing American health insurance while improving the quality of that care. It has become the predominant system of delivering and receiving American health care since its implementation in the early 1980s, and has been largely unaffected by the Affordable Care Act of 2010.

...intended to reduce unnecessary health care costs through a variety of mechanisms, including: economic incentives for physicians and patients to select less costly forms of care; programs for reviewing the medical necessity of specific services; increased beneficiary cost sharing; controls on inpatient admissions and lengths of stay; the establishment of cost-sharing incentives for outpatient surgery; selective contracting with health care providers; and the intensive management of high-cost health care cases. The programs may be provided in a variety of settings, such as Health Maintenance Organizations and Preferred Provider Organizations.

A fidelity bond or fidelity guarantee is a form of insurance protection that covers policyholders for losses that they incur as a result of fraudulent acts by specified individuals. It usually insures a business for losses caused by the dishonest acts of its employees.

Assurant, Inc. is a global provider of risk management products and services with headquarters in Atlanta. Its businesses provide a diverse set of specialty, niche-market insurance products in the property, casualty, extended device protection, and preneed insurance sectors. The company's main operating segments are Global Housing and Global Lifestyle.

Farmers Insurance Group is an American insurer group of vehicles, homes and small businesses and also provides other insurance and financial services products. Farmers Insurance has more than 48,000 exclusive and independent agents and approximately 21,000 employees. Farmers is the trade name for three reciprocal exchanges, Farmers, Fire, and Truck, each a managed by Farmers Group, Inc. as attorney-in-fact on behalf of their respective policyholders. Farmers Group, Inc. is a wholly owned subsidiary of Swiss-based Zurich Insurance Group.

In insurance claims, a total loss or write-off is a situation where the lost value, repair cost or salvage cost of a damaged property exceeds its insured value, and simply replacing the old property with a new equivalent is more cost-effective.

The California Department of Insurance (CDI), established in 1868, is the agency charged with overseeing insurance regulations, enforcing statutes mandating consumer protections, educating consumers, and fostering the stability of insurance markets in California. The CDI has authority over how the insurance industry conducts business within California, and licenses and regulates the rates and practices of insurance companies, agents, and brokers in the state.

In the United States, health insurance helps pay for medical expenses through privately purchased insurance, social insurance, or a social welfare program funded by the government. Synonyms for this usage include "health coverage", "health care coverage", and "health benefits". In a more technical sense, the term "health insurance" is used to describe any form of insurance providing protection against the costs of medical services. This usage includes both private insurance programs and social insurance programs such as Medicare, which pools resources and spreads the financial risk associated with major medical expenses across the entire population to protect everyone, as well as social welfare programs like Medicaid and the Children's Health Insurance Program, which both provide assistance to people who cannot afford health coverage.

Medicare Advantage is a type of health plan offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage. Under Part C, Medicare pays a sponsor a fixed payment. The sponsor then pays for the health care expenses of enrollees. Sponsors are allowed to vary the benefits from those provided by Medicare's Parts A and B as long as they provide the actuarial equivalent of those programs. The sponsors vary from primarily integrated health delivery systems to unions to other types of non profit charities to insurance companies. The largest sponsor is a hybrid: the non-profit interest group AARP using UnitedHealth.

Public auto insurance is a government-owned and -operated system of compulsory automobile insurance used in the Canadian provinces of British Columbia, Saskatchewan, Manitoba, and Quebec. It is based on the idea that if motorists are compelled to purchase auto insurance by the government, the government ought to ensure motorists pay fair premiums and receive high-quality coverage. Governments across the country have used various insurance schemes from full tort to full no-fault in pursuit of that goal.

Established by the legislature in 1976, The Division of Insurance Fraud is the law enforcement arm of the Department of Financial Services and is responsible for investigating insurance fraud; crimes associated with claim fraud, insurance premium fraud, workers' compensation claim fraud, workers’ compensation premium avoidance and diversions, insurer insolvency fraud, unauthorized insurance entity fraud and insurance agent crimes. The law enforcement detectives of the Division of Insurance Fraud also investigate viatical settlement application fraud, defalcations of escrow funds held in trust by title insurance firms, and non-Medicaid related health care fraud.

The New Jersey Department of Banking and Insurance (DOBI) is one of 15 principal departments in New Jersey government. The department's mission is to regulate the banking, insurance and real estate industries in a professional and timely manner that protects and educates consumers and promotes the growth, financial stability and efficiency of these industries. The Commissioner of DOBI is Marlene Caride.

Vehicle insurance in the United States is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage. Most states require a motor vehicle owner to carry some minimum level of liability insurance. States that do not require the vehicle owner to carry car insurance include Virginia, where an uninsured motor vehicle fee may be paid to the state, New Hampshire, and Mississippi, which offers vehicle owners the option to post cash bonds. The privileges and immunities clause of Article IV of the U.S. Constitution protects the rights of citizens in each respective state when traveling to another. A motor vehicle owner typically pays insurers a monthly or yearly fee, often called an insurance premium. The insurance premium a motor vehicle owner pays is usually determined by a variety of factors including the type of covered vehicle, marital status, credit score, whether the driver rents or owns a home, the age and gender of any covered drivers, their driving history, and the location where the vehicle is primarily driven and stored. Most insurance companies will increase insurance premium rates based on these factors and offer discounts less frequently.

A staged crash, or crash for cash is when criminals maneuver unsuspecting motorists into crashes in order to make false insurance claims. The cars generally suffer little damage in relation to the large demand that is then fraudulently submitted.

References

- ↑ “A New Weapon In The Fight Against Fraud”. National Underwriter Property & Casualty-Risk & Benefits Management Journal, July 1993, p. 26.

- 1 2 Brostoff, Steven. “New Anti-Fraud Coalition Formed”. National Underwriter Property & Casualty-Risk & Benefits Management Journal, 1993, p. 46.

- ↑ Kopit, Alan (April 23, 2004). "Don't fall prey to health insurance fraud". MSNBC. Archived from the original on February 10, 2010.

- ↑ "Fraud Survey" (PDF). KPMG Forsenic. 2003.

- ↑ Schrenk, Edward L. (1997). "Fraud and Its Effects on the Insurance Industry". Defense Counsel Journal. 64: 64.

- ↑ Staff (2011). "Geico and NCL Join CAIF". Property Casualty 360.

- 1 2 Archived June 26, 2012, at the Wayback Machine

- ↑ Archived February 19, 2012, at the Wayback Machine

- ↑ Dennis Jay; Jim Quiggle. "Model insurance fraud act". Insurancefraud.org. Archived from the original on 2012-05-01. Retrieved 2014-02-07.

- ↑ Dennis Jay; Jim Quiggle; Howard Goldblatt; Kendra Smith; Jennifer Tchinnosian. "Legislation". Insurancefraud.org. Archived from the original on 2012-11-25. Retrieved 2014-02-07.

- ↑ Archived May 1, 2012, at the Wayback Machine

- ↑ "Research". Archived from the original on 2012-05-01. Retrieved 2012-05-16.

- ↑ "JIFA". Insurancefraud.org. Retrieved 2014-02-07.

- ↑ Coalition, Staff. “Get a Grip on Fraud”, December 2009, Washington D.C.

- ↑ Jay, Dennis, Effectiveness of warnings on benefit checks”, October 2000

- ↑ Coalition, Staff (October 1997), Four faces: why Americans do and don't tolerate fraud (PDF), Insurancefraud.org, archived from the original (PDF) on 2012-05-02, retrieved 2012-10-09

- ↑ Coalition, Staff. “Insurer Fraud Measurement”, December 2004

- ↑ Coalition, Staff. “Prescription for Peril”, December 2007

- ↑ Coalition, Staff (June 2003). "Study on SIU Performance Measurement" (PDF). Insurancefraud.org.

- ↑ Coalition, Saff. “State Insurance Frauds Bureaus, A Progress Report: 2001 to 2006”, February 2007, Washington D.C.

- ↑ Dennis Jay; Jim Quiggle. "Scam alerts". Insurancefraud.org. Archived from the original on 2012-08-09. Retrieved 2014-02-07.

- ↑ Dennis Jay; Jim Quiggle. "News release". Insurancefraud.org. Retrieved 2014-02-07.