Related Research Articles

A value chain is a progression of activities that a business or firm performs in order to deliver goods and services of value to an end customer. The concept comes from the field of business management and was first described by Michael Porter in his 1985 best-seller, Competitive Advantage: Creating and Sustaining Superior Performance.

The idea of [Porter's Value Chain] is based on the process view of organizations, the idea of seeing a manufacturing organization as a system, made up of subsystems each with inputs, transformation processes and outputs. Inputs, transformation processes, and outputs involve the acquisition and consumption of resources – money, labour, materials, equipment, buildings, land, administration and management. How value chain activities are carried out determines costs and affects profits.

A warehouse is a building for storing goods. Warehouses are used by manufacturers, importers, exporters, wholesalers, transport businesses, customs, etc. They are usually large plain buildings in industrial parks on the outskirts of cities, towns, or villages.

Vendor-managed inventory (VMI) is an inventory management practice in which a supplier of goods, usually the manufacturer, is responsible for optimizing the inventory held by a distributor.

Procurement is the process of locating and agreeing to terms and purchasing goods, services, or other works from an external source, often with the use of a tendering or competitive bidding process. The term may also refer to a contractual obligation to "procure", i.e. to "ensure" that something is done. When a government agency buys goods or services through this practice, it is referred to as government procurement or public procurement.

An invoice, bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products, quantities, and agreed-upon prices for products or services the seller had provided the buyer.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

Purchasing is the procurement process a business or organization uses to acquire goods or services to accomplish its goals. Although there are several organizations that attempt to set standards in the purchasing process, processes can vary greatly between organizations.

In Economics and Law, exclusive dealing arises when a supplier entails the buyer by placing limitations on the rights of the buyer to choose what, who and where they deal. This is against the law in most countries which include the USA, Australia and Europe when it has a significant impact of substantially lessening the competition in an industry. When the sales outlets are owned by the supplier, exclusive dealing is because of vertical integration, where the outlets are independent exclusive dealing is illegal due to the Restrictive Trade Practices Act, however, if it is registered and approved it is allowed. While primarily those agreements imposed by sellers are concerned with the comprehensive literature on exclusive dealing, some exclusive dealing arrangements are imposed by buyers instead of sellers.

Cover is a term used in the law of contracts to describe a remedy available to a buyer who has received an anticipatory repudiation of a contract for the receipt of goods. Under the Uniform Commercial Code, the buyer is permitted to find another source of the same type of goods. The buyer may then file a lawsuit against the breaching seller to recover the difference, if any, between the cost of the goods offered and the cost of the goods actually purchased.

Consignment is a process whereby a person gives permission to another party to take care of their property and retains full ownership of the property until the item is sold to the final buyer. It is generally done during auctions, shipping, goods transfer, or putting something up for sale in a consignment store. The owner of the goods pays the third-party a portion of the sale for facilitating the sale. Consignors maintain the rights to their property until the item is sold or abandoned. Many consignment shops and online consignment platforms have a set time limit at which an item's availability for sale expires. Within the time of contract, reductions of the price are common to promote the sale of the item, but vary by the type of item sold.

Finished goods are goods that have completed the manufacturing process but have not yet been sold or distributed to the end user.

In a supply chain, a vendor, supplier, provider or a seller, is an enterprise that contributes goods or services. Generally, a supply chain vendor manufactures inventory/stock items and sells them to the next link in the chain. Today, these terms refer to a supplier of any goods or service. In property sales, the vendor is the name given to the seller of the property.

Buyer credit is a term credit available to an importer (buyer) from overseas lenders such as banks and other financial institution for goods they are importing. In simple words it is the credit that is given by a bank to a foreign buyer where funds are paid directly to the buyer through a lending bank. The overseas banks usually lend the importer (buyer) based on the letter of comfort issued by the importer's bank. For this service the importer's bank or buyer's credit consultant charges a fee called an arrangement fee.

ECGC Limited is a government owned export credit agency of India. It is under the ownership of the Ministry of Commerce and Industry, Government of India, and is headquartered in Mumbai, Maharashtra. It provides export credit insurance support to Indian exporters and banks. Its topmost official is designated as Chairman and Managing Director, who is a central government civil servant under Indian Trade Service (ITS) cadre.

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifests itself in the form of letters of credit (LOC), guarantees, or insurance, and is usually provided by intermediaries.

Multimodal transport is the transportation of goods under a single contract, but performed with at least two different modes of transport; the carrier is liable for the entire carriage, even though it is performed by several different modes of transport. The carrier does not have to possess all the means of transport, and in practice usually does not; the carriage is often performed by sub-carriers. The carrier responsible for the entire carriage is referred to as a multimodal transport operator, or MTO.

Domestic Tariff Area (DTA) or Domestic Tariff Zone (DTZ) means an area within India that is outside the Special Economic Zones and EOU/EHTP/STP/BTP.

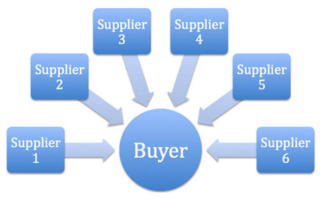

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

Supply chain financing is a form of financial transaction wherein a third party facilitates an exchange by financing the supplier on the customer's behalf. The term also refers to practices used by banks and other financial institutions to manage capital invested into the supply chain and reduce risk for the parties involved.

OW Bunker, founded in 1980, was a marine fuel (bunker) company based at Nørresundby in northern Denmark. It was the world's largest bunker supplier until its collapse on 7 November 2014. It went from initial public offering (IPO) to bankruptcy in less than a year. The dramatic collapse of the company led to expedited litigation in the English courts.

References

- Bruno Zeller (January 1999). International Commercial Law for Business. Federation Press. pp. 155–. ISBN 978-1-86287-323-0.