The Constitution of Canada is the supreme law in Canada; the country's constitution is an amalgamation of codified acts and uncodified traditions and conventions. Canada is one of the oldest constitutional democracies in the world. The constitution outlines Canada's system of government, as well as the civil rights of all Canadian citizens and those in Canada.

The House of Commons of Canada is a component of the Parliament of Canada, along with the Sovereign and the Senate. The House of Commons currently meets in a temporary Commons chamber in the West Block of the parliament buildings on Parliament Hill in Ottawa, while the Centre Block, which houses the traditional Commons chamber, undergoes a ten-year renovation.

The Parliament of Canada is the federal legislature of Canada, seated at Parliament Hill in Ottawa, the national capital. The body consists of the Canadian monarch, represented by a viceroy, the Governor General; an upper house, the Senate; and a lower house, the House of Commons. Each element has its own officers and organization. By constitutional convention, the House of Commons is dominant, with the Senate and monarch rarely opposing its will. The Senate reviews legislation from a less partisan standpoint and the monarch or viceroy provides royal assent to make bills into law.

The Constitution Act, 1982 is a part of the Constitution of Canada. The Act was introduced as part of Canada's process of patriating the constitution, introducing several amendments to the British North America Act, 1867, including re-naming it the Constitution Act, 1867.. In addition to patriating the Constitution, the Constitution Act, 1982 enacted the Canadian Charter of Rights and Freedoms; guaranteed rights of the Aboriginal peoples of Canada; provided for future constitutional conferences; and set out the procedures for amending the Constitution in the future.

The Saskatchewan Act, S. C. 1905, c. 42. is an Act of the Parliament of Canada which established the new province of Saskatchewan, effective September 1, 1905. Its long title is An Act to establish and provide for the government of the Province of Saskatchewan. The Act received royal assent on July 20, 1905. The Saskatchewan Act is part of the Constitution of Canada.

"Consolidated fund" or "consolidated revenue fund" is a term used in many countries with political systems derived from the Westminster system to describe the main bank account of the government. General taxation is taxation paid into the consolidated fund for general spending, as opposed to hypothecated taxes earmarked for specific purposes.

Taxation in Canada is a prerogative shared between the federal government and the various provincial and territorial legislatures. Under the Constitution Act, 1867, taxation powers are vested in the Parliament of Canada under s. 91(3) for:

The Quebec Resolutions, also known as the seventy-two resolutions, were a group of statements written at the Quebec Conference of 1864, which laid out the framework for the Canadian Constitution. They were adopted by the majority of the provinces of Canada, and became the basis for the London Conference of 1866. Some of the major points that were addressed in the resolutions are as follows: Canada will have a strong central government, the central government is to be responsible for the legislation of peace, order and good government, provinces will have defined powers and will be accountable for handling local affairs and social and cultural issues, the United Province of Canada, will be split into Quebec and Ontario, a federal government will be composed of two law making houses. These are just five of the important acts used to construct Canada as it is today.

In Canada, a lieutenant governor is the viceregal representative in a provincial jurisdiction of the Canadian monarch and head of state, Queen Elizabeth II. On the advice of his or her prime minister, the Governor General of Canada appoints the lieutenant governors to carry out most of the monarch's constitutional and ceremonial duties for an unfixed period of time—known as serving at His Excellency's pleasure—though five years is the normal convention. Similar positions in Canada's three territories are termed Commissioners and are representatives of the federal government, however, not the monarch directly.

This is a list of leaders and office-holders of Canada. See also Canadian incumbents by year.

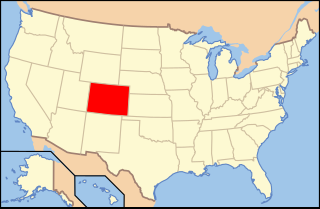

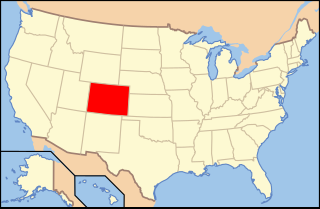

The Constitution of the State of Colorado is the foundation of the laws and government of the U.S. state of Colorado. The current, and only, Colorado State Constitution was drafted on March 14, 1876; approved by Colorado voters on July 1, 1876; and took effect upon the statehood of Colorado on August 1, 1876. From 1876 through 2007, the Colorado Constitution was amended 152 times. The Constitution of Colorado provides and derives its authority from the sovereignty of the people and is the foremost source of state law. In addition to providing for voting, the people of Colorado have reserved initiative of laws and referendum of laws enacted by the legislature to themselves and provided for recall of office holders.

The Pennsylvania State Treasurer is the head of the Pennsylvania Treasury Department, an independent department of state government. The state treasurer is elected every four years. Treasurers are limited to two terms.

In Canada, municipal government is a type of local council authority that provides local services, facilities, safety and infrastructure for communities. Canada has three levels of government; federal, provincial and municipal. According to Section 92(8) of the Constitution Act, 1867, "In each Province the Legislature may exclusively make Laws in relation to... Municipal Institutions in the Province." There are about 3,700 municipal governments in Canada. Municipal governments are established under provincial/territorial authority.

Accountant general or accountant-general is, or was, the name of a government post in several countries.

Section 3 of the Constitution of Australia deals with the salary of Governor General. The salary of Governor-General is paid from the Consolidated Revenue Fund and is regulated by the Constitution, which fixed the initial salary at £10,000, an amount that would not increase until 1974.

Chapter II of the Constitution of Australia establishes the executive branch of the Government of Australia. It provides for the exercise of executive power by the Governor-General advised by a Federal Executive Council.

The Immigration Act, 1869 was the first immigration act passed by the government of Canada after Canadian Confederation.