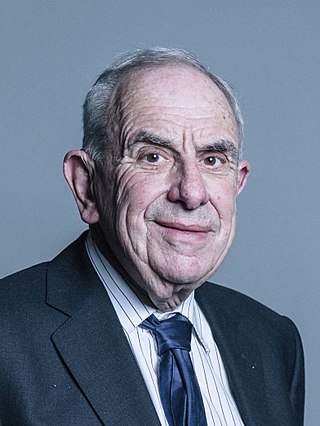

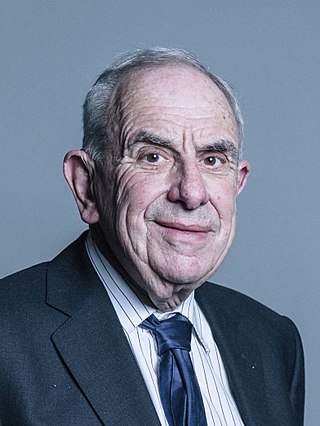

William John Kenneth Diplock, Baron Diplock, was a British barrister and judge who served as a lord of appeal in ordinary between 1968 and until his death in 1985. Appointed to the English High Court in 1956 and the Court of Appeal five years later, Diplock made important contributions to the development of constitutional and public law as well as many other legal fields. A frequent choice for governmental inquiries, he is also remembered for proposing the creation of the eponymous juryless Diplock courts. Of him, Lord Rawlinson of Ewell wrote that "to his generation Diplock was the quintessential man of the law".

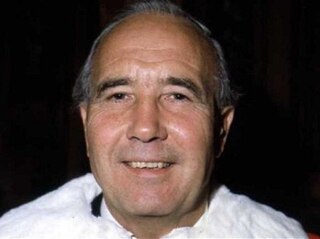

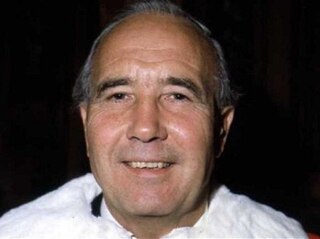

Sir Garfield Edward John Barwick was an Australian judge who was the seventh and longest serving Chief Justice of Australia, in office from 1964 to 1981. He had earlier been a Liberal Party politician, serving as a minister in the Menzies government from 1958 to 1964.

The doctrine of legitimate expectation was first developed in English law as a ground of judicial review in administrative law to protect a procedural or substantive interest when a public authority rescinds from a representation made to a person. It is based on the principles of natural justice and fairness, and seeks to prevent authorities from abusing power.

The High Court of New Zealand is the superior court of New Zealand. It has general jurisdiction and responsibility, under the Senior Courts Act 2016, as well as the High Court Rules 2016, for the administration of justice throughout New Zealand. There are 18 High Court locations throughout New Zealand, plus one stand-alone registry.

Leonard Hubert "Lennie" Hoffmann, Baron Hoffmann is a senior South African–British judge. Currently, he serves as a Non-Permanent Judge of the Court of Final Appeal of Hong Kong; he formerly served as a Lord of Appeal in Ordinary from 1995 to 2009.

The Commission of Inquiry into Certain Matters Relating to Taxation, popularly known as the Winebox Inquiry, was an inquiry undertaken in New Zealand to investigate claims of corruption and incompetence in the Serious Fraud Office (SFO) and Inland Revenue Department (IRD).

Sydney William Templeman, Baron Templeman, MBE, PC was a British judge. He served as a Lord of Appeal in Ordinary from 1982 to 1995.

Aboriginal title is a common law doctrine that the land rights of indigenous peoples to customary tenure persist after the assumption of sovereignty to that land by another colonising state. The requirements of proof for the recognition of aboriginal title, the content of aboriginal title, the methods of extinguishing aboriginal title, and the availability of compensation in the case of extinguishment vary significantly by jurisdiction. Nearly all jurisdictions are in agreement that aboriginal title is inalienable, and that it may be held either individually or collectively.

R v Davis [2008] UKHL 36 is a decision of the United Kingdom House of Lords which considered the permissibility of allowing witnesses to give evidence anonymously. In 2002 two men were shot and killed at a party, allegedly by the defendant, Ian Davis. He was extradited from the United States and tried at the Central Criminal Court for two counts of murder in 2004. He was convicted by the jury and appealed. The decision of the House of Lords in June 2008 led to Parliament passing the Criminal Evidence Act 2008 a month later. This legislation was later replaced by sections 86 to 97 of the Coroners and Justice Act 2009.

Schmidt v Rosewood Trust Ltd[2003] UKPC 26 is a judicial decision concerning the information rights of a beneficiary under a discretionary trust. Although the judgment involved a question as to the law of the Isle of Man, the Privy Council's judgment in Schmidt v Rosewood was adopted into English law by Briggs J in Breakspear v Ackland[2008] EWHC 220 (Ch).

The corporate veil in the United Kingdom is a metaphorical reference used in UK company law for the concept that the rights and duties of a corporation are, as a general principle, the responsibility of that company alone. Just as a natural person cannot be held legally accountable for the conduct or obligations of another person, unless they have expressly or implicitly assumed responsibility, guaranteed or indemnified the other person, as a general principle shareholders, directors and employees cannot be bound by the rights and duties of a corporation. This concept has traditionally been likened to a "veil" of separation between the legal entity of a corporation and the real people who invest their money and labor into a company's operations.

Downsview Nominees Ltd v First City Corp Ltd[1992] UKPC 34, [1993] AC 295 is a New Zealand insolvency law case decided by the Judicial Committee of the Privy Council concerning the nature and extent of the liability of a mortgagee, or a receiver and manager, to a mortgagor or a subsequent debenture holder for his actions.

David Collins is a retired judge of the Court of Appeal of New Zealand. He is an acting judge of the Court of Appeal until 18 March 2026. He was the Solicitor-General of New Zealand from 1 September 2006 to 15 March 2012, before being made a judge of the High Court in 2012.

Prebble v Television New Zealand Ltd is a decision of the Judicial Committee of the Privy Council, on appeal from the Court of Appeal of New Zealand, regarding claims in defamation and the defence of parliamentary privilege.

Finnigan v New Zealand Rugby Football Union, was a case taken by a member of the Auckland University Rugby Football Club and a member of the Teachers Rugby Football Club against the decision of the New Zealand Rugby Football Union (NZRFU) Council to accept an invitation for the All Blacks to tour South Africa. The invitation came just four years after the 1981 South Africa rugby union tour of New Zealand had divided the New Zealand public over the All Blacks refusal to participate in the sporting boycott of South Africa during the Apartheid era. The decision primarily concerned whether the two plaintiffs had sufficient standing to challenge the NZRFU decision. The decision marked the adoption of the principles of R v Inland Revenue Commissioners ex p National Federation of Self-Employed and Small Businesses [1982] AC 617 approach to standing in judicial review into New Zealand law.

Section 90 of the Constitution of Australia prohibits the States from imposing customs duties and excise duties. The section bars the States from imposing any tax that would be considered to be of a customs or excise nature. While customs duties are easy to determine, the status of excise, as summarised in Ha v New South Wales, is that it consists of "taxes on the production, manufacture, sale or distribution of goods, whether of foreign or domestic origin." This effectively means that States are unable to impose sales taxes.

Miller v Minister of Mines [1962] NZPC 1; [1962] UKPC 30; [1963] AC 484; [1963] NZLR 560; [1963] 2 WLR 92; [1963] 1 All ER 109 is a cited case in New Zealand regarding property law.

Elders Pastoral Limited v Bank of New Zealand [1990] NZPC 3; [1990] UKPC 29; [1990] 3 NZLR 129; [1990] 1 WLR 1090; (1990) 2 PRNZ 333 is a cited case in New Zealand case law regarding constructive trusts.

The rule against foreign revenue enforcement, often abbreviated to the revenue rule, is a general legal principle that the courts of one country will not enforce the tax laws of another country. The rule is part of the conflict of laws rules developed at common law, and forms part of the act of state doctrine.